Everyone has different spending and saving habits. Some people believe in spending extravagantly on things that make them happy. Other folks like to have a hefty bundle insavingsas a kind of security blanket. Whatever your financial habits are, it’s important to discuss them with your partner.

Overspending is usually the biggest cause of problems inrelationships, but in this one, excessive thriftiness caused some issues. It also made people question how much is too much when it comes to saving money.

HighlightsThe woman was annoyed her partner saved $1,500 from his $3,800 salary while splitting bills.Financial experts Bola Sokunbi, and Paul Merriman advised that the couple needs clear communication about money goals.Most commenters believed the partner was being sensible about securing financial future.

More info:Mumsnet

RELATED:

Everyone’s taught to save up for a rainy day, but some folks take that saying a bit too seriously

Image credits:HelloDavidPradoPerucha / Freepik (not the actual photo)

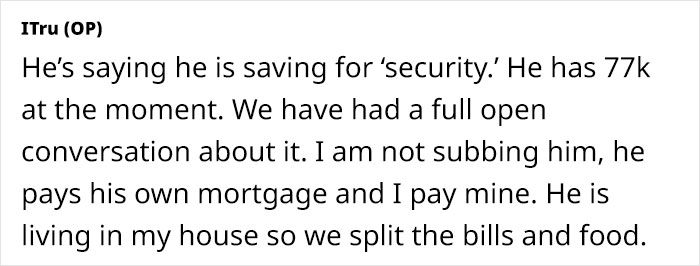

The poster shared that she and her partner would split food bills and the cost of heating for her home and that he still managed to save $1,500 of his salary

Image credits:SHVETS production / Pexels (not the actual photo)

When she found out how much he was saving, she felt annoyed that he avoided splurging and kept choosing the cheapest options

Image credits:ITru

The woman asked netizens if she was wrong to think her partner’s saving habits were a bit too extreme

That’s whyBored PandacontactedBola Sokunbi, a Certified Financial Education Instructor (CFEI), finance expert, 4-time bestselling author, speaker, and founder ofClever Girl Finance-one of the largest personal finance media/education platforms for women in the U.S. We asked her whether she thought the woman’s partner was being too extreme with his saving habits.

Bola said that “it seems like her partner is definitely prioritizing his savings, but whether it’s extreme depends on his personal goals and mindset around money. Saving $1,500 from $3,800 (about 39%) is quite a significant portion of his income, which might feel extreme to her, especially if it impacts their shared experiences, like going out for dinner or vacations.”

“It’s possible that he has agoalhe’s really focused on, but without clear communication, it can come across as excessive or unbalanced to his partner. It definitely sounds like a deeper conversation between them would help and is needed. They need to talk openly about their individual goals around money and how they can align them,” she added.

Once a couple clarifies their thoughts about money, it helps them understand each other’s perspective.Expertsalso say that, after the initial discussion, partners should check in with each other at least twice a year about their thoughts and any concerns regarding their finances.

We also contacted Paul Merriman, the CEO ofFairstone Ireland,who started ‘askpaul’ to provide jargon-free expert financial advice. Paul is seen as one of Ireland’s top financial advisers, with over 20 years of experience in the field and an internationally recognized CFP® certification in finance.

He told us that “in relationships, financial habits can sometimes cause tension. In this case, while 40% might seem high, it could be reasonable if the person has a clear financial goal in mind, such as purchasing a home, retiring early, or building an emergency fund. Saving aggressively isn’t inherently negative, but it can feel restrictive if it comes at the cost of enjoying your present life or if it causes tension in a relationship.”

Image credits:Karolina Kaboompics / Pexels (not the actual photo)

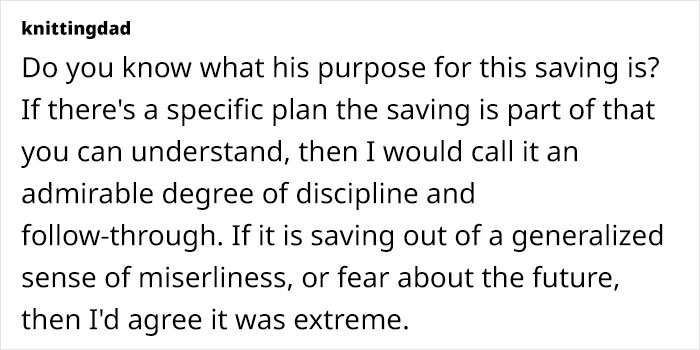

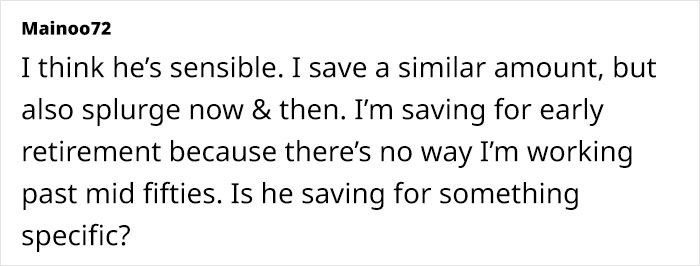

The poster later told commenters that when she asked her partner why he was saving so much, he said he was doing it for “security.” Bola told us that “he could also be coming from a place of financial insecurity orfear, where saving gives him a sense of control and safety.”

She also said that many people save aggressively if they’re “working toward a large financial goal, like paying off a big debt, preparing for a big purchase, or early retirement/financial independence.”

Paul also suggests that “an individual might save aggressively if they have experienced financial instability in the past. Perhaps they grew up in a household where money was tight, or they went through a period of unemployment and now want to secure their future.”

That’s why we asked Bola if there was an ideal amount that a person should try and save from their salary. She explained that “there isn’t a one-size-fits-all answer, but a general rule of thumb is to save at least 10-20% of your income if possible.”

“This can be adjusted based on individual circumstances, like debt, future goals, cost of living, and lifestyle. It’s important to save for the future while also enjoying life in the present, especially when in a relationship where bothpartnersneed to feel valued and considered–balance is key.”

When it comes to determining how much a person should save, Paul also said that “financial experts generally recommend saving at least 20% of your income. This percentage allows for the accumulation of a solid emergency fund, the ability toinvestfor future goals, and some room for discretionary spending.”

Paul shared that “If someone is saving 40% of their salary, as in this case, it’s essential toevaluate whether this is sustainable in the long term and whether it fits both partners’financial goalsand lifestyles. In relationships, it’s vital to have open discussions about financial goals and habits.”

Image credits:Alexander Grey / Unsplash (not the actual photo)

A very important thing Paul shared about finances is that “while saving is crucial, it should not feel restrictive or create friction between partners. Each person may have a different approach to managing their money, but compromise and communication are key.”

To understand your financial goals better, invest, and build long-term wealth, you can check out Bola’s new workbook calledMy Wealth Planand the2nd editionof her 1st book on personal finance. You can also get a lot of help and guidance from the wide range ofaskpaul financial servicesthat you can find on Paul Merriman’s website.

Don’t forget to let us know whether you think the woman’s partner was being miserly or extremely smart about money. We’d love to hear your thoughts.

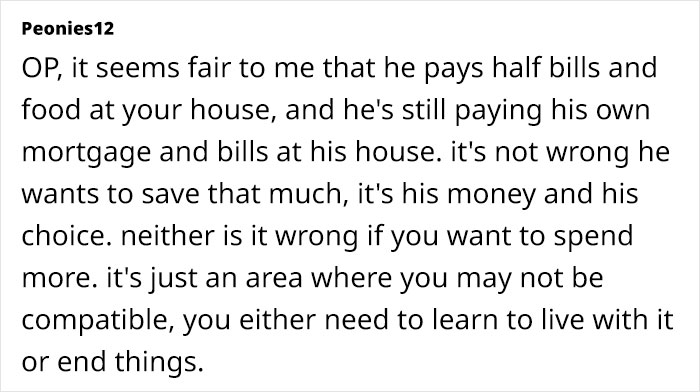

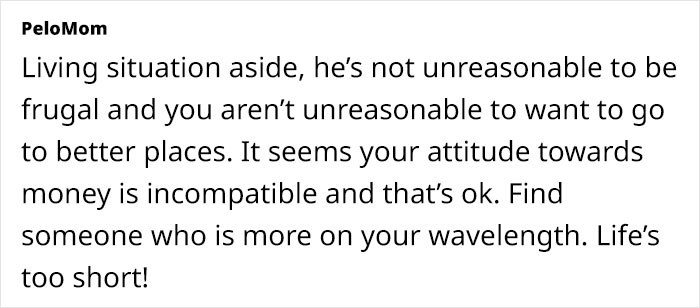

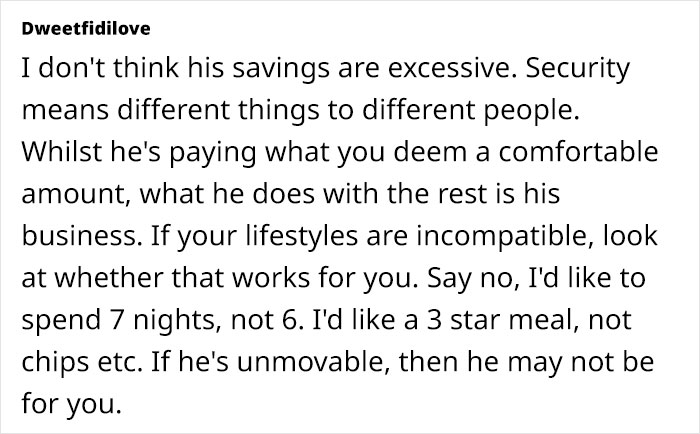

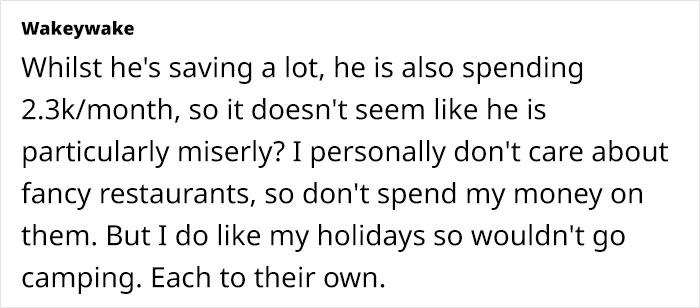

Most folks felt that the guy was being sensible to save up for the future and disagreed with the woman about his saving habits being extreme

Thanks! Check out the results:

Work & Money