Complaints from the older generation that “young people just don’t want to work hard and earn money” have become widespread – but how justified are these complaints? In a TikTok post, realtorFreddy Smithsuggested turning to the simplest arguments – numbers.

More info:TikTok

RELATED:

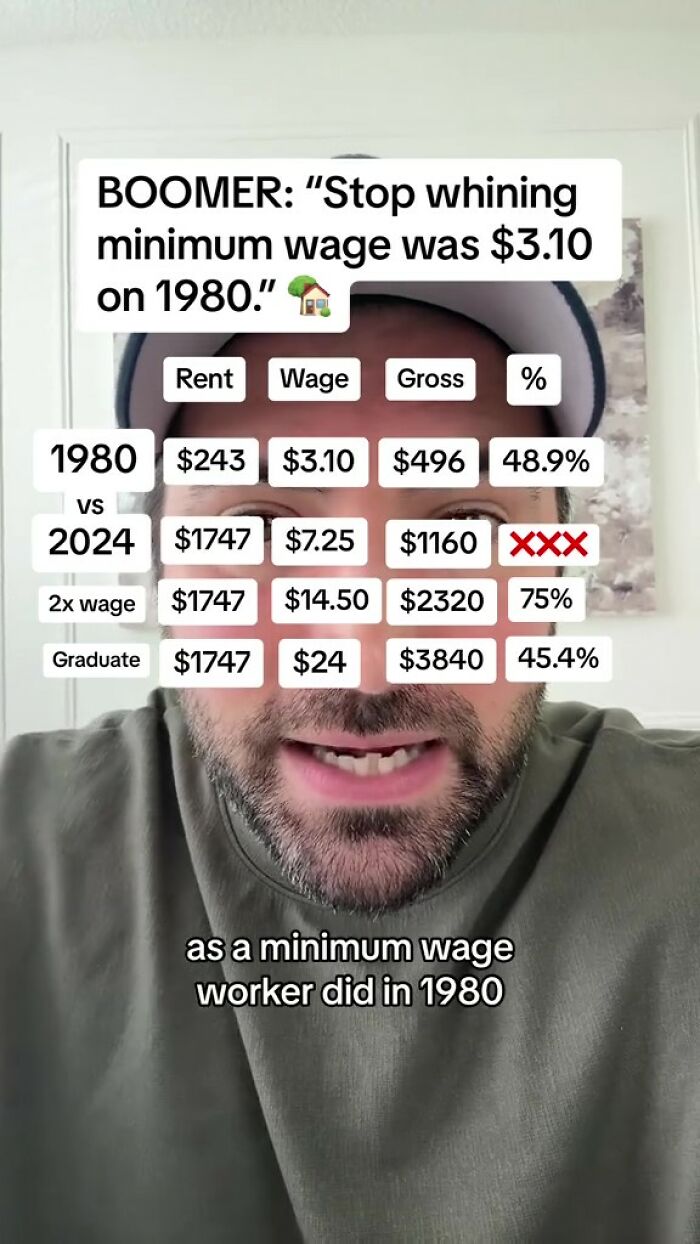

The author of the video is a realtor and he makes an analysis of the rent/wages ratio of 2024 compared to 1980

Image credits:fmsmith319

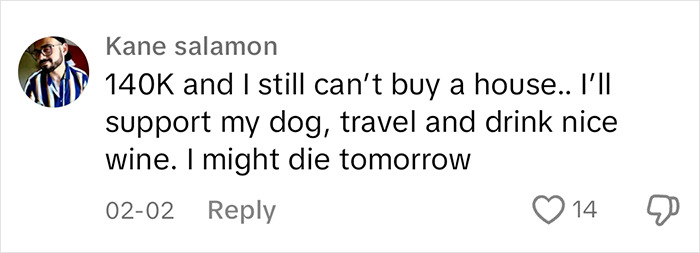

So, the Original Poster (OP) quotes many representatives of the older generation about how they rented apartments themselves from an early age in their youth, and worked, worked, worked… Okay, let’s leave aside all aspects ofmodern work, and focus on rent.

In 1980, Smith says, average rent was $243, while the federal minimum wage was $3.10 per hour, so rent took up almost 49% of the monthly gross income. Today, according to the OP, average rent is $1,747 but the federal minimum wage is just $7.25. So, basic arithmetic proves that you won’t be able to rent an apartment on the minimum wage.

Okay, Mr. Smith continues, that’s just the minimum wage, and many Walmart and roadhouse workers make around $15 a day nowadays. But even if we double the minimum wage, taxes turn that into 75% – making it nearly impossible to rent even the smallest apartment.

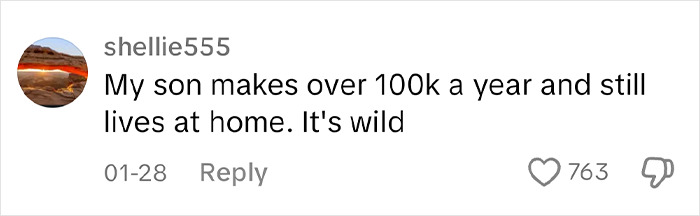

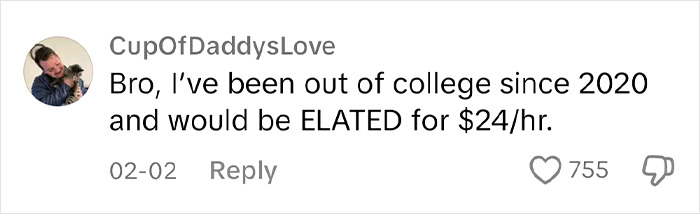

College graduatesare no better off. So, according to the author of the video, the starting rate for bachelors nowadays is around $24 – which means that rent is 45.4% of their gross monthly income in 2024.

Image credits:Markus Winkler (not the actual photo)

Image credits:Tima Miroshnichenko (not the actual photo)

Today, even college graduates have to spend the same share of their incomes on rent, as minimum-wage workers spent in 1980, the author concludes

Now let’s go back to the second paragraph of the text, where rent had almost the same share inthe incomeof minimum wage workers in 1980! But then the worker just studied for a couple of weeks and started their job, and to get a bachelor’s degree today, you need to spend several years in college. And to pay for your tuition too.

In other words, Freddie Smith states, today bachelors spend the equivalent on rent of what minimum wage workers spent in 1980. And you want to object to something about ‘childish’ millennials and Gen Z?

You can watch the original video here

Well, it is not surprising that thecost of renthas increased compared to 1980 – after all,inflationhas done its job over the past four decades. If we look at this CPIinflation calculator, we’ll see that $1 in 1980 is worth $3.81 today. That is, almost four times. On the other hand, rent has grown much more since then.

Thus, data from the websiteiPropertyManagementshows us that in 1980, the average rent was indeed $243, and according to last year’s data, as Forbes claims, it was $1,372. That is, the growth over the same period of time was 5.64 times.

And even if we take the states with the lowest rent – accordingto Forbes, these are North Dakota, Iowa and South Dakota – then the growth in the cost of rent will be from 3.65 to 4.02 times. As we can see, this is much closer to the dollar inflation rate over the past 44 years.

“Don’t forget that apartments require 3 times the amount of rent along with non refundable application fees first months last months and security deposit down,” one of the commenters reasonably wrote. “And it’s going to be even worse this year due to the raise in taxes,” another responder added.

Thanks! Check out the results:

Work & Money