A popular standard for budgeting says you should spend a maximum of 30% of your monthly income on rent. But a lot of people in many places across the world find it hard to follow.

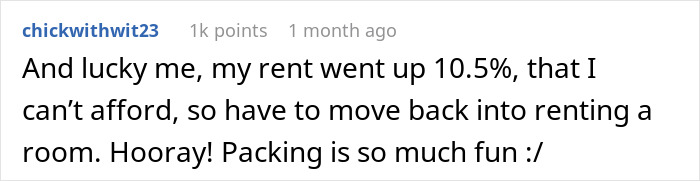

After a wave of “pandemic pricing” during much of 2020, rents started to climb in 2021 and into the middle of last year as people came back to urban life for in-person work and learning. Would-be homeowners remained renters because they were simply priced out of buying a home and an overall lack of housing sent rents soaring.

With few vacancies and rapidly rising prices, renters are facing a crisis in many places all over the world

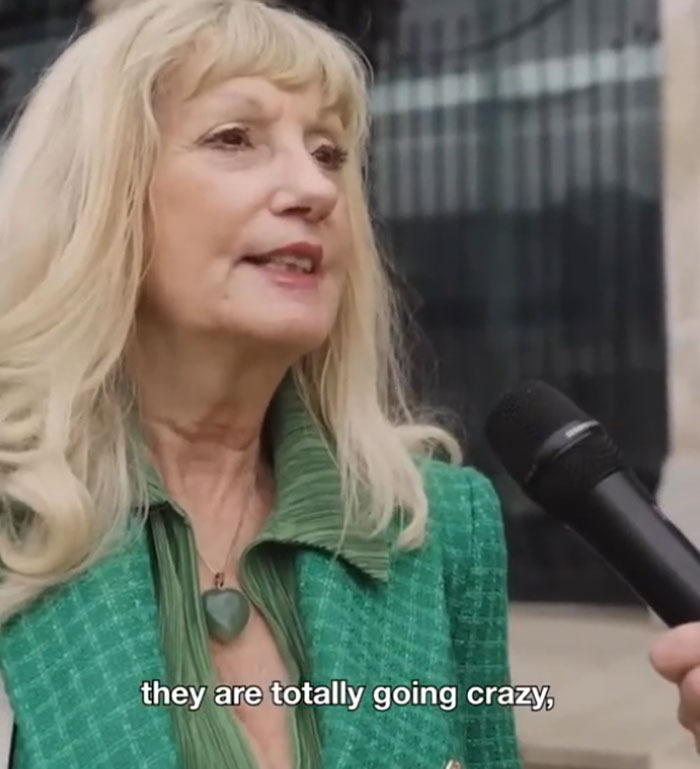

Image credits:novaramedia

But this British landlord couldn’t be happier

Interviewer: How are things in the market for you at the moment?Landlord: Very good. Yeah, the rentals are fantastic.Interviewer: Because rents are going up and up, I’ve heard?Landlord: Exactly. Yes.Interviewer: How have your tenants reacted to the increase in the rent?

Landlord: Um, I think so, yes. I mean, they can be replaced very easily because there just aren’t enough properties to go around at the moment so people are sort of, you know, they’re totally going crazy, ‘Oh, I’ve got to get a property to live in.’Interviewer: So you think they might be going crazy because the cost of living is spiraling?Landlord: Yeah, exactly. So it’s very, very high, but it actually is the agent that puts the rent up, not myself. So I think it’s done automatically after a year.

And the woman isn’t the only landlord who’s glad about the current situation in the market

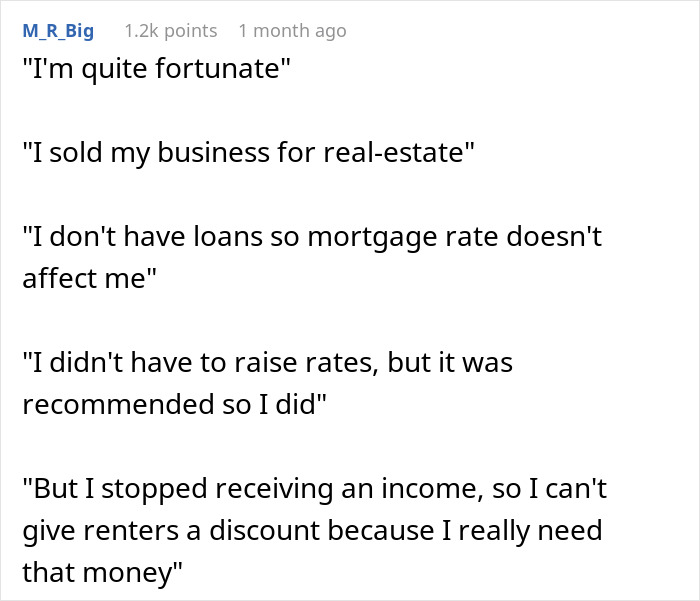

Interviewer: Do you consider yourself a successful landlord?Landlord: I’ve got five or six mixed properties. Commercial, residential. So yeah, success. I’m making a bit of money.Interviewer: Have you had to increase your rent? At the moment, I know rates are going up, etc.Landlord: I’ve not had to, but the management agent I use is basically coming to me and saying, you know, we can get X amount more this year.

Interviewer: You didn’t personally feel like you needed to, but that was an opportunity to, so you sort of took it?Landlord: Absolutely. I’m quite fortunate. I sold my business six years ago, so I’ve got very little in the way of finance loans. It’s all personal money. So I’m quite fortunate in that, I haven’t got mortgages on the property, so didn’t have to increase the rents, but just following the market trends, really.

Interviewer: Have you ever considered giving your renters a reduction because of their kind of cost of living crisis?Landlord: I should say yes. No, ultimately, this is an income stream for me. I’ve worked hard to get that income in the first place. So no, I need the income now. I’ve stopped working. I’ve effectively semi-retired from my main job, so I do need that income. So the short answer is no.

In Britain, where these interviews were taken, on average there are20 peoplerequesting to view each rental property that comes on the market, more than triple what it was in 2019. In some northwest parts of the country, that number reaches even 30 per property. Moving house has always been stressful, but it has become an all-consuming battle for many people as rents rise and demand outweighs supply.

The UK is a vivid example of what happens when there is very little regulation and protection for renters. But those who seek solutions,do find them. In Denmark, for example, renters can stay in their homes indefinitely; in France, landlords cannot issue evictions in the winter months; landlords in Germany cannot charge 10% more than the average rent for similar properties in the area; and social rents set the norm for private rents in Sweden.

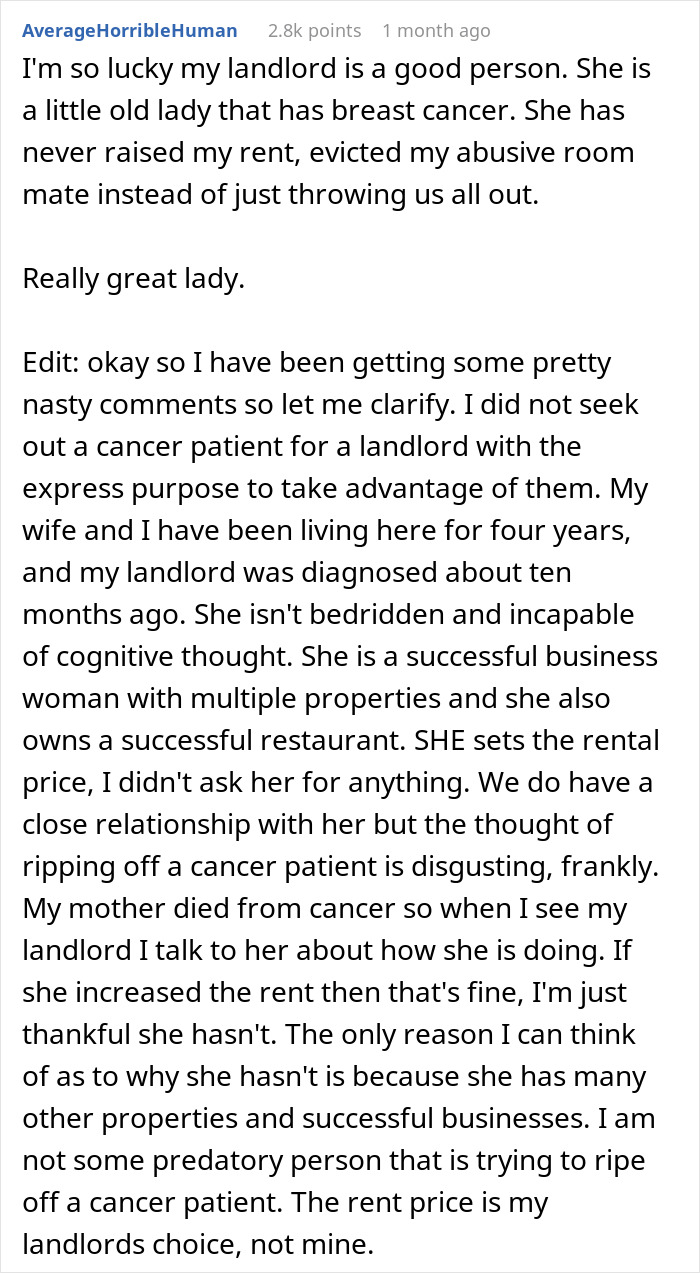

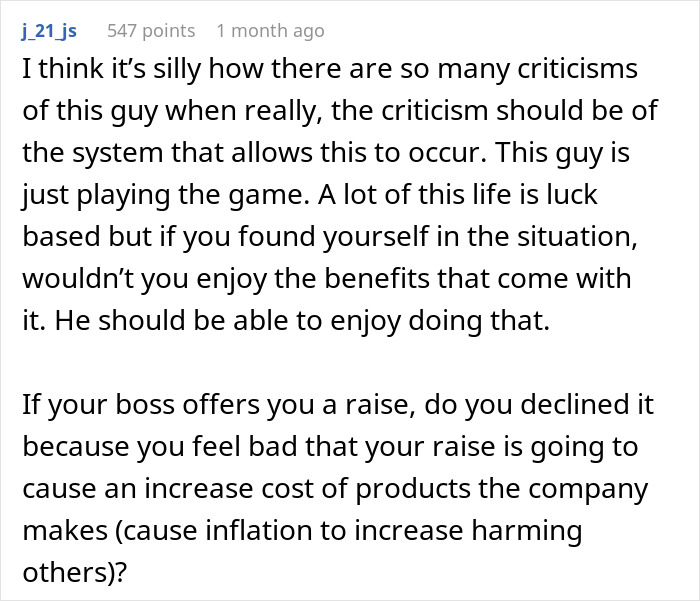

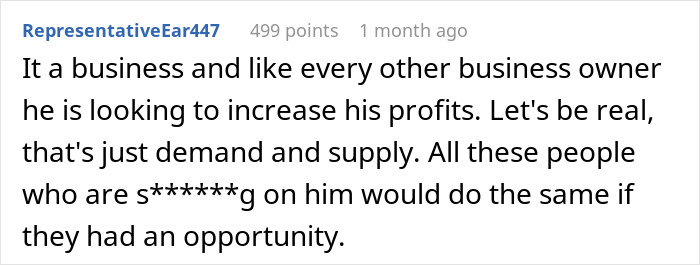

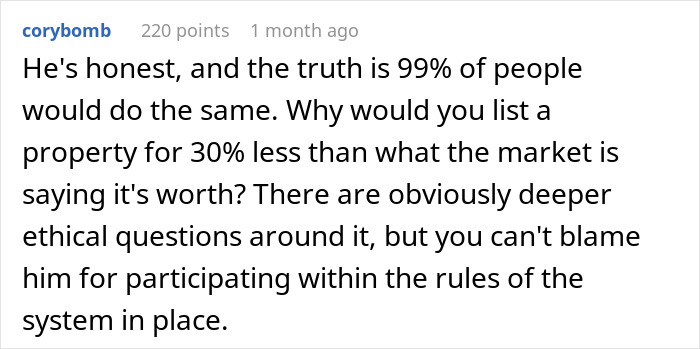

After watching these videos, TikTokers were absolutely appalled

Eventually, the clips spread to other platforms, continuing the discussion

Work & Money