Owning real estate is a goal for many—if not most—of us. While some people believe that it’s attainable with a good enough job, healthy spending habits, and steady investments, others feel far less optimistic about ever being able to afford their dream home. Seeing these struggles, somefamilymembers decide to step in and help them out a little bit financially. However, this sort of help can lead to a lot of envy among siblings.

An anonymous dadopened uponline about how he decided to help his son out with the down payment on his home, for which he was extremely grateful. However, seeing this, the man’s daughter feltenviousand like he was playing favorites. The twist? She had married into wealth and was set for life. While favoritism can have hugely negative effects, the fact is that the siblings’ financial situations were also radically different. Read on for the full story.

Bored Pandawanted to find out how parents can approach these sorts of money-related situations while avoiding favoritism, so we reached out to personal finance expert Sam Dogen for advice. He also shed some light on the steps that young adults can take to maximize their chances of owning property in this market. You’ll find his insights below. Dogen is the founder of theFinancial Samuraiblog and the author of the bestsellerHow To Engineer Your Layoff.

RELATED:

Many young people hope to become homeowners. However, in today’s market, that dream seems distant

Image credits:Kindel Media / Pexels (not the actual photo)

A dad decided to help his son out with the down payment for his home. However, the man’s daughter thought he was playing favorites

Image credits:Tima Miroshnichenko / Pexels (not the actual photo)

Image credits:Mysterious_Win9549

Image credits:Juan Pablo Serrano / Pexels (not the actual photo)

The expert said that transparency is key and that the daughter should feel happy that her brother got help

Personal finance expert Dogen explained how parents can approach situations where their children may need different degrees of financial help, so they don’t seem like they’re playing favorites. “Parents should set expectations early, openly discussing their philosophy on financial assistance to manage potential misunderstandings. This way, when something like this occurs, kids are not as bent out of shape,” he told Bored Panda.

“Transparency is key; explaining the reasoning behind decisions—such as helping one child with a down payment because they face financial struggles while another is already secure—can mitigate feelings of inequity,” he said.

“Finally, it’s important to frame support around needs rather than equality, recognizing that life circumstances differ and financial help should reflect these realities,” Dogen told us.

According to Dogen, there are actionable steps that people can take to increase the odds of homeownership, despite affordability issues in this challenging environment. Your first step should be to establish a clear savings plan. “This includes cutting non-essential expenses and automating contributions to a dedicated home-buying fund,” he said.

“Second, consider expanding your search to more affordable markets or neighborhoods where property values are within reach. Flexibility in location can open up more options. Third, take advantage of first-time homebuyer programs, which often offer down payment assistance, lower interest rates, or reduced closing costs. Research local and federal programs that might apply to your situation.”

According toDogen, a “subtle yet effective strategy” for homeownership is to genuinely invest in the social side of things and foster a strong relationship with your parents. “Many parents today are sitting on considerable wealth, accumulated through decades of savings and investments during an unprecedented bull market. Often, they are more than willing to assist their children with a down payment—provided there’s a genuine bond and mutual respect,” he said.

“Parents love to feel appreciated and valued, not just financially but emotionally. Regularly reaching out, spending quality time together, and showing interest in their lives can make a significant difference. On the flip side, no parent wants to feel like an ATM for a child who only calls when they need money. Building a strong relationship with your parents is the ultimate ‘house hack‘ as an adult!”

Image credits:Vidal Balielo Jr. / Pexels (not the actual photo)

It’s very common for parents to play favorites. Unfortunately, this can have many negative side effects

Parental favoritism, which psychologists call parental differential treatment (PDT), is fairly common. As per the BBC, it occurs innearly two-thirds(65%) of families, across different cultures. This favoritism can be damaging to children not just growing up but also well into adulthood.

Low self-esteem, anxiety, depression, and behavioral problems like risky behavior can affect children who see their parents behaving more warmly toward their siblings compared to them. There are also some indications that parental favoritism can be a pretty good predictor for mobile phone addiction, but more research is necessary.

On the one hand, parents who constantly play favorites can breed a lot of frustration and resentment in the family. Blatant favoritism, even when done unconsciously, can make children feel unwanted, unloved, and uncared for. That, in turn, can lead to all sorts of self-esteem issues, push them away, and harm their relationships with the rest of the family.

On the other hand, the simple fact is that no two kids are the same. Not even twins. Their core needs are going to be the same: food, shelter, love, support, education, attention, etc. But their other wants and needs can look entirely different.

If one of your munchkins is applying to college to get a science degree so they can work at NASA, you’ll have to support them differently from your other kids who may want to travel the world, save up for their first car, or are planning on getting married.

Image credits:Mikhail Nilov / Pexels (not the actual photo)

Your children may have different needs, so, as a parent, you need to be able to recognize that and support them accordingly

Sure, money definitely plays a role here. Let’s not be naive about that. But cold hard cash isn’t the solution to every situation. One of your kids may need more emotional support and parental wisdom to handle all the stress of starting a new stage in their life. Or they might feel more confident if you accompanied them while they toured their prospective college campus. Other kids may need you to teach them purely technical skills like how to drive better or how to get over their fear of public speaking so they can say their vows with confidence.

So, as a parent, you need to be able to recognize those different needs and adapt accordingly. To bring this back a bit closer to home, if one of your kids has married into wealth and lives in a fancy mansion, but the other doesn’t own any real estate yet, you’re probably going to financially support the second one. Why? Because the first kid doesn’t have the same money problems as the other.

Of course, all of this assumes that you have some spare money lying around to help with a huge thing like a down payment in the first place.

This isn’t playing favorites. It’s being practical. Furthermore, if you have supported your other child through thick and thin before this, then they don’t have much reason to be upset.

The evidence that you love them lies in the fact that you’ve sacrificed your time, energy, nerves, and money to help them when they were in need before. It would only be favoritism if there was a long history of putting one person’s needs above the other’s.

Owning a new family home in the US is, on average, twice as expensive as 5 years ago

CNN reports that American households that wanted to afford a new single-family home, as well as pay property taxes and insurance costs needed to earn$107,700 per yearin the third quarter of 2024. Just half a decade ago, in 2019, you’d need to earn ‘just’ $56,800 annually.

That’s nearly double the needed household income in 5 years. It’s no wonder that many young adults are demotivated about their chances to afford real estate.

Location matters a ton. If you’re living in San Jose, California, then you’re in the least affordable United States metro region where the median house price is a whopping $1.89 million and you need an income of $461,000 to afford a new home.

On the flip side, you only need to earn between $64,600 to $75,300 to buy a new home in Cleveland, Louisville, Detroit, and St. Louis in the Midwest. There is a huge difference in your purchasing power there compared to California.

The recent report from Oxford Economics found that merely 36% of American households earned enough money to afford anew home. That’s a massive drop from 59% in 2019. It’s not just an issue with earning potential.

The spike in home prices is also due to higher demand and fiercer competition in the real estate market. Another major factor is the rise in mortgage rates. “While house prices increased in every metro, the rise in mortgage rates eroded affordability more significantly as rates nearly doubled from 3.7% in Q3 2019 to a high of 7.3% in Q4 2023,” explains senior Oxford Economics economist Barbara Denham.

What’s your take on the situation, dear Pandas? Are you siding with the dad for supporting his son when he needed it or do you think this is too much favoritism? How are you supporting your kids as they’re moving into adult life? Have you ever had any familyhelp youwith your down payments, college tuition, or bills? Let us know!

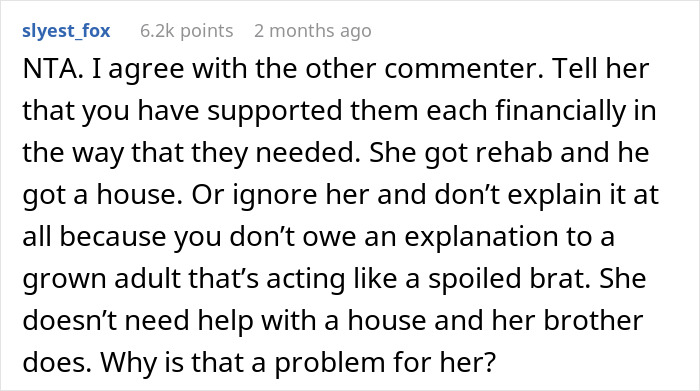

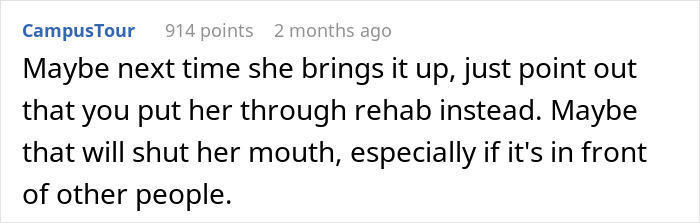

Most readers were on the dad’s side. They thought he shouldn’t feel guilty about supporting his son. Here are their thoughts

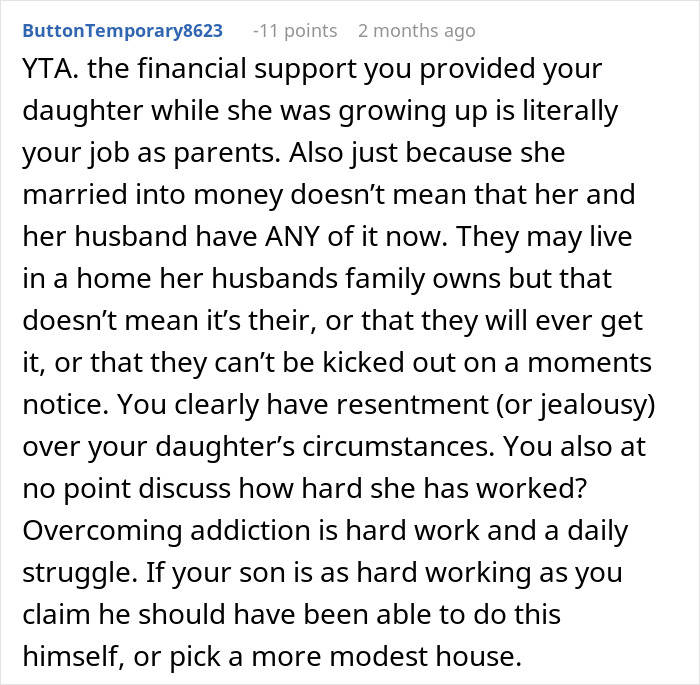

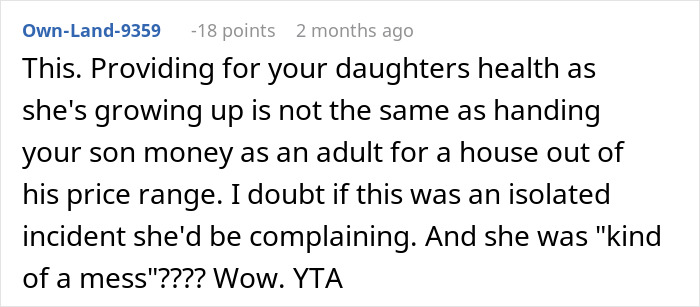

A few internet users expressed some contrarian points of view that were less than popular among others

Thanks! Check out the results:You May LikeWoman Refuses To Care For Old Mother After Learning She Won’t Be Getting The HouseMindaugas BalčiauskasGolden Child Wins £1.9M Jackpot, Leaves Family With A Small Cut, Now They Want PaybackMantas Kačerauskas“You’re Really Gonna Make Me Do This?”: Woman Bursts Into Tears Over Son’s GF’s “Petty” House RuleGabija Saveiskyte

Mindaugas Balčiauskas

Mantas Kačerauskas

Gabija Saveiskyte

Relationships