Money can enable people to do things they otherwise couldn’t. Or at the very least, make them much easier. But it can also change us, cause stress, and spark conflict.

For the mother and daughter whose story you are about to learn, it did both.

After the man of the house passed away, they received a fair amount of funds to start a second life and make good decisions.

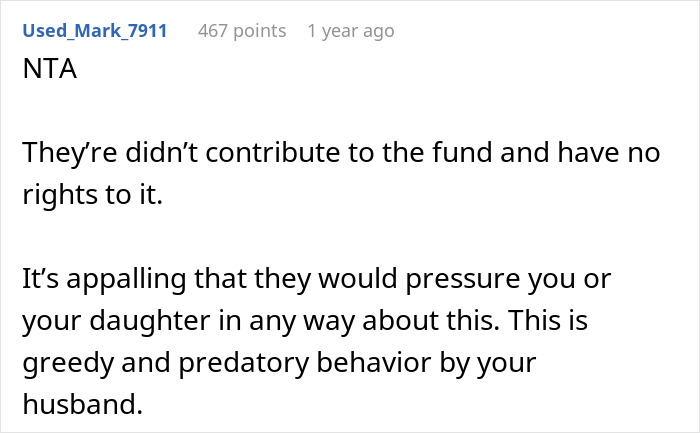

Eventually, the woman remarried, and the family blended with that of her new partner. However, when the girl started preparing for college and word got out about her assets, her stepfather demanded she share them with his children.

Disappointed, angry, and a bit confused, the womanturned to Reddit, asking everyone how she should proceed.

RELATED:

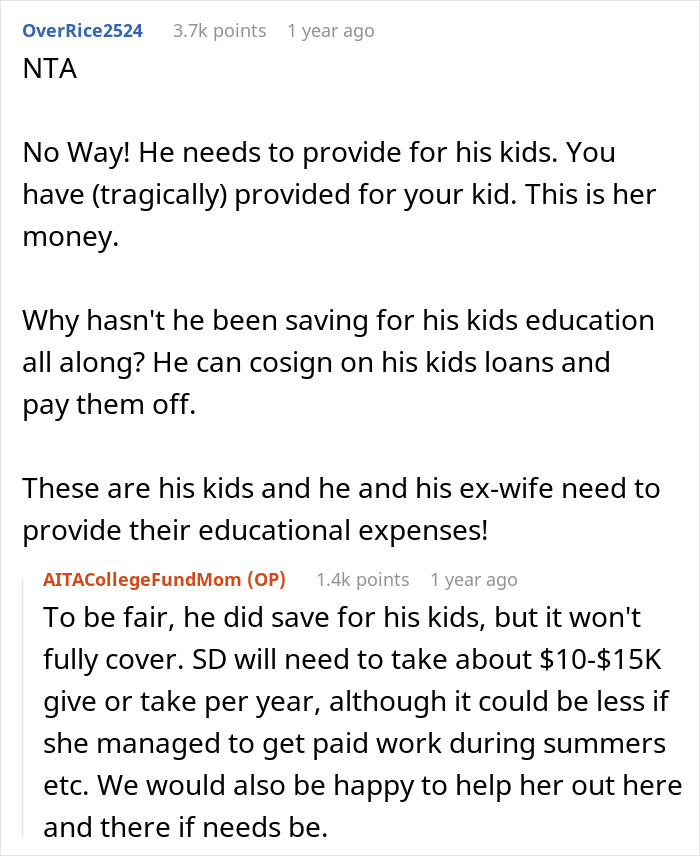

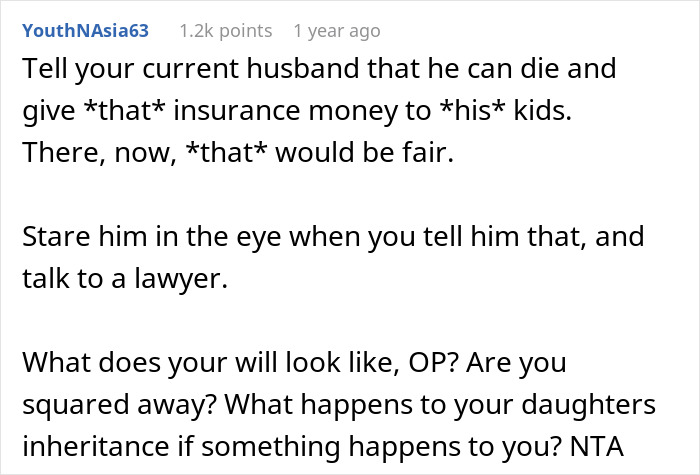

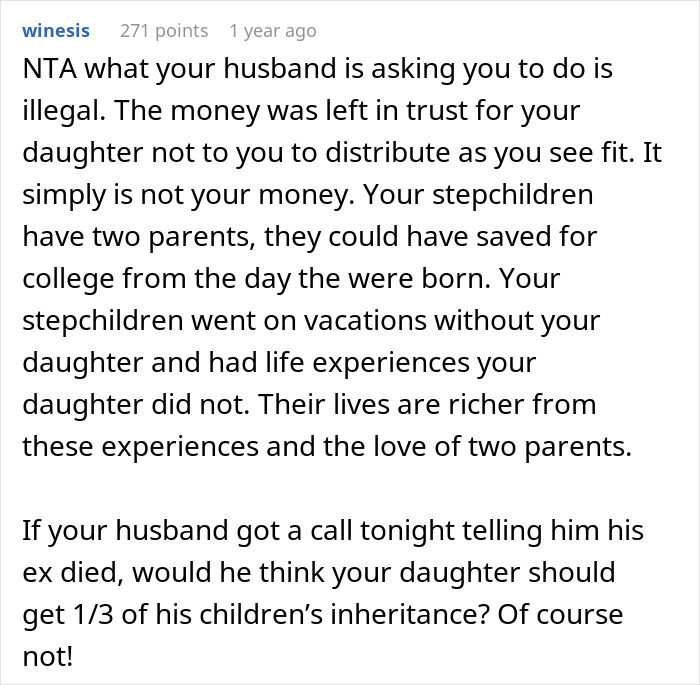

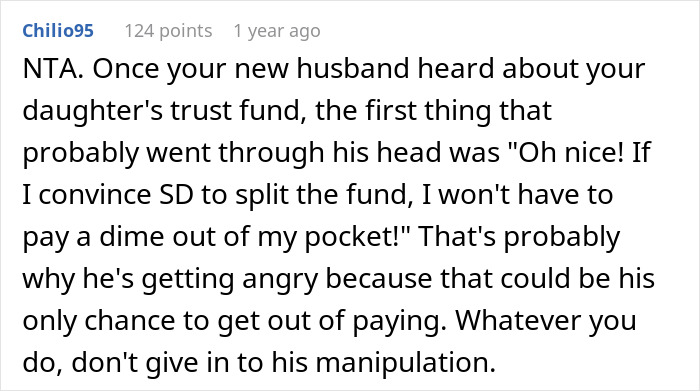

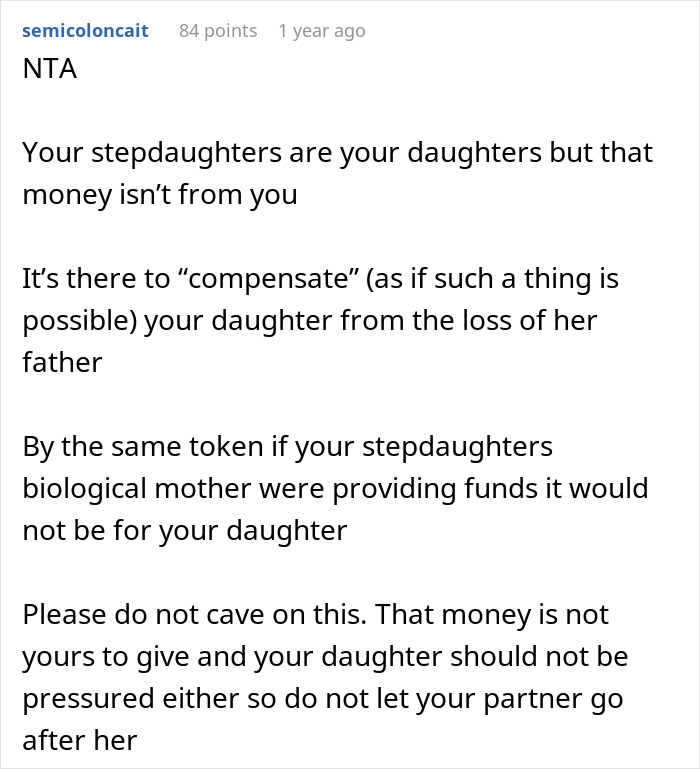

This woman told her second husband she wouldn’t split her late partner’s money with his kids

Image credits:nd3000 / Envato (not the actual photo)

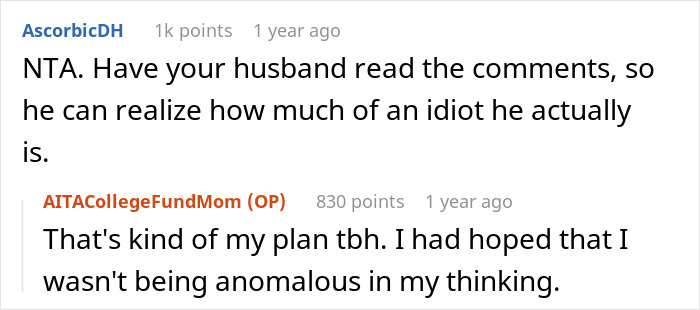

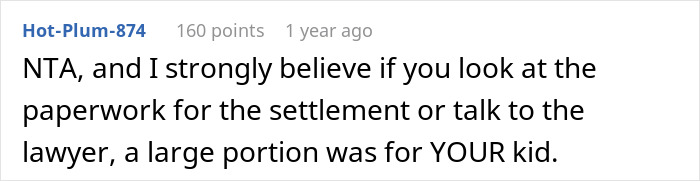

And that put a tremendous strain on their blended family

Image credits:valeriygoncharukphoto / Envato (not the actual photo)

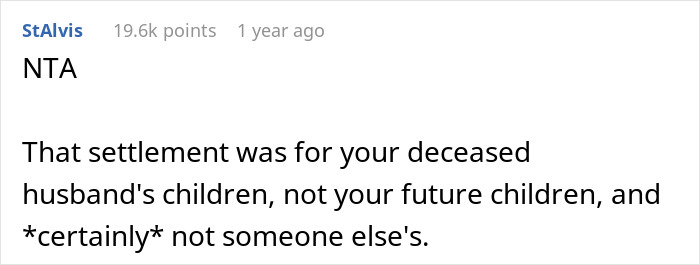

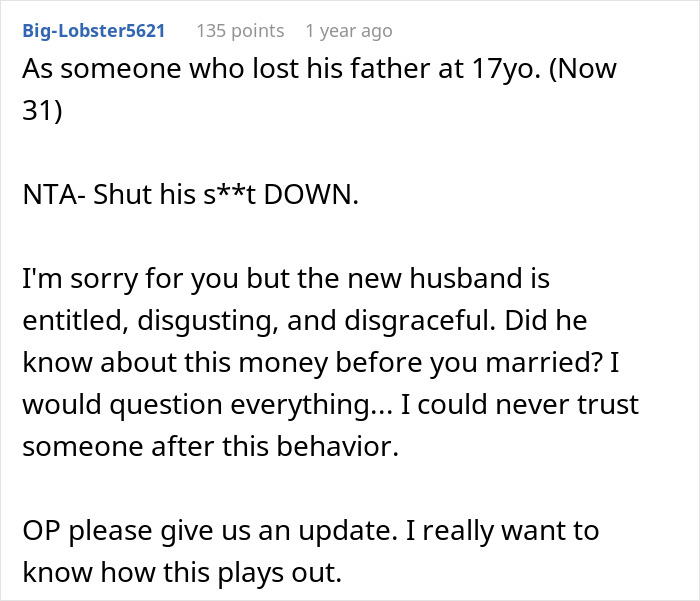

Image credits:AITACollegeFundMom

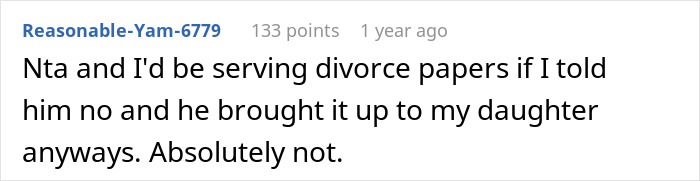

Couples need to cooperate to align their money goals and spending habits

Image credits:Unai82 / Envato (not the actual photo)

Figuring out how to manage money together is an important part of a fulfilling relationship, but as we have just witnessed, the skill doesn’t come naturally.

“When there’s conflict or discord, it’s usually not about the money itself, but related to the meaning each person is attaching to money,”saysCohen Taylor, a licensed family and marriage therapist and behavioral wealth specialist at the registered investment advisory Wealth Enhancement Group. “There’s always something deeper.”

Getting on the same page as your partner when it comes to finances usually requires a lot of communication and at least some compromise because people’s perception of their partner’s financial situation and literacy might not be entirely accurate.

It could be that the author of the post and her new husband, for whatever reason, didn’t get the opportunity to learn about each other in that way.

“You need clear boundaries and rules so everyone knows their role within the blended family dynamic,” he explains. The adults should plan in advance how they will share expenses related to the children’s car insurance, cell phone plans, and, of course, college. This might sound like a lot of homework, but it does prevent bigger problems down the line.

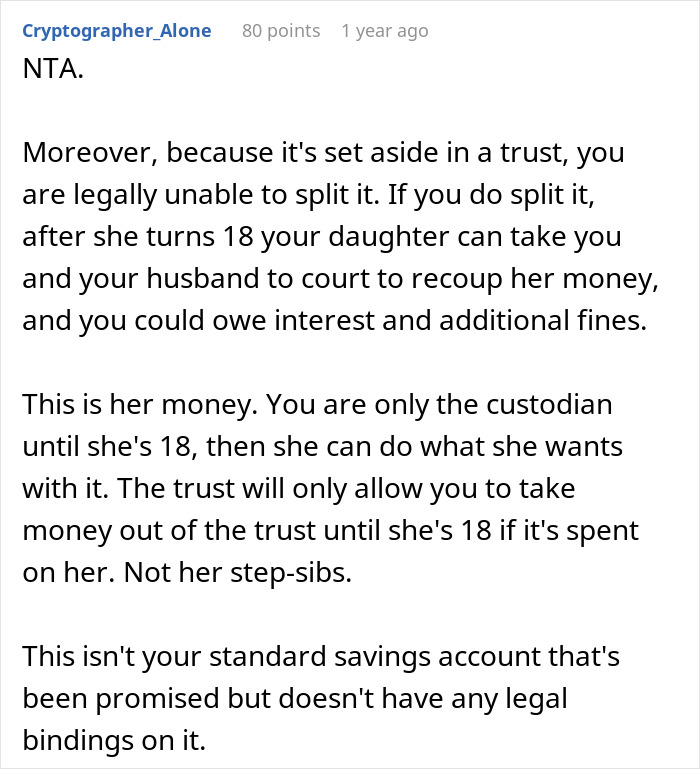

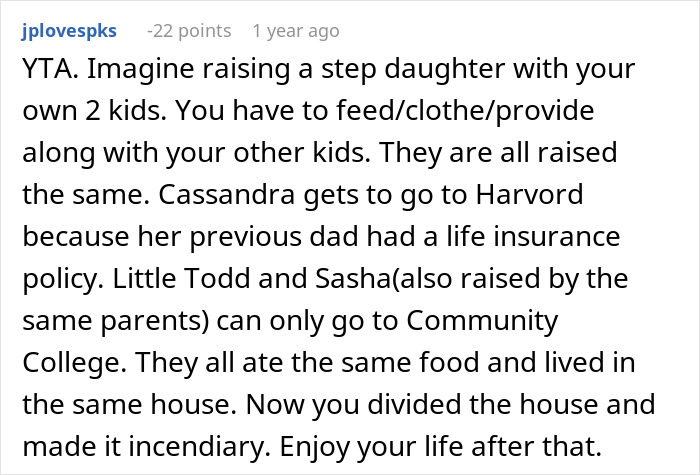

The majority of people who read the woman’s story said she shouldn’t share the money

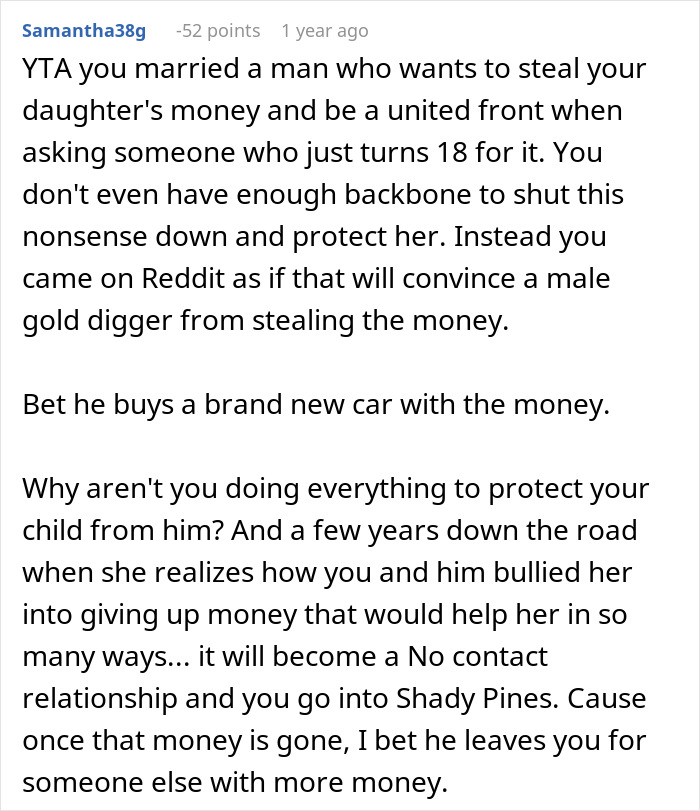

But a few believe she should be more generous

Thanks! Check out the results:You May LikeGuy Makes Demands Over GF’s Inheritance, Ends Up Single InsteadShelly FourerMom Kicks Out 17YO Daughter, Word Spreads And Karma Bites Her Where She Least ExpectedIlona BaliūnaitėInheritance Drama Ensues After Mom Abandons Daughter For 25 Yrs And Leaves Everything To NeighborJustinas Keturka

Shelly Fourer

Ilona Baliūnaitė

Justinas Keturka

Relationships