Going through a breakup and having to move out is disruptive enough, but having your identity stolen on top of it just takes the cake. Credit cardfraudcan destroy your credit score and have debt recovery services knocking down your door for payback.

This was the situation facing one Redditor when his ex-girlfriend opened two credit cards in his name before maxing them out and leaving him in a mountain of debt. When he went after her, she got her new boyfriend, the violent type, to threaten him.

More info:Reddit

RELATED:

Breakups can get messy, but for this guy, it almost got very expensive too

Image credits:freepik / Freepik (not the actual photo)

About a year after his breakup and unbeknownst to him, his ex-girlfriend opened two credit cards in his name and maxed them out

The guy was shocked when he got served with a lawsuit for over $5,000 for a defaulted credit card, but that was just the beginning of his troubles

Image credits:Vladan Raznatovic / Unsplash (not the actual photo)

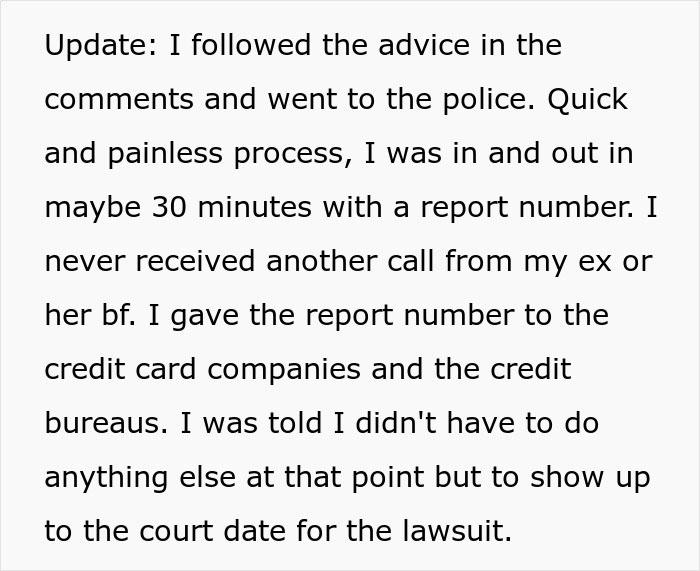

When he called his ex about it, she denied everything, but got her violent new boyfriend to threaten him

Image credits:easynowsteven

The guy turned to the web for legal advice and, a month later, updated the community with the news that his ex-girlfriend had been arrested

Imagine his surprise, then, when he got served with a lawsuit for over $5,000 dollars for a defaulted credit card. When he pulled his credit, he discovered that not only had the card been defaulted for months, but there was anothercredit cardthat had been closed for $2,500. OP immediately disputed both of the accounts on all three bureaus’ websites.

He managed to talk to someone about one of the cards, and it turned out it had been sent to his old address. He adds that he received the statements for one of the cards and the billings were for Nordstrom and Macy’s, his ex’s two favoriteshoppinghaunts. At this point, OP assumed she had used his SSN from his oldtaxreturns to open the accounts.

He decided to call his ex about it, and she denied everything, screaming at him that he couldn’t seriously accuse her of anything. Shortly after that, OP got a call from a blocked number; it was his ex’s newboyfriendthreatening to make his life a living hell. Unsure what to do, OP turned to Reddit for advice, which he duly followed.

OP’s ex-girlfriend is on the hook for two things: credit card fraud and identity theft.

Image credits:Rai Singh Uriarte / Unsplash (not the actual photo)

Digital security expert Brett Cruz writes that credit card security has become increasingly critical as the U.S. edges towards becoming acashlesseconomy. American consumers rely heavily on their plastic, supplying fraudsters with a steady stream of potential targets.

Despite the sweeping impact of credit card fraud, this crime remains somewhat misunderstood. Consumers might assume their accounts are safe as long as they keep their physical cards secure, yet most unauthorized transactions involve credit cards that weren’t lost or physically stolen but rather swindled through remote technology.

Financial institutions are already spending billions of dollars on cybersecurity to keep credit card systems protected. Still, a couple of simple good habits can go a long way to keeping one’s accounts secure.

Experts recommend that every cardholder adhere to basic precautions such as regularly reviewing credit card statements, subscribing to spending alerts, enabling multi-factor authentication, enrolling in a credit monitoring service, and using online password managers.

According to the AARPwebsite, identity fraud cost Americans $43 billion in 2023. The issues of account takeovers and new-account fraud, which sees criminals use a victim’s personal information to open fraudulent new accounts, are growing, Javelinreports.

Account takeover fraud produced nearly $13 billion in losses in 2023 (up from $11 billion in 2022), while new-account fraud reached $5.3 billion (compared with $3.9 billion in 2022).

The Javelin survey also discovered that resolving a case of identity fraud is now more challenging — or at least more time-consuming — than ever before. The researchers reported that fraud victims spent an average of 10 hours resolving identity fraud, up from just six hours in 2022.

With identity theft running rampant, it’s very fortunate for OP that he had his issues resolved so swiftly, along with a restored credit score. For his ex, depending on state law, she could be facing a felony conviction.

Thanks! Check out the results:

Work & Money