When acouple starts living together, one of the first issues to figure out is how they’re going to split the rent. Sometimes, one person in the couple might still be in school or between jobs, so the burden then falls entirely on the shoulders of the other. There are cases, however, when a partner volunteers to cover all the rent.

Figuring out how to split rent can be a contentious topic for many couples

Image credits:Alexander Grey / unsplash (not the actual photo)

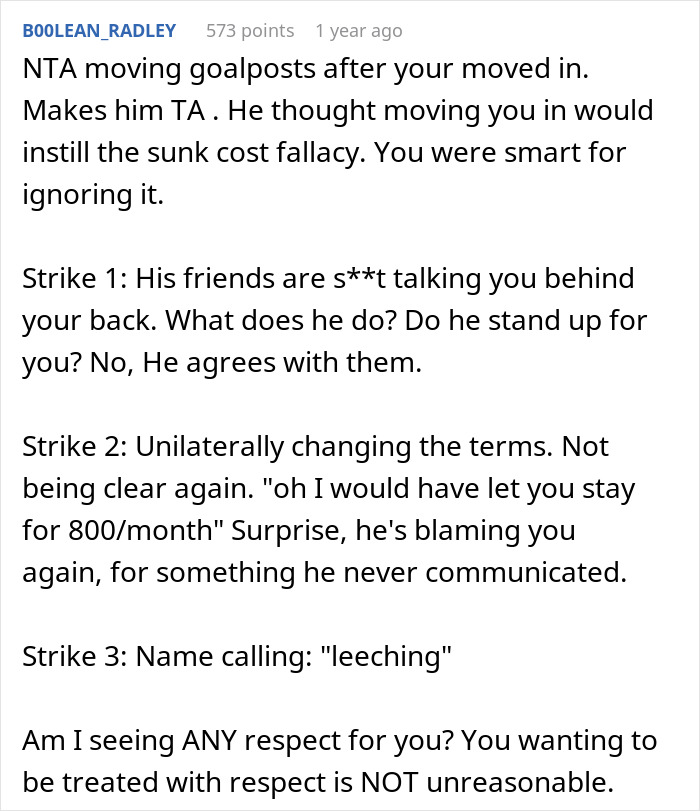

This woman decided to move out after her boyfriend suddenly started demanding she help him pay rent

Image credits:Andrea Piacquadio / pexels (not the actual photo)

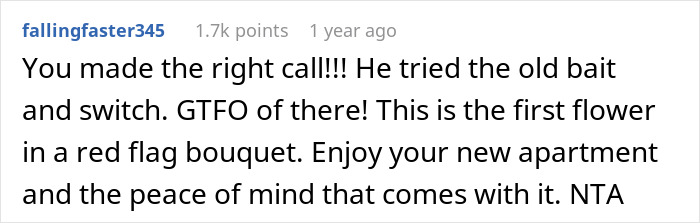

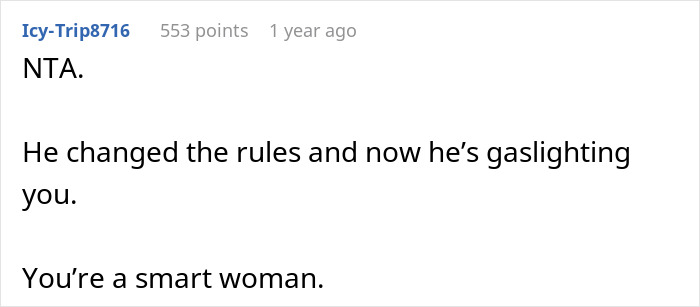

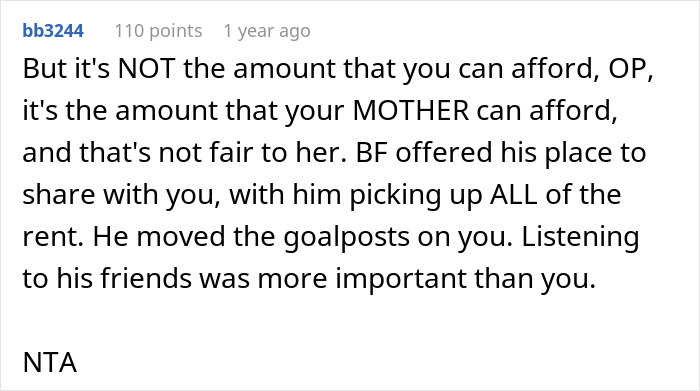

In an update, the woman shared how she left her boyfriend and explained the particulars of renting in NYC

Image credits:idiotrichboyfriend

Many young couples don’t discuss their finances before important milestones, but they should

Image credits:Blue Bird / pexels (not the actual photo)

The situation described here happens more often than we think.Credit Karmareports that for many young people, money issues are the dealbreaker in a relationship. 38% of Gen Z and 36% ofMillennialssay they would break up with a partner if they didn’t share the same money values.

Many respondents also said they don’t talk about finances until they reach an important milestone, like moving in together or getting engaged. This points to a big mistake young couples make, one that personal finance experts highlight as a must for all couples who want to be successful in the long-run.

That’s being open and communicating about each other’s finances from the get-go. Instead of doing that, however, many couples choose to sus out their potential partner’s financial situation online. 35% of Gen Z and 25% of Millennials said in the Credit Karma survey that they look up their dates on LinkedIn and Glassdoor to gauge how much they’re making.

Yet manypersonal financeexperts say that it’s crucial for partners to be transparent about money. Kayla Welte, financial planner at District Capital Management, toldBloombergit’s never too early to discuss money. Couples should talk about their career plans, savings,credit scores, and attitudes toward spending at the very beginning of the relationship.Bankraterecommends starting small if you’ve been dating for a month or less. Discuss date budgets and whether you can take that weekend vacation or not.

If couples are not sure how to do that, Brittany Wolff, founder of Wolff Financial in South Carolina, alsosayshow they can arrange ‘money dates,’ a time when they can discuss their situation and goals. Making it fun – like a date – can take the pressure off, keeping the conversation light and productive.

When one partner makes more than the other, there are bound to be disagreements

Image credits:Karolina Grabowska / pexels (not the actual photo)

In an ideal world, money doesn’t matter in relationships. However, in reality, income gaps between partners often lead to arguments and misunderstandings between couples. Relationship expert Susan Winter toldInsiderthat a significant income disparity can strain a relationship. “Traditionally speaking, money equals power. And the one with the power is the one who controls the relationship.”

What’s the solution? Again, communication. Winter said that the individual who feels discomfort because they’re making less or their partner is making significantly more should let their feelings be known. They should also evaluate what exactly makes them feel this discomfort.

Because in many cases, the person who makes less money can contribute in other ways, whether that’staking on more of the household choresor bearing more of the emotional labor. Winter also notes how the partner can express their affection for their significant other so as to let them know it’s not about the money, or they can plan inexpensive dates to treat them.

Also, the fact that you’re making less doesn’t mean you can’t contribute. There are three different ways couples candistribute income. The first one, of course, is the 50/50 model, where each person contributes equally. However, ‘fair’ doesn’t always have to be ‘equal.’ Like in this story, one person in a couple can be making significantly less or even no money at all.

The last technique is “all in.” That’s when both partners put their salaries together and cover expenses from the joint account. This model might work best when there’s complete trust between the couple and both are on the same page about what their expenses should look like. Every couple should work out which technique works best for them, and if none do, perhaps their financial values just don’t align.

Thanks! Check out the results:You May LikeMan Accuses “Terrible” Sister Of Prioritizing Her Dog’s Life Over His Career, Family AgreesGabija Palšytė“Yes, I’m Stupid”: 30 Men Reveal Things About Women They Had No Idea About Before Getting A GFViktorija OšikaitėWoman’s Stench Leaves Man Resentful And Revolted, Gets Told He’s The Problem In The EquationRugilė Žemaitytė

Gabija Palšytė

Viktorija Ošikaitė

Rugilė Žemaitytė

Relationships