There comes a time when we have to take responsibility for our lives and start making decisions that contribute positively to our own well-being. Not just rely on the kindness of others.

But in a post on the subreddit ‘Entitled People,’ platform userArchi_Femme10said that her brother — despite being 26 years old — still hadn’t realized it.

It had gotten so bad that their mother, who sounds like a pleasant, conflict-avoidant lady, decided to teach the guy a lesson and took matters into her own hands.

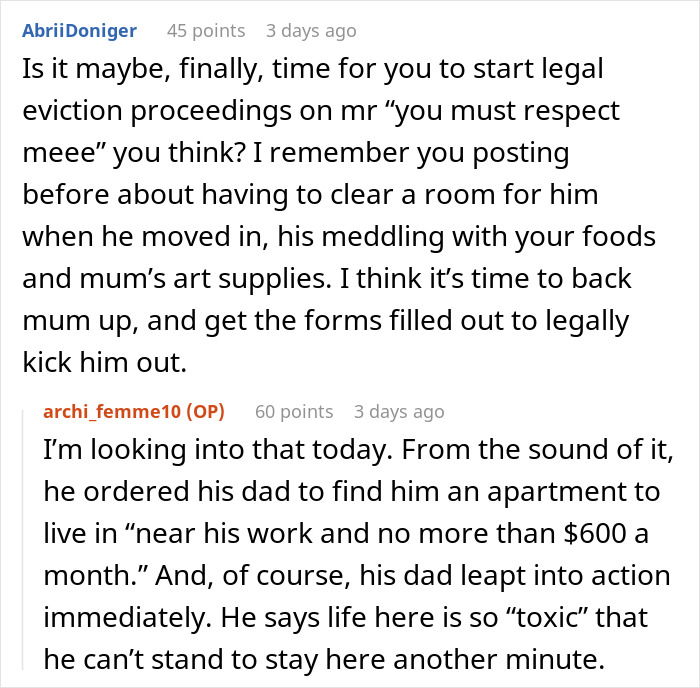

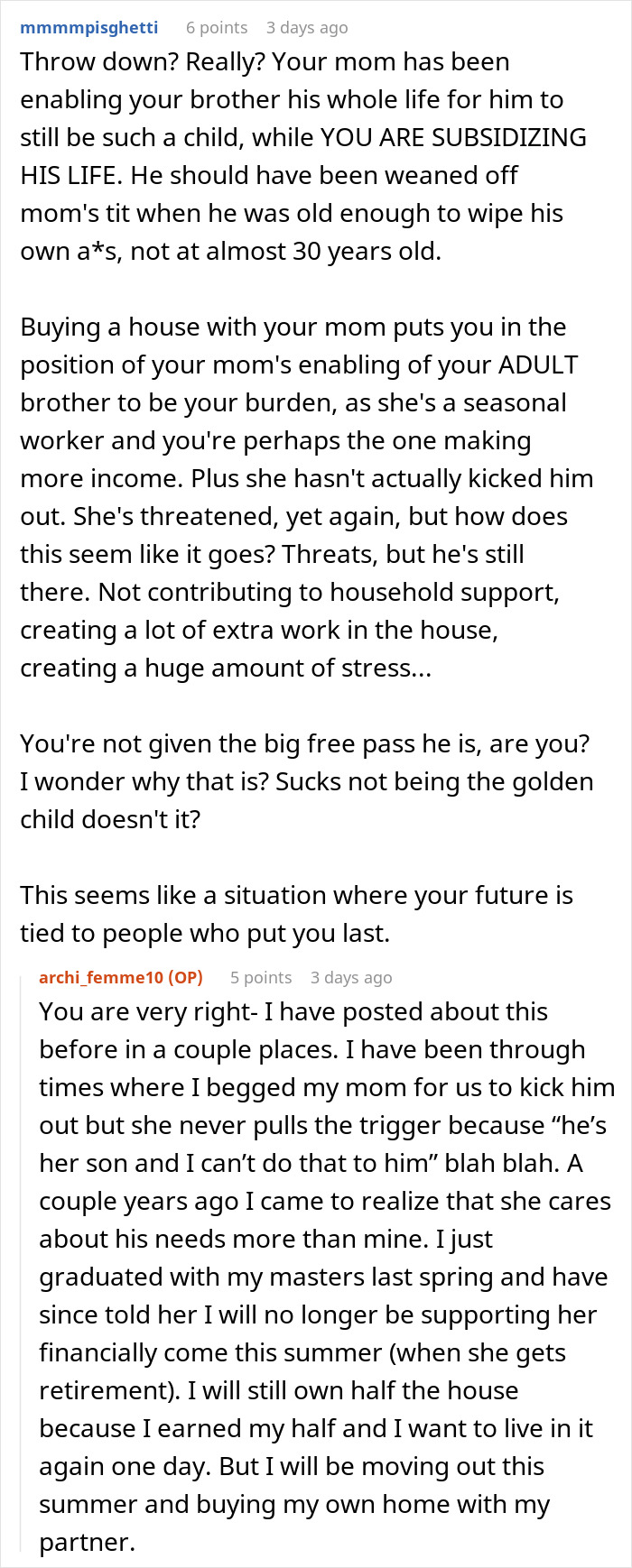

Grown-up siblings are supposed to be on each other’s side

Image credits:dekddui1405 / envato (not the actual photo)

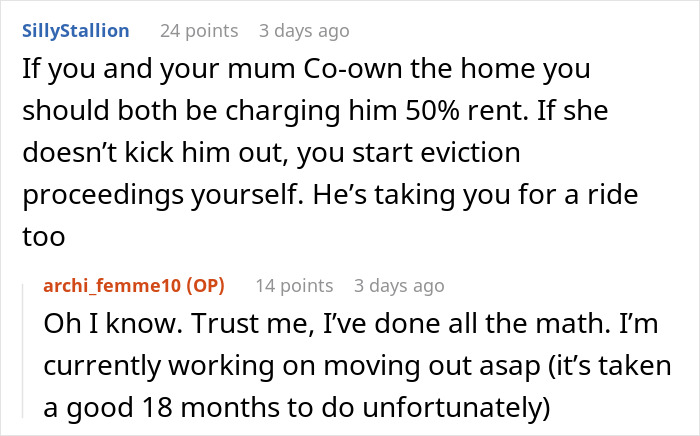

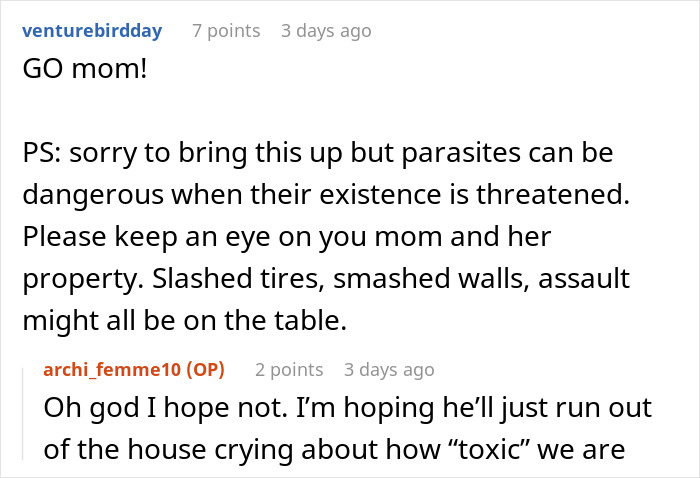

But when this woman learned that her mother was kicking her brother out of the house, she was quite ecstatic

Image credits:Lazy_Bear / envato (not the actual photo)

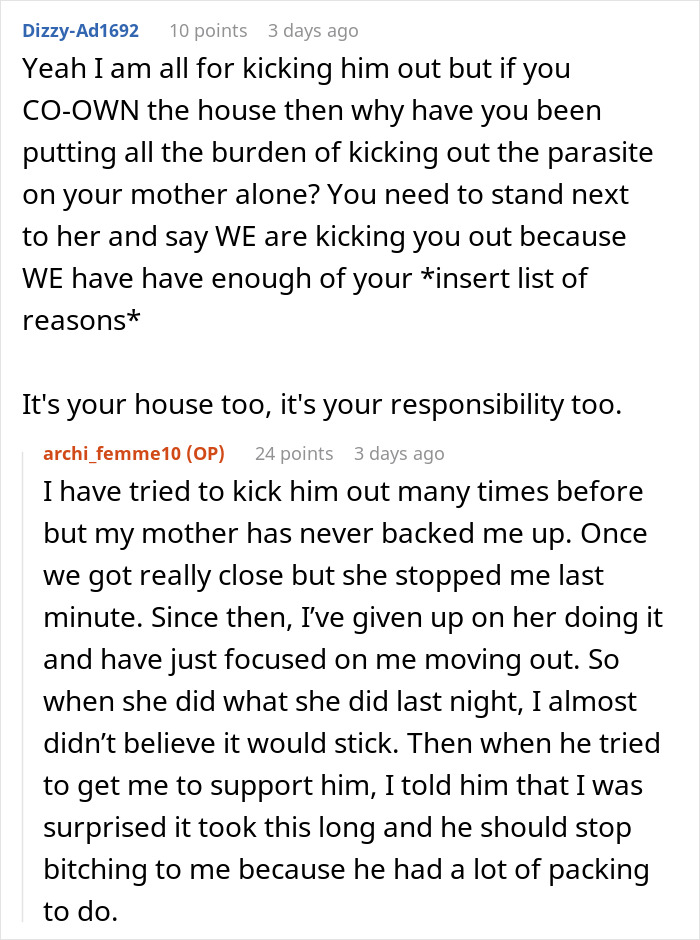

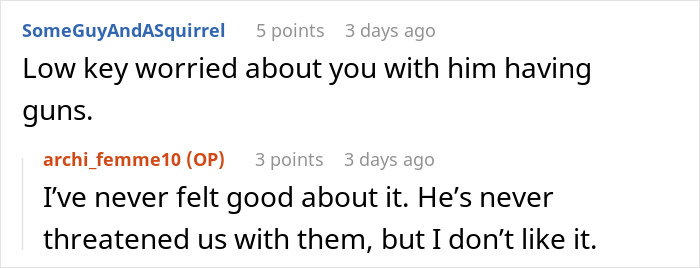

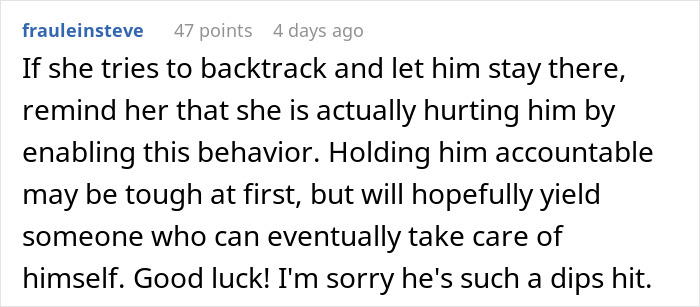

Image credits:archi_femme10

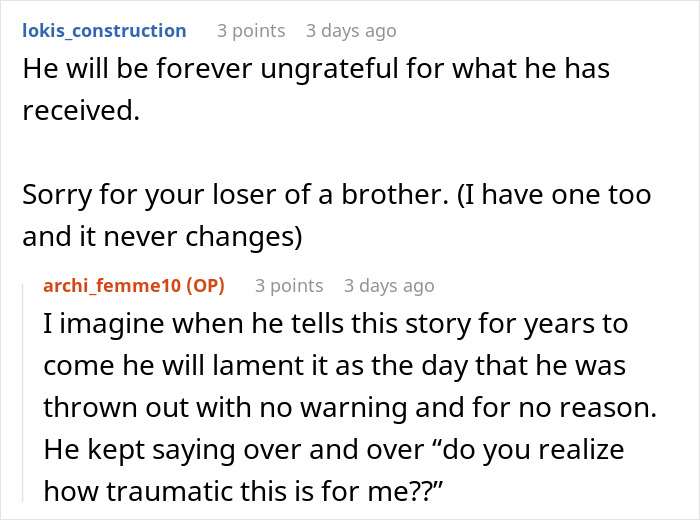

Experts say parents should prioritize their own financial security and set clear boundaries when providing financial support to their grown children

Image credits:Karolina Grabowska / pexels (not the actual photo)

According to a 2024 Savings.comsurvey, 47% of parents with grown children provide them with some form of financial support (not including adult children with disabilities).

On average, these parents are shelling out $1,384 a month, the research found.

Compared with their parents at this age, Gen Zers — the cohort to which the guy from the story belongs — are more likely to have a college degree and work full-time. So in this sense, he’s more of an outlier.

However, of the adult children who are still living at home, 61% don’t contribute to household expenses at all.

As the situation we just learned about illustrates, supporting grown children can be a substantial drain, especially to those whose own retirement security is at risk.

Savings.com discovered that 58% of parents have sacrificed their financial security for the sake of their adult children, a jump from 37% of parents a year earlier.

Therefore, Carolyn McClanahan, a certified financial planner and founder of Life Planning Partners in Jacksonville, Florida, believes that first and foremost, parents should have a good financial plan for themselves, and only then budget how much they can give their kids.

“You need to create boundaries and figure out a balance,” shetoldCNBC commenting on the issue, adding that as a rule of thumb, you should set aside money for your retirement and emergency fund first.

So judging from the post, it sounds like the lady is doing the right thing.

Thanks! Check out the results:You May LikeMom Kicks Out 17YO Daughter, Word Spreads And Karma Bites Her Where She Least ExpectedIlona BaliūnaitėMan Confused Why Wife Lies About Him To Her Friends, Finds Even More Text ConversationsViktorija Ošikaitė“I Feel Bad For His Wife”: People Give Man A Reality Check For Insisting On His Daily RoutineJustinas Keturka

Ilona Baliūnaitė

Viktorija Ošikaitė

Justinas Keturka

Relationships