Our friendships are supposed to be sources of joy, but when money gets involved, things can become complicated.

The single mom recently received additional funds and gave her friend a substantial sum to cover an urgent mortgage payment. But as time passed, the friend didn’t seem to be interested in returning the loan.

RELATED:

Image credits:Ave Calvar (not the actual photo)

However, when the friend got back on her feet, she chose to go on expensive trips and buy a new car instead of repaying what she owed

Image credits:Getty Images (not the actual photo)

Image source:Goldilock1234

As this experience illustrates, money is a known destroyer of friendships

Earlier this year, Bread Financial, a financial services company providing payment, lending, and saving solutions, conducted astudyand discovered that lending money to friends can, indeed, come at a high cost.

More than half (57%) of respondents reported borrowing money from friends at some point, with bills being the most common reason at 63%.

However, nearly a third (30%) of these borrowers also admitted they have never repaid their friends. This often leads to friction in friendships, with 33% of respondents indicating that repeated borrowing without repayment was a top driver of relationship tension.

Among the most interesting findings, 21% of the 1,670 people surveyed have lost a friendship over money, and 26% feel they are financially incompatible with their friends.

Image credits:Curated Lifestyle (not the actual photo)

Lending money to friends and family can unite people in times of hardship, but as we just read, it can also complicate relationships, largely because “so much of our financial decisions involve emotions,” says Michelle Singletary, author of a number of books on money management, includingWhat to Do With Your Money When Crisis Hits: A Survival Guide.

We have to be able to say no to people in these situations.

“You cannot potentially sink your own ship to bail out someone else,” Aja Evans, a board-certified therapist who specializes in financial therapy,tellsCNBC Make It.

That’s not to say having that conversation is easy. Close friends or family members, Evans says, may be aware of the things you’re spending money on, like clothes or vacations, and make judgments about what they believe you can or can’t afford.

But no one knows your money better than you. “Just because you have it in your account doesn’t mean you can give it,” she adds. “Especially if you know other bills are coming.”

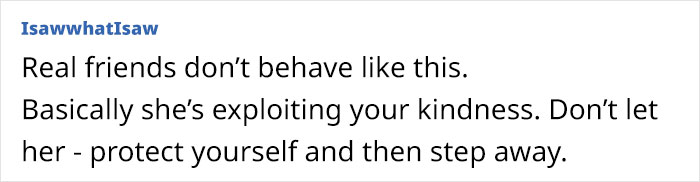

People were really supportive of the woman

Thanks! Check out the results:You May Like30 Times People Had A Heartbreaking Realization That Their Friends Were FakeViktorija Ošikaitė28 Signs Of A Fake Friend And A Toxic RelationshipLinas SimonaitisWoman Thinks It’s Not Fair To Split The Bill For Meal She Didn’t Eat, Gets A Reality CheckRugile Baltrunaite

Viktorija Ošikaitė

Linas Simonaitis

Rugile Baltrunaite

Relationships