No one will argue that parenthood is not only a great joy, but also an equally great burden associated with many issues and problems. And many parents actually perceive their kids aspotential insurancefor the days of their own retirement. They say, we spend time bringing them up now – let them do the same in several decades!

This approach, to put it mildly, is wrong. However, some parents even go further – like, for example, the mom and dad of the useru/credithelpscammed, the author of our story today, who did not hesitate to take a hefty loan behind their adult child’s back. So, let’s read on.

More info:Reddit

RELATED:

The author of the post has elderly parents who always wanted to buy a pontoon boat to enjoy their retirement

Image credits:lsame / pixabay (not the actual photo)

The boat wasn’t cheap so it wasn’t an easy task to buy it – but the couple finally managed to do it

Image credits:u/credithelpscammed

Image credits:Tima Miroshnichenko / pexels (not the actual photo)

However, some months after turning to a bank for a mortgage loan, the author found out they have a $30K overdue loan now

Image credits:Pixabay / pexels (not the actual photo)

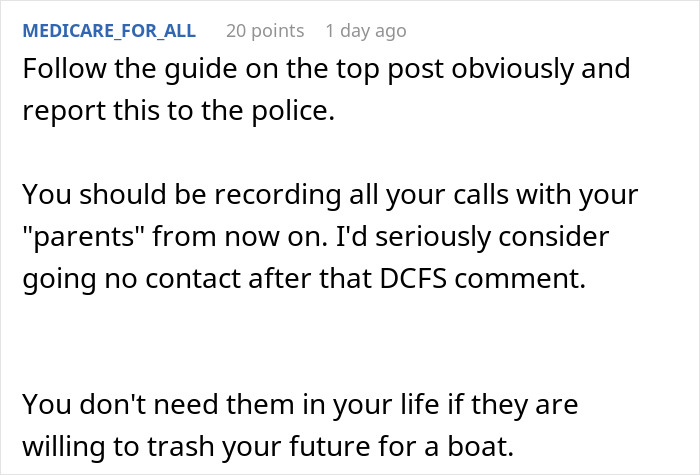

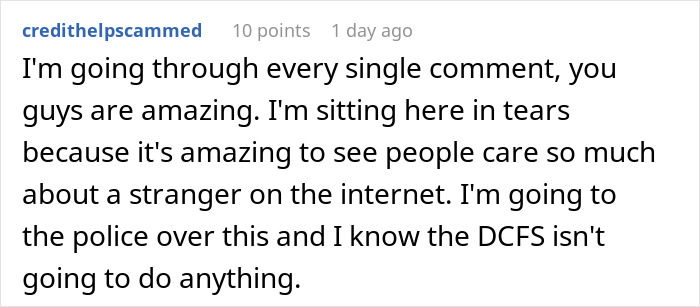

After doing an investigation, the author discovered that their mom had taken the loan in their name using their old shared account

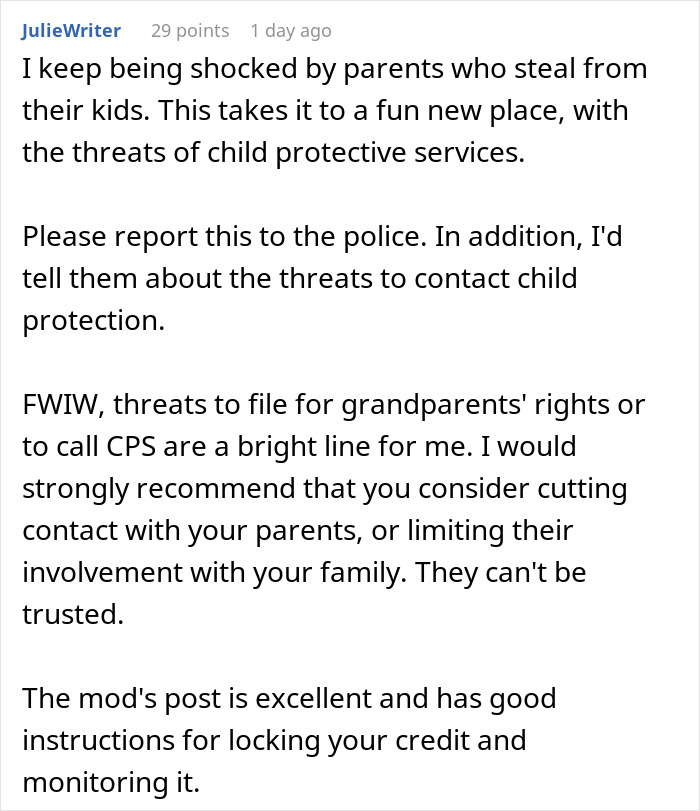

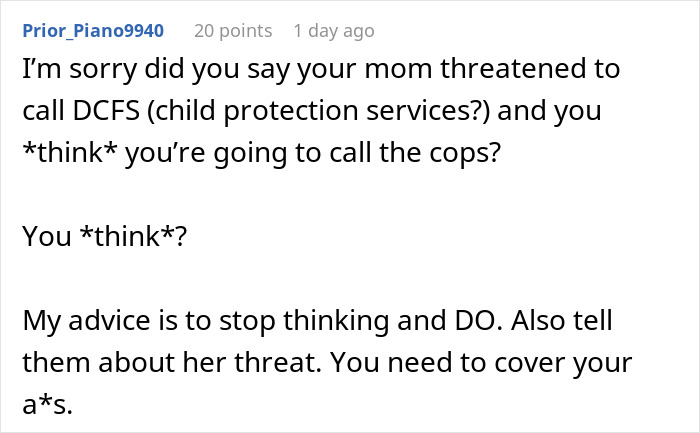

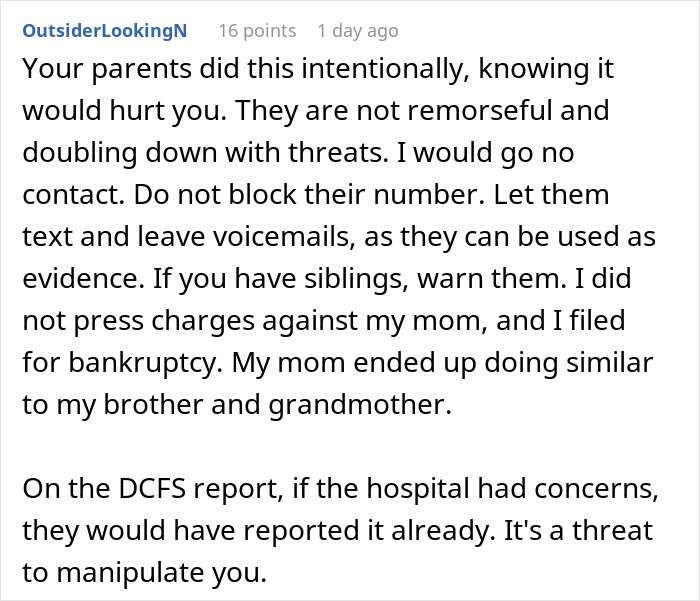

After the child told their mom they were going to report the police, the mom threatened to get Department of Children and Family Services involved on them in return

It all actually started with a boat: a pontoon boat that was so much-coveted for the Original Poster’s (OP) parents aftertheir retirement. Well, you probably understand it perfectly well. People have worked hard for many decades, and now they want to enjoy life to the fullest. And a boat is a great idea for this, you must agree.

But there’s a catch. Money. A boat is not a cheap pleasure, and the author’s parents, although they worked hard all their lives, couldn’t save up enough money so that buying a boat would not make a hole in their family budget comparable to the one the iceberg made in the Titanic. And yet, they did it.

An investigation was launched – after all, the bank employee assumed that the author’s identity might have been stolen. The author shared their bank account only with theirex-fiance, but that was a long time ago, and that account was closed a couple of years ago – just after they broke up. So this thread led nowhere…

About a week later, the OP received a notice from a certain company – that if the payment on this loan was not made on time, then they were going to charge off the account. The author went to their office, the matter went to the fraud department – and the trail led to an account that the OP had shared withtheir momas a minor.

And then there’s more. After the purchase, having made only one payment, the spouses realized that the obligation they had taken on for as many as 5 years would simply be beyond their means. And they did what seemed the most logical thing to them – they simply stopped paying. It also turned out that the boat can’t be repossessed, since it’s a personal loan.

As a possible alternative, the decent lady suggested declaring bankruptcy – but this would automatically put an end to the possibility of buying a house for the author. When the OP threatened to contact the police, the mom first said that they wouldn’t take such a report seriously. And then, realizing that this promise was real, she threatened to contact the Department of Children and Family Services in response.

The thing is that the author’stoddlerrecently accidentally burned himself on a hot pan. Nothing terrible happened – the tot is already completely fine, but his grandma decided that this incident was an excellent opportunity to blackmail the parent. However, the author still plans to contact the police, and just decided to enlist the support of netizens.

Image credits:pressfoto / freepik (not the actual photo)

Well, using someone else’s account to get a bank loan is a crime under the laws of any country. And here, the parents of the original poster really face serious consequences. “Loan fraud can occur in many different forms. But in each case, it has the potential to ruin your credit rating and get in the way of buying a home, lending money, or starting a business,” Aura’s dedicatedblog postclaims.

Social Issues