There is a completely brilliant—and about half the time true—phrase: “The road to hell is paved with good intentions.” And this phrase, alas, also applies to our New Year’s resolutions. At least, very often, the promises that we solemnly make to ourselves in the first days of the new year remain just pipe dreams.On the other hand, is it worth giving up these resolutions? Definitely not—after all, for many of us, they really help us to become better and get rid of bad habits. For example, mindlessly spending money on something not worth our attention, while concentrating, on the contrary, on something both exciting and frugal. Andthis threadin the AskReddit community is dedicated to exactly such cases.More info:RedditThis post may includeaffiliate links.

There is a completely brilliant—and about half the time true—phrase: “The road to hell is paved with good intentions.” And this phrase, alas, also applies to our New Year’s resolutions. At least, very often, the promises that we solemnly make to ourselves in the first days of the new year remain just pipe dreams.

On the other hand, is it worth giving up these resolutions? Definitely not—after all, for many of us, they really help us to become better and get rid of bad habits. For example, mindlessly spending money on something not worth our attention, while concentrating, on the contrary, on something both exciting and frugal. Andthis threadin the AskReddit community is dedicated to exactly such cases.

More info:Reddit

This post may includeaffiliate links.

Using my local library more. I never realized how much my local library has. I can borrow state park passes for 1 week, get a streaming service, and free passes to my local children’s museum.

RELATED:

Focusing more on experiences vs things. My partner and I did not get each other Christmas gifts this year. And instead we decided to take ballroom dance classes together.

I’m selling most of the purses sitting in my closet that don’t give me joy anymore and investing in half-dead plants at Lowe’s to revive and give beauty to my home. I’ve realized I have a greener thumb than I thought and have been successful at reviving almost every plant I’ve brought home from the half-dead section.

On literally the first day of 2025, an interestingthreadappeared in the AskReddit community, where the topic starter—user u/riddlestheanswer—asked netizens: “What things are you doing in 2025 to both save money and find more fulfillment?“The author explained that they personally want morefinancialfreedom in the new year—and this, combined with the difficult economic situation, actually means cutting some expenses. For example, on hobbies that do not bring much joy, but are quite expensive. And so, the topic starter asked people online about various “frugal hobbies” for the new year.

On literally the first day of 2025, an interestingthreadappeared in the AskReddit community, where the topic starter—user u/riddlestheanswer—asked netizens: “What things are you doing in 2025 to both save money and find more fulfillment?”

The author explained that they personally want morefinancialfreedom in the new year—and this, combined with the difficult economic situation, actually means cutting some expenses. For example, on hobbies that do not bring much joy, but are quite expensive. And so, the topic starter asked people online about various “frugal hobbies” for the new year.

I’m going to stop coloring my hair and start embracing the gray…saving money and helping me love my natural self ♥️.

I’m cutting out Amazon prime and a bunch of my subscriptions completely. Going to focus on losing the final 45lbs, creating art, writing my screenplay, and learning programming/unreal engine.

- Actually track my personal spending. Write out every penny that goes out of my bank account or on a credit card.-shop the sales. I am challenging myself to only spend $65 a week on groceries and use up what we have in the pantry-cancel some subscriptions. Disney and crave are already cut.

It must be said that among the answers to the author’s question—and there are almost 200 of them today—there are ideas about which things should be abandoned in the new year, as well as hobbies that allow a person to acquire many useful skills. Which, in turn, provide an opportunity tosave.For example, many readers admit that the ability to sew or cook well are incredibly useful skills that not only bring them joy, but also make them more thrifty. After all, home-cookedmealswill, in any case, be cheaper than meals from a restaurant. And much healthier than, for example, fast food. This means that it’s also an opportunity to save on probable treatment and medications.

It must be said that among the answers to the author’s question—and there are almost 200 of them today—there are ideas about which things should be abandoned in the new year, as well as hobbies that allow a person to acquire many useful skills. Which, in turn, provide an opportunity tosave.

For example, many readers admit that the ability to sew or cook well are incredibly useful skills that not only bring them joy, but also make them more thrifty. After all, home-cookedmealswill, in any case, be cheaper than meals from a restaurant. And much healthier than, for example, fast food. This means that it’s also an opportunity to save on probable treatment and medications.

Decided a few days ago to stop drinking alcohol altogether. It’s not just the money I spend on alcohol, it’s the money I’d then spend on a pack of cigarettes, the takeaway food, the feeling like s**t for days afterwards. Not worth it anymore! Calculated I probably spend between €2000 and €3000 a year on alcohol and alcohol-related purchases.

Making one large, simple meal that can be shoved in the fridge and eaten for 2 more evenings. Good for portion control and the wallet. Lentil/chickpea pasta with tons of veggies is a family favorite.

To save money I just recently found out that the brand of cat food I buy has a contact us page where one of the entries is coupon requests and they said you can contact them every 3 months to have them send out coupons. I set a reminder on my phone that goes off once every 3 months to contact them for more coupons. When I did my last request they sent out a $10 off and 2x $5 off coupons, so if they still send 3 coupons per letter it would be a savings of at least $60 a year.

“These are the basic foundations of economics at the micro level - that is, at the level of an individual household or any person. When there’s a financial opportunity, then the person tries to delegate some areas of their life to professionals,” says Valery Bolgan, a historian andeditor-in-chiefof Intent news agency from Ukraine, whomBored Pandaasked for a comment here. “And so it has been for centuries.““Because, all other things being equal, for example, a professional chef will cook food faster and tastier than any of us. But the cost of any ready-made dish, in addition to the cost of ingredients, includes many other factors and markups. Therefore, when it becomes difficult for us to regularly eat ready-made food, we begin to cook ourselves.”

“These are the basic foundations of economics at the micro level - that is, at the level of an individual household or any person. When there’s a financial opportunity, then the person tries to delegate some areas of their life to professionals,” says Valery Bolgan, a historian andeditor-in-chiefof Intent news agency from Ukraine, whomBored Pandaasked for a comment here. “And so it has been for centuries.”

“Because, all other things being equal, for example, a professional chef will cook food faster and tastier than any of us. But the cost of any ready-made dish, in addition to the cost of ingredients, includes many other factors and markups. Therefore, when it becomes difficult for us to regularly eat ready-made food, we begin to cook ourselves.”

Duolingo is free. If you set up a classroom in the app it even gets rid of the adverts.

Volunteering more, gardening, trying to learn a third language, lots of camping and backpacking trips. would like to get more serious with birding because we have a very diverse bird population right in our backyard. I’m grieving the loss of both my beloved dog and my mom so i’m just trying not to rot in 2025 lol.

Finally started a budget so we can start saving for a new house! Drinking less is a big part of it. Late 30s and no savings is getting old.

So many people are just trying to save money—but at the same time, the modern person is looking for hobbies thatinterestto them.

“Decades and centuries of social development have done their job - modern people are no longer ready to just do something that is not interesting to them, just in order to save some money. Ideally, this should bring not only savings, but also joy. Therefore, such threads are quite reasonable nowadays,” Valery Bolgan explains.

I’m expanding my vegetable garden from 84 square feet to over 500. That fits both categories.

Looking for a job that pays more.

Sewing is fun! if you enjoy it, knitting and crocheting could be nice frugal hobbies tooi’m into crossword puzzles and language learning at the momentwhat about meditation, journaling, going for walks, cooking, baking, meal prepping, drawing, foraging, gardening, reading?

So, various and numerous interesting hobbies, useful for everyday life, are trending these days. Just as in the era when stamped factory goods dominated, handmade things are incredibly highly valued again… So, please feel free to scroll through this list to the end, and in case you have similar hobbies, please share them here. Or maybe tell us what New Year’sresolutionsyou have also made for yourself.

Make sourdough bread, going on 2 years. It’s good for you and you don’t need anything fancy. It’s delicious, healthy and you don’t need to buy store bought bread anymore.

I’m hoping to sell stuff that I or my family no longer use, not buy as much junk food (my family has major sweet teeth), and learn how to cook properly.

I got a weekly CSA box delivered to my house this year. With the cost of gas it’s comparable to regular grocery shopping. It forces me to be more creative with cooking. And even though I still have some waste it’s less than before. Also, I’m spending less on groceries because there are fewer impulse buys.For 2025, my goal is to get better at not forgetting I have zucchini in the fridge. And to remember which fruits & veg go bad fastest.Edit: spelling.

See Also on Bored Panda

I’m going to use cash for several categories of spending in my budget rather than credit cards. I’ll be using a combination of YNAB and envelopes to keep things tidy. I went way too far with instant gratification online purchases this year.

Minimizing, shopping trips and impulse purchases.

No gym membership - in lieu of that, I’m going to just do more walking around the house. Outside, also walk and run (whether permitting). Do stretches, push ups, sit ups, crunches, and planks. If we can manage to “get off our butts” to do this, then perhaps a gym membership won’t be a waste of money since it shows we’re disciplined enough to get **** done.

I am focusing on my health and starting the 2025 challenge where I walk 2,025 miles in a year. I am focusing on me this year and it will be glorious (and a first)!!

We had an extremely busy year and we are both ready to switch gears and have fun. We live near several big rivers and plan on spending a lot of time on our kayaks. We have had them for 7 years so they don’t cost us anything now. Tomorrow we are going snowshoeing and plan on going as often as we can this winter. We always pack our own food/snacks so it is pretty much free fun. The exercise is good for us, too. We cut the cord years ago on cable, have a roof full of solar panels and well water and have no debt.. Only pay for phone, trash, wi-fi and insurance.

I am getting chickens! I just spend ten dollars for 18!Exercising more too.

My goal is to keep doing well at work and continue to get raises. Next month, I will have paid off all of my high interest debt. My student loan payments will be due in Fall unless something changes. I’m super excited to start saving for my emergency fund at the end of next month. I’m going to keep sticking to my budget and planning out my expenses.

I’m leaning into creating at home vs buying. Food specifically. My kids love granola bars but they are so dang expensive so I’m going to try and make them at home.I got really into baking in 2024 how I’m going to use those skills to make some things I might otherwise buy.Also I have a ton of really nice clothes I won’t ever wear again and I’m going to focus on selling them to make some money and give them new life.

- Booking flight tickets much in advance- House parties over Clubbing- Saying no to alcohol (have cut down to once in 3 months in 2024 from 3 times a month in 2023)- Less gifts to partner, instead investing in experiences- Using credit cards wisely for more incentives- Cooking food instead of ordering or going out- Focus on my work (get more incentives, build a small business that can cover my needs to start with).

Selling all the furniture I’ve rehabbed. Also my prime membership is going 🚽.

Downgrading to a flip phone.

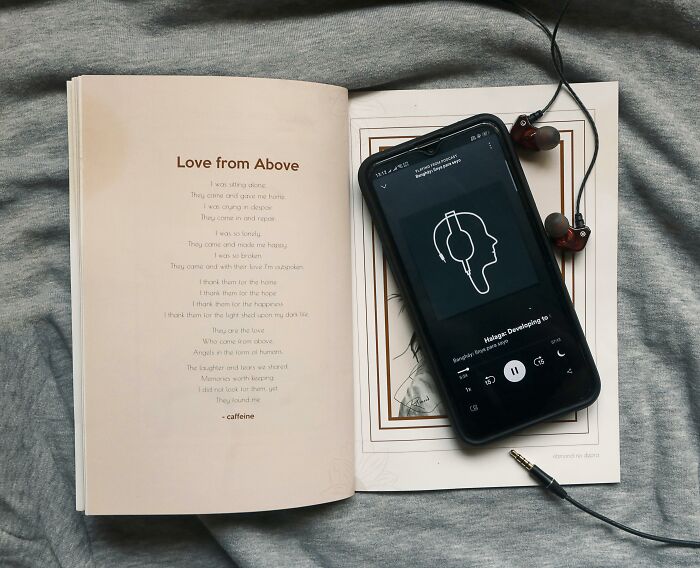

I am transitioning from podcasts/reels/other short form dopamine content to audiobooks to force myself to keep making art.This in turn keeps me off my phone and pining less for impulse purchasing.We also just got a deep freezer and I will be figuring out bulk cooking/freezing so we stop ordering out so damn much. I’m not the best cook, but having things prepared and ready to reheat will help pare down the decisions made during the workweek as well and maximize time to create.

think less dairy, it will be hard though becuz cheese! But it’s just gotten so expensive.

Not spending money on sugar.

Modal closeAdd Your Answer!Not your original work?Add sourcePublish

Modal close

Add Your Answer!Not your original work?Add sourcePublish

Not your original work?Add sourcePublish

Not your original work?Add source

Modal closeModal closeOoops! Your image is too large, maximum file size is 8 MB.UploadUploadError occurred when generating embed. Please check link and try again.TwitterRender conversationUse html versionGenerate not embedded versionAdd watermarkInstagramShow Image OnlyHide CaptionCropAdd watermarkFacebookShow Image OnlyAdd watermarkChangeSourceTitleUpdateAdd Image

Modal closeOoops! Your image is too large, maximum file size is 8 MB.UploadUploadError occurred when generating embed. Please check link and try again.TwitterRender conversationUse html versionGenerate not embedded versionAdd watermarkInstagramShow Image OnlyHide CaptionCropAdd watermarkFacebookShow Image OnlyAdd watermarkChangeSourceTitleUpdateAdd Image

Ooops! Your image is too large, maximum file size is 8 MB.

Upload

UploadError occurred when generating embed. Please check link and try again.TwitterRender conversationUse html versionGenerate not embedded versionAdd watermarkInstagramShow Image OnlyHide CaptionCropAdd watermarkFacebookShow Image OnlyAdd watermark

Error occurred when generating embed. Please check link and try again.

TwitterRender conversationUse html versionGenerate not embedded versionAdd watermark

InstagramShow Image OnlyHide CaptionCropAdd watermark

FacebookShow Image OnlyAdd watermark

ChangeSourceTitle

You May Like30 Frugal Choices That Ended In Tears, Fires, And FiascosIlona Baliūnaitė30 Nightmarish Financial Decisions That Left People Broke, Broken, And BewilderedGabija PalšytėGuy Hides His Lottery Millions For Years Until He Meets The One And Can Finally Reveal ItMonika Pašukonytė

Ilona Baliūnaitė

Gabija Palšytė

Monika Pašukonytė

Work & Money