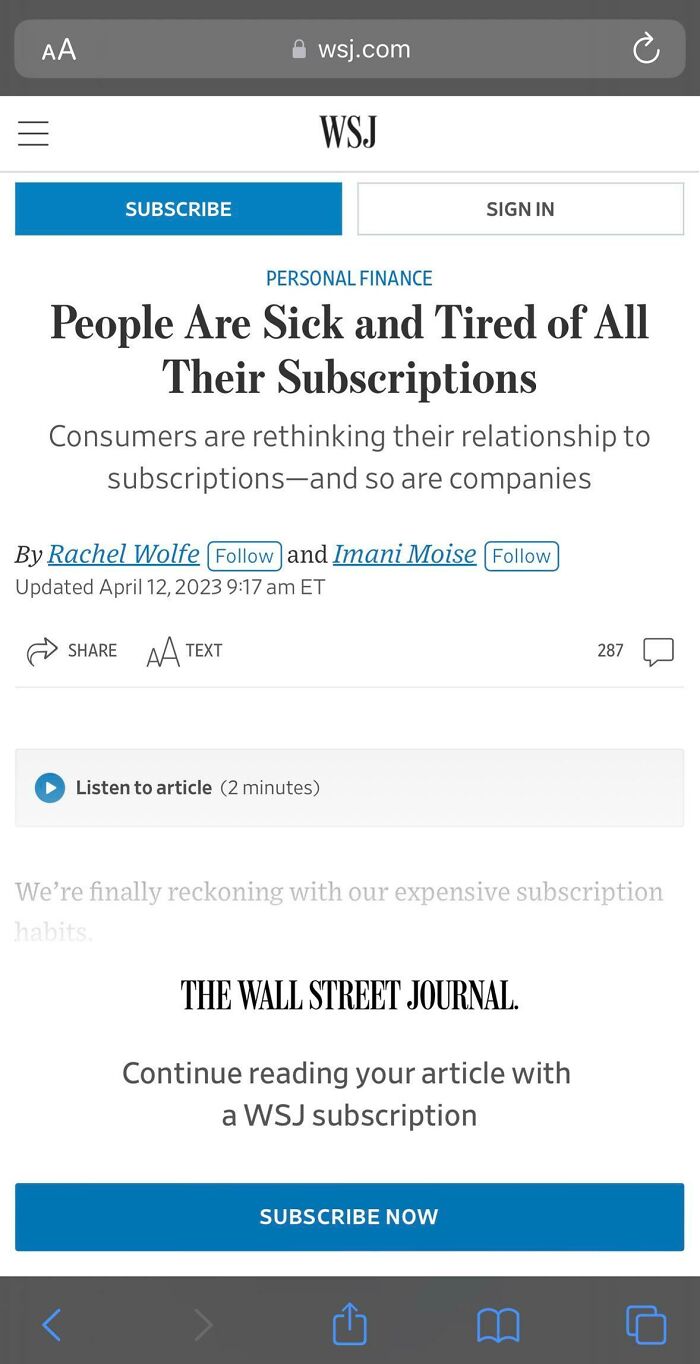

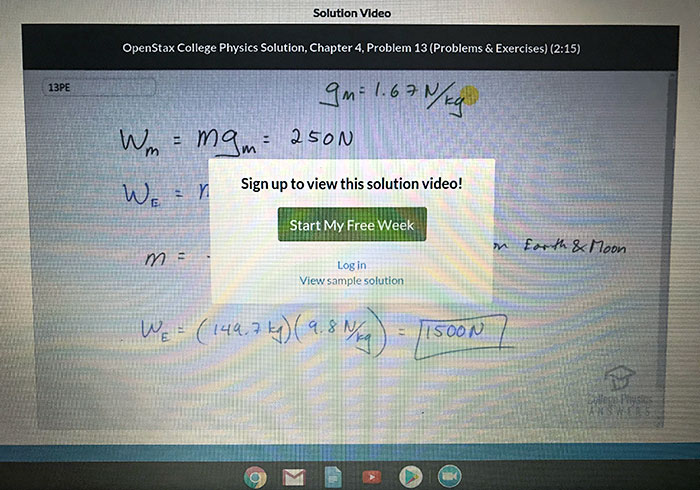

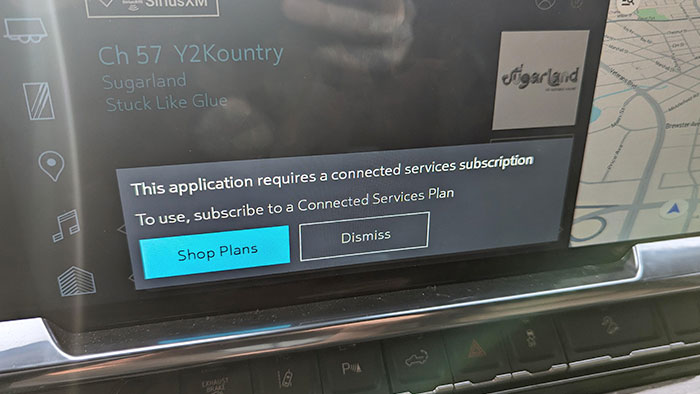

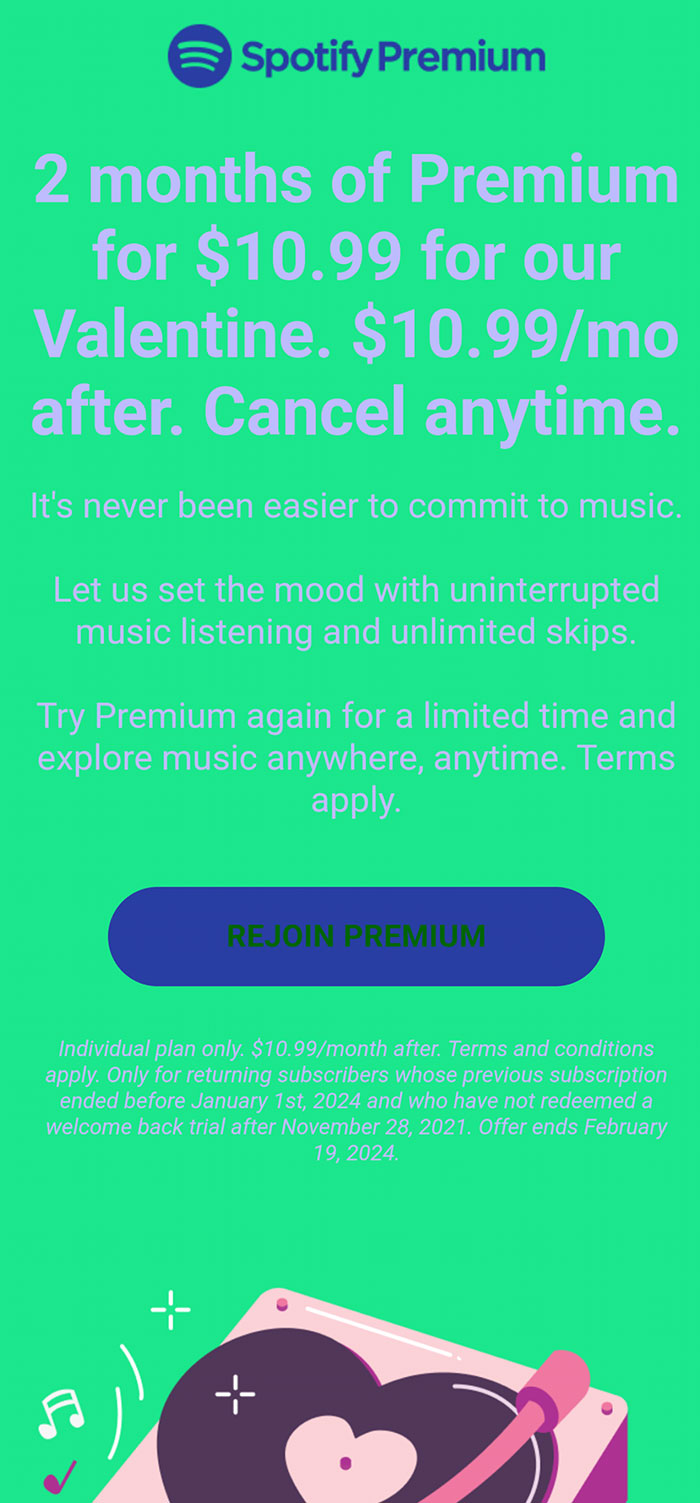

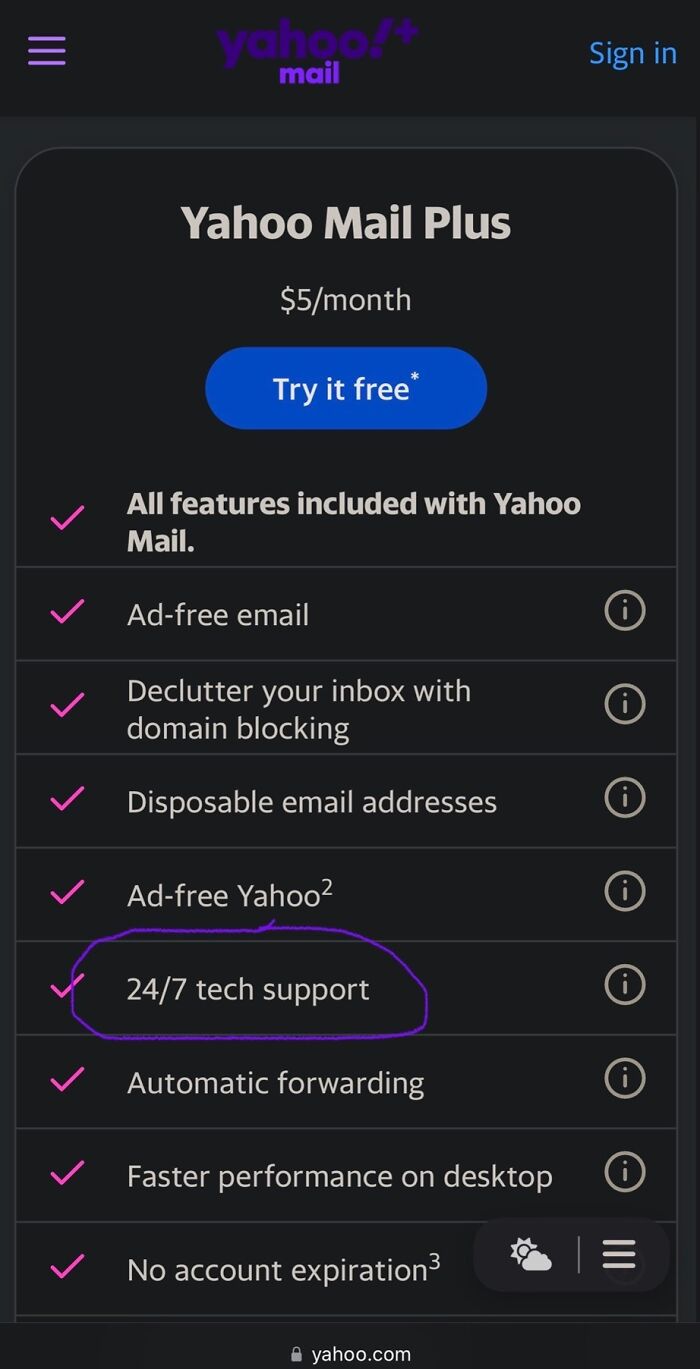

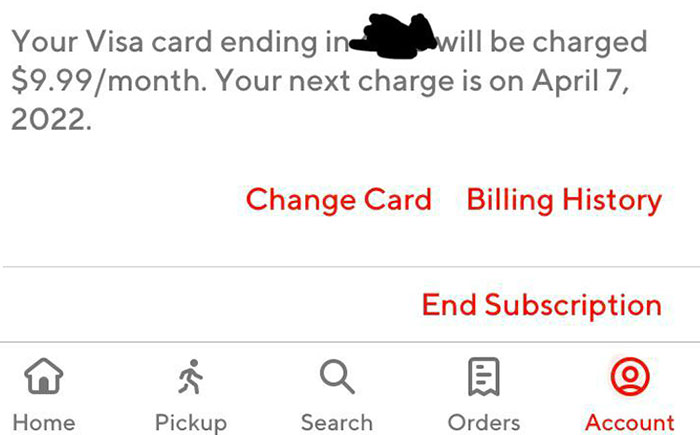

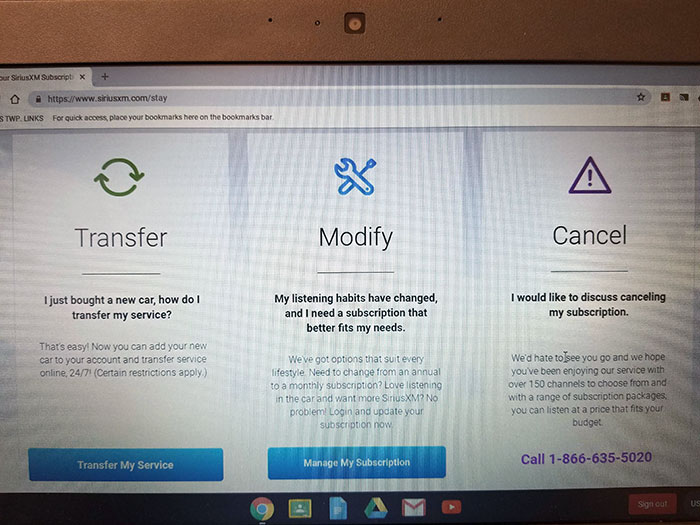

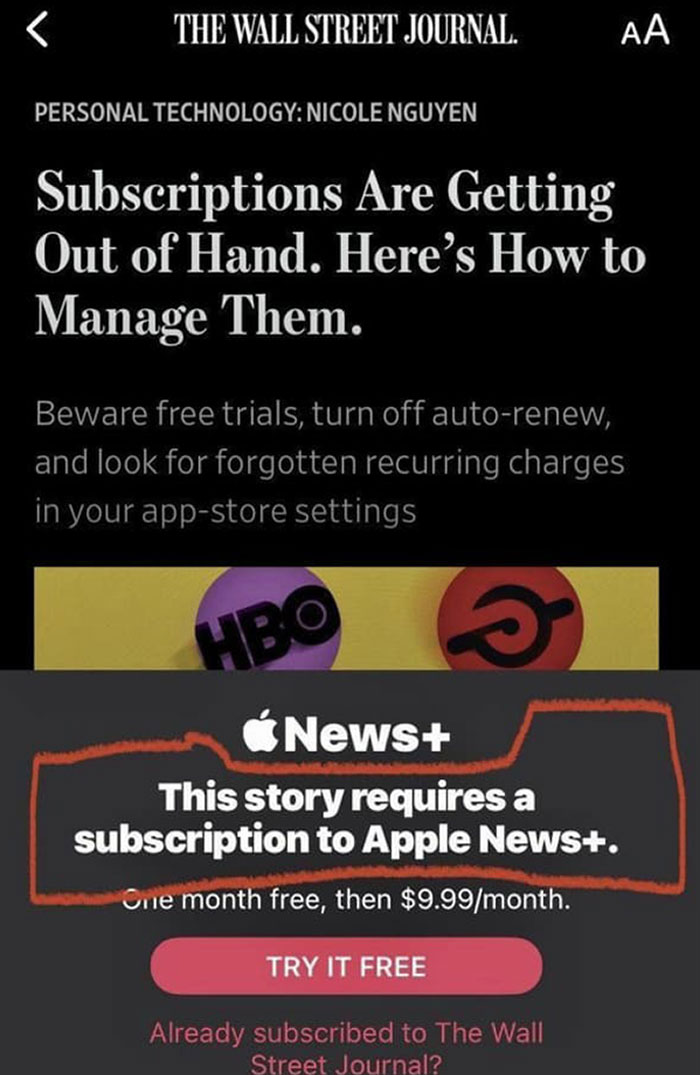

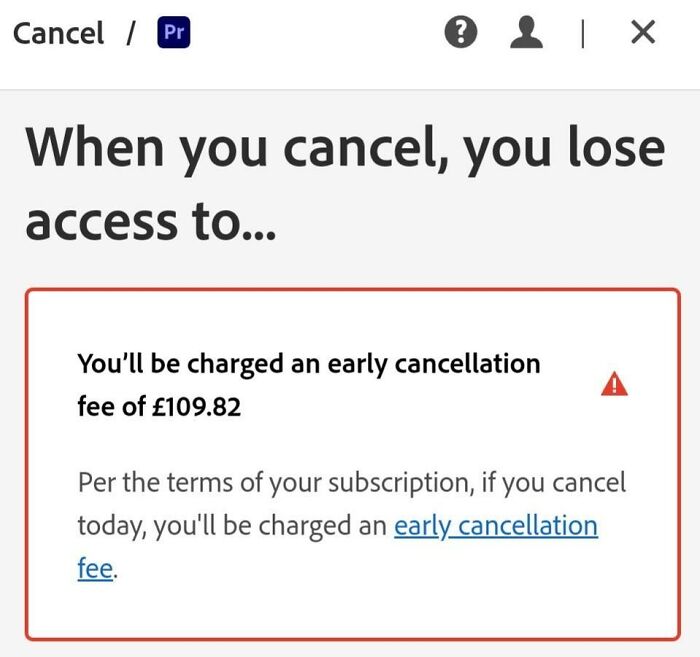

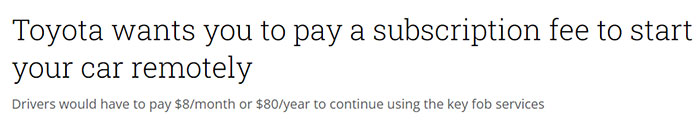

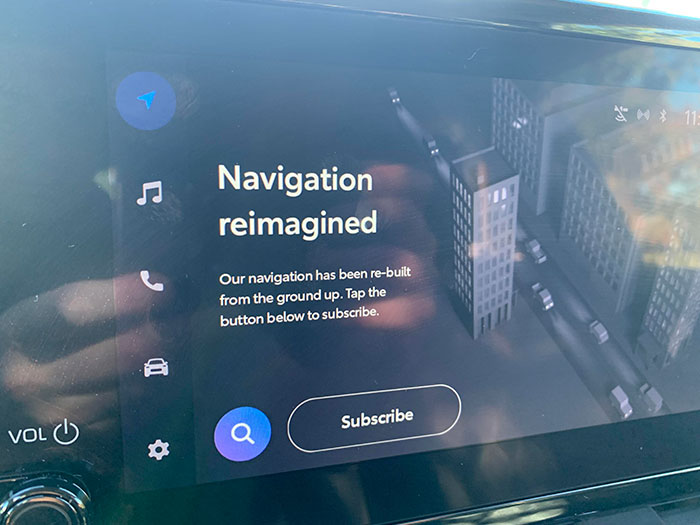

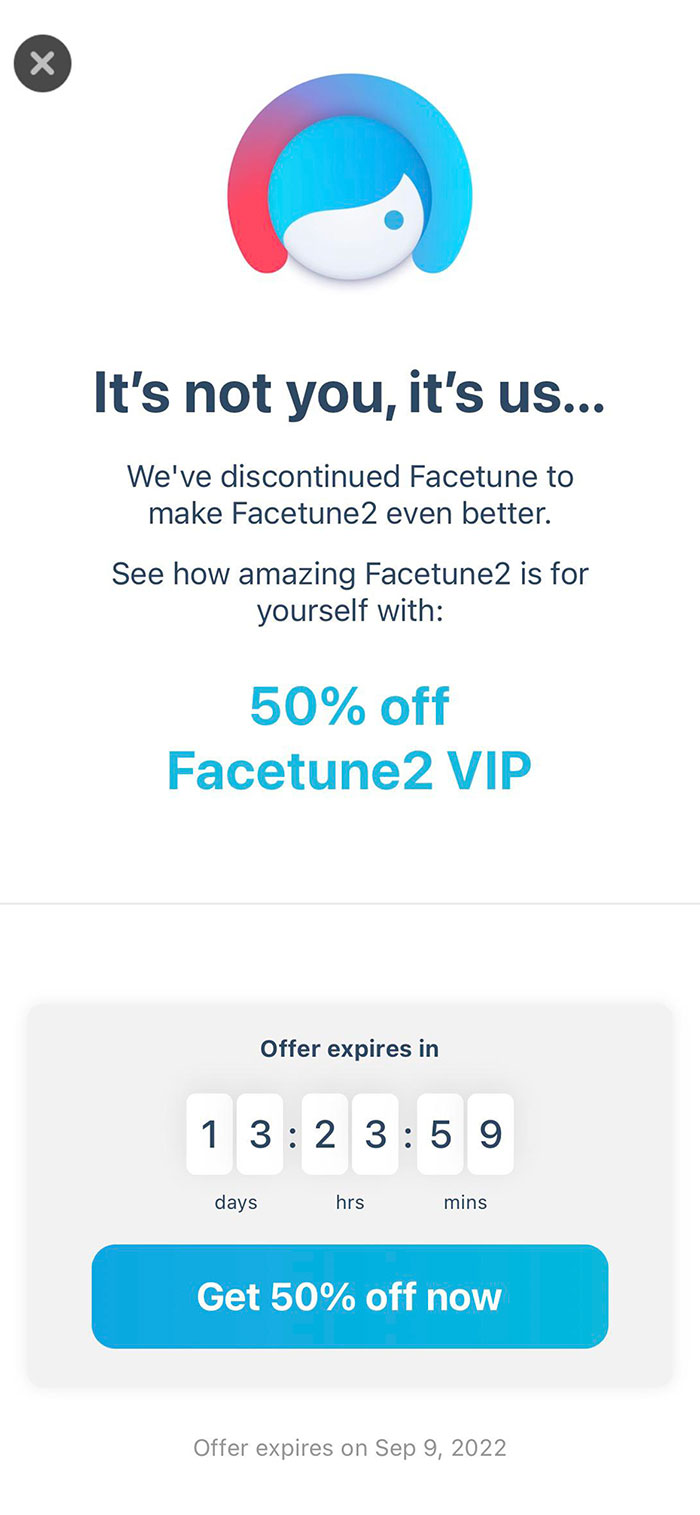

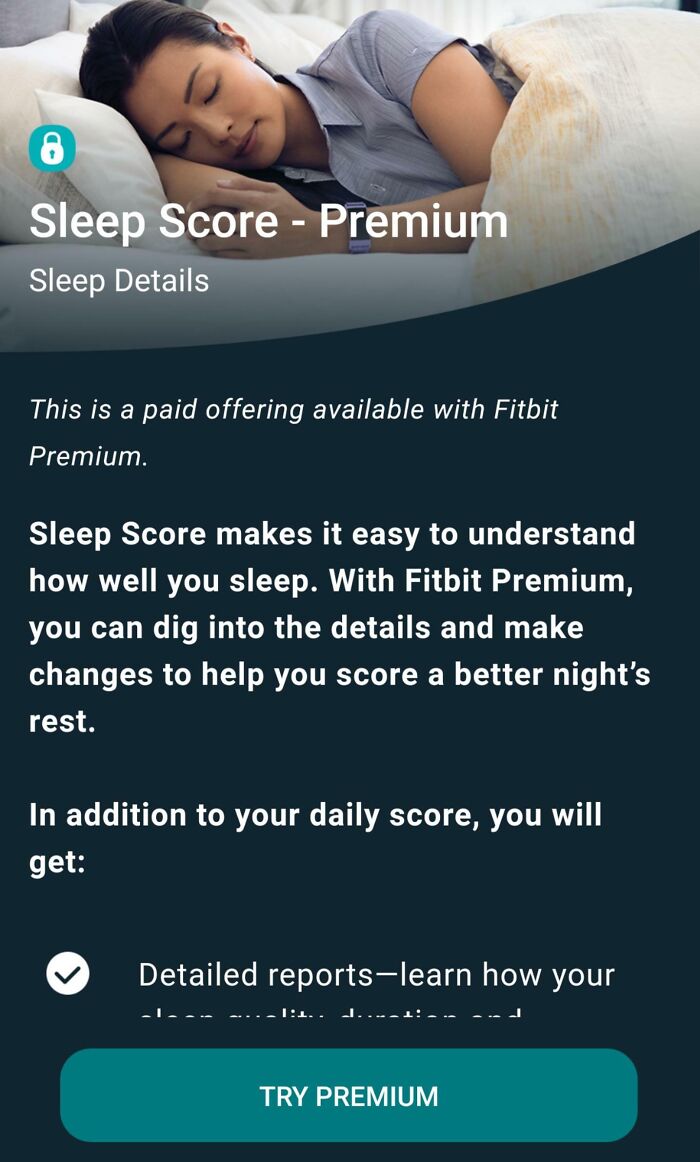

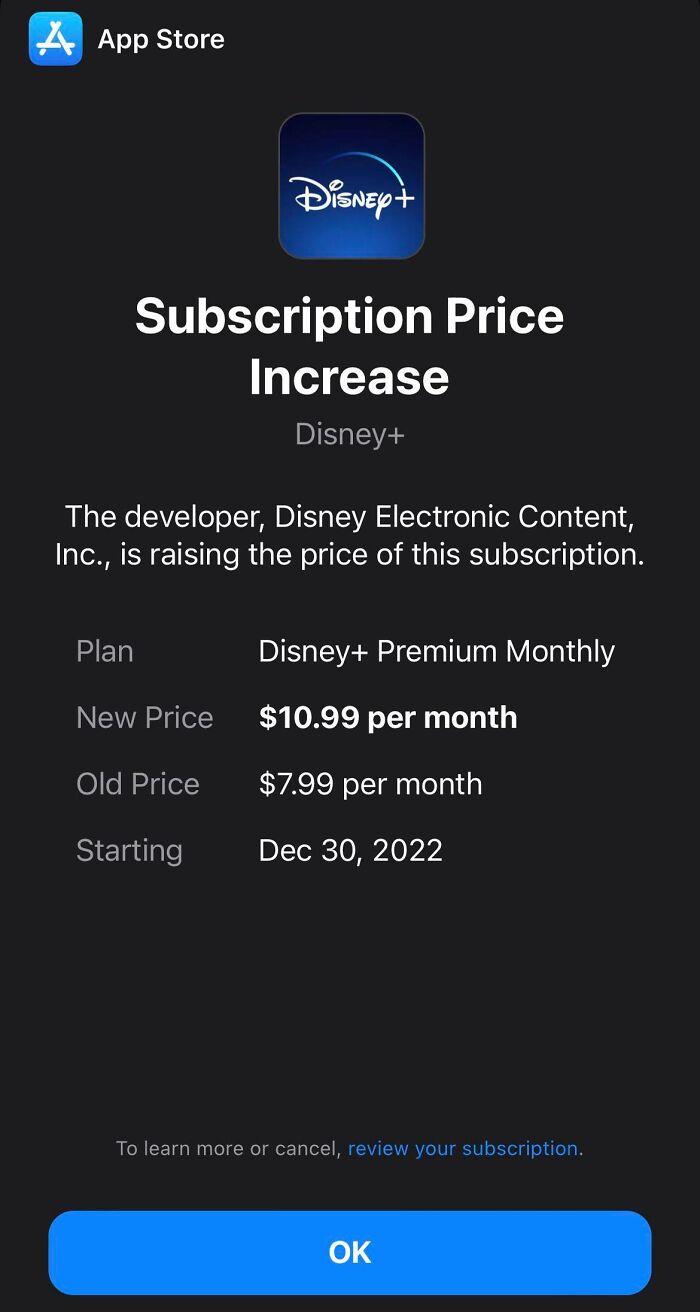

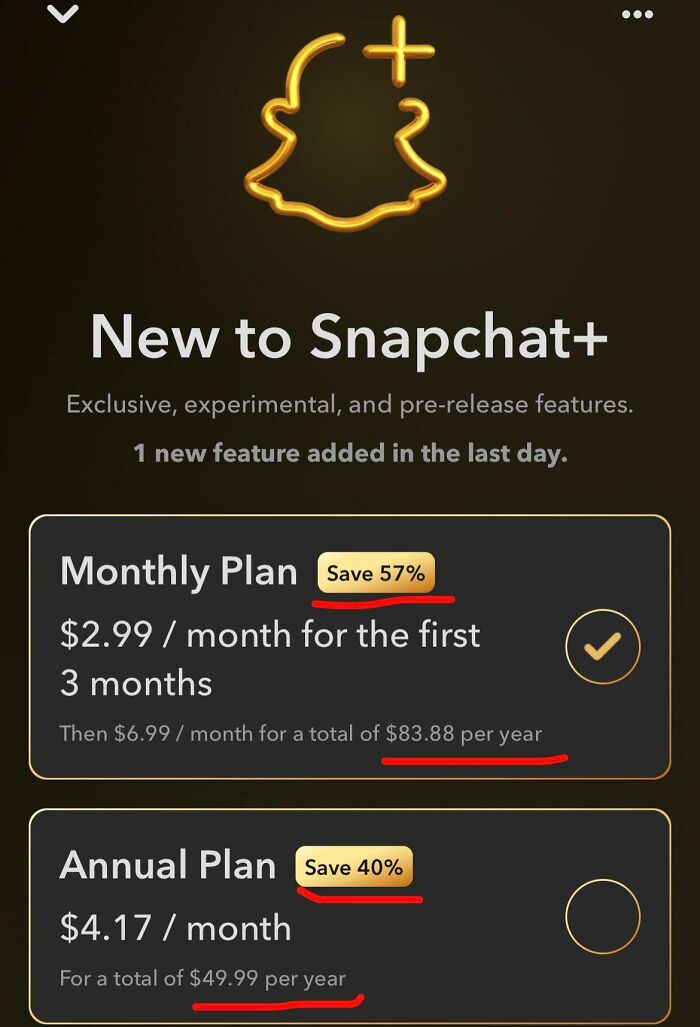

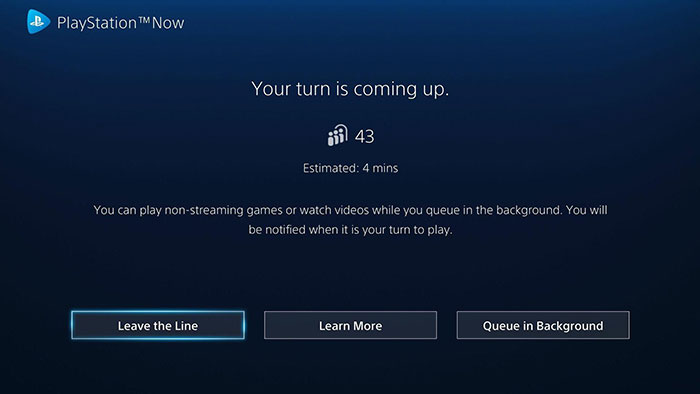

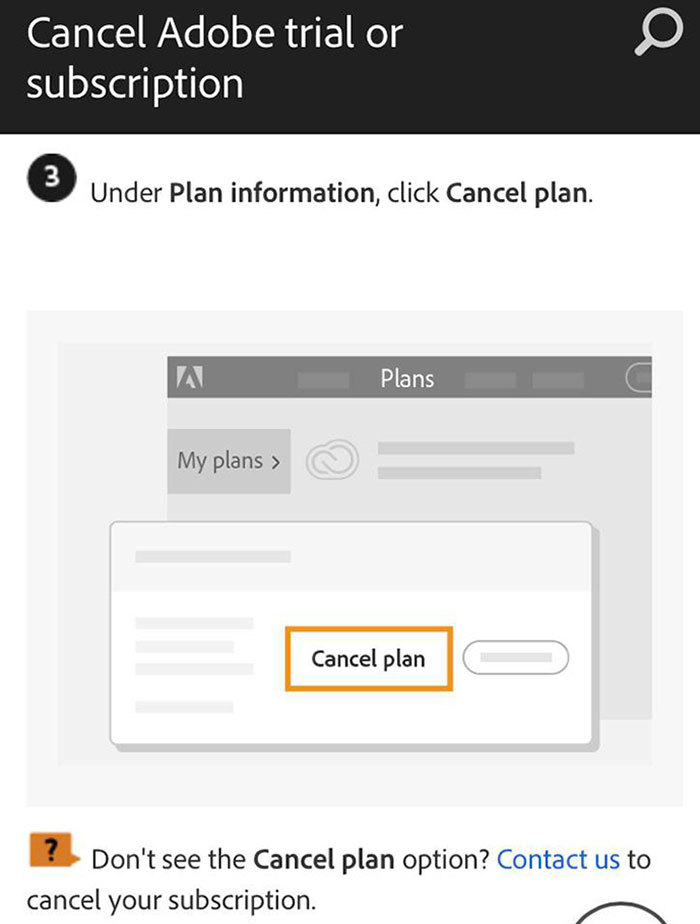

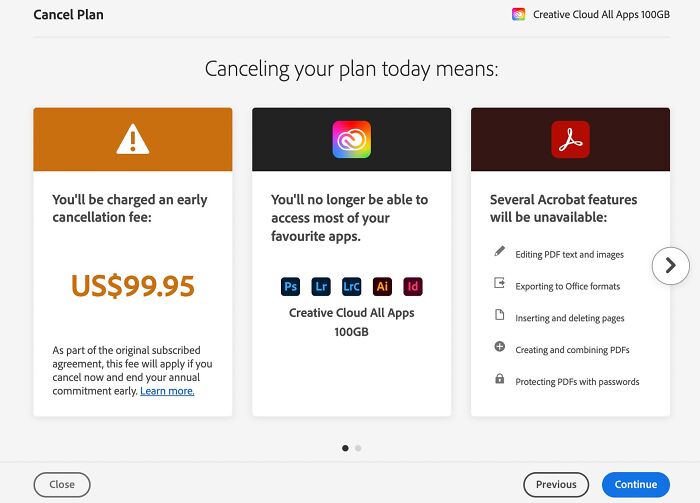

These days, it seems there’s a subscription for everything—from music and video streaming to photo editing, and even monthly boxes of exotic snacks. Signing up is a breeze, but canceling? That’s where the trouble begins.

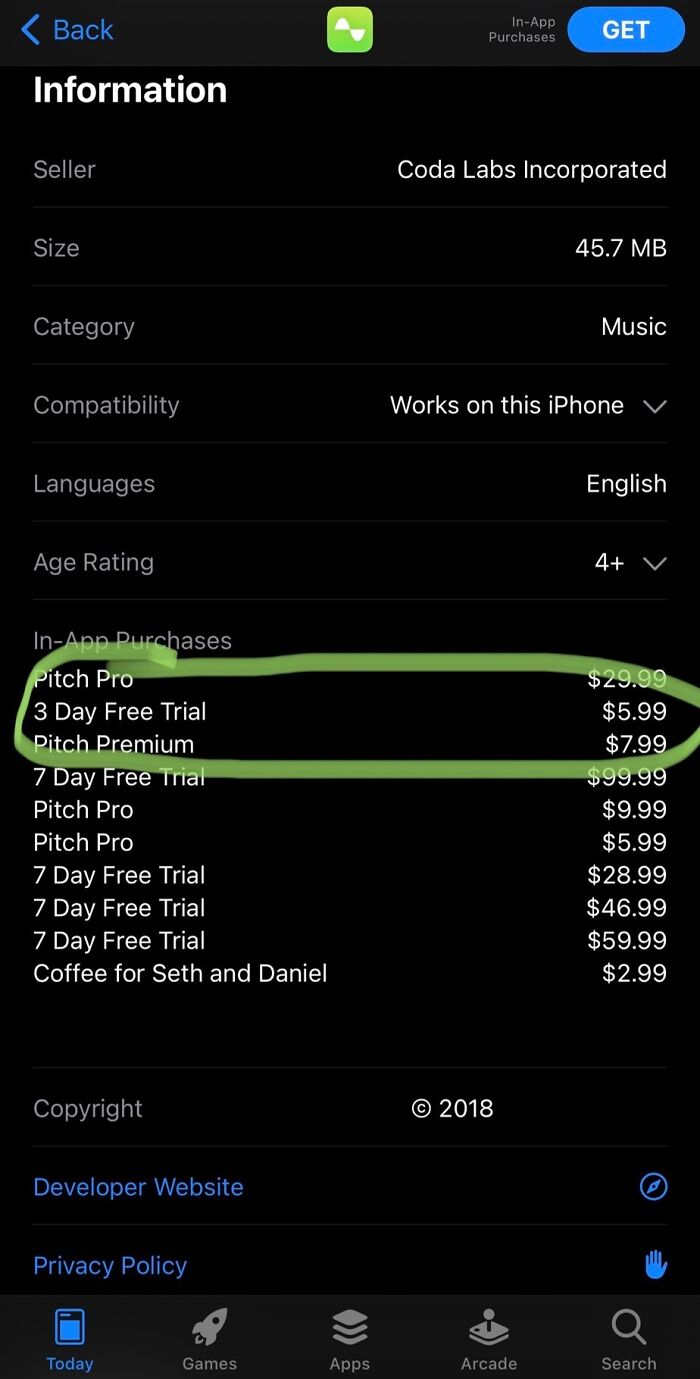

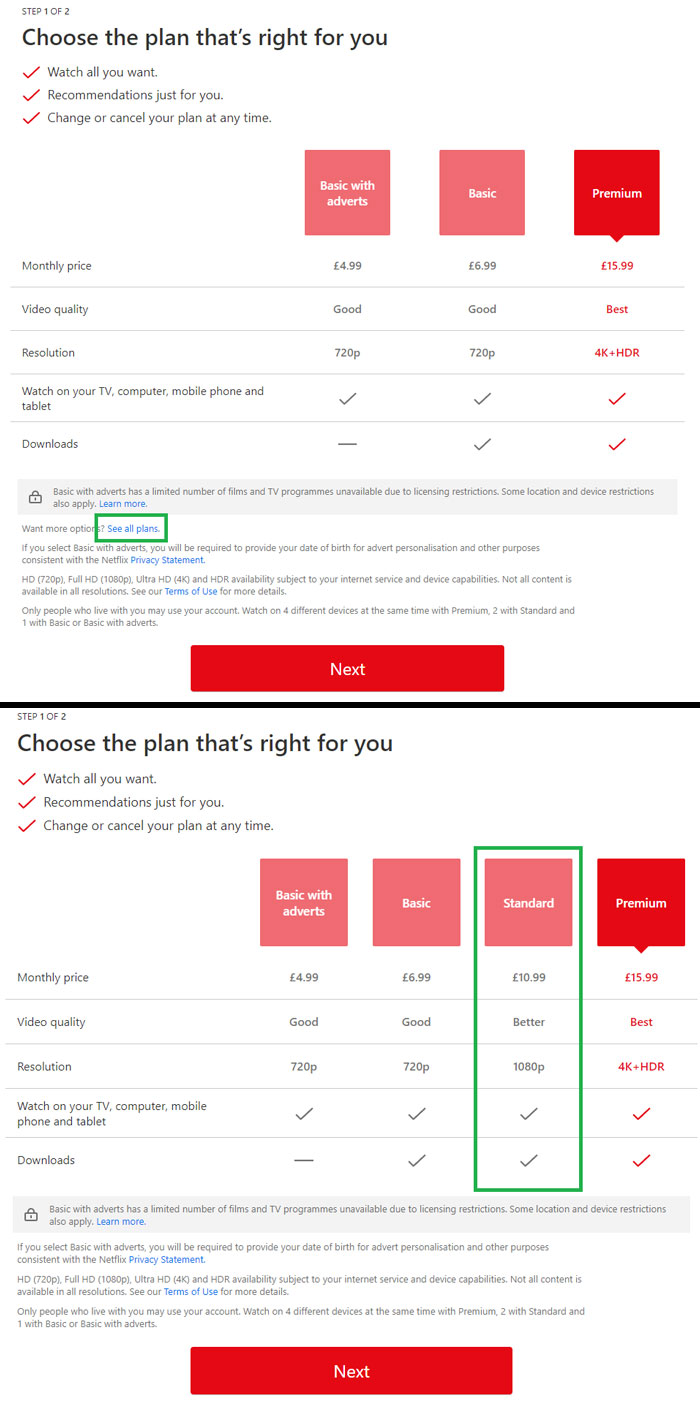

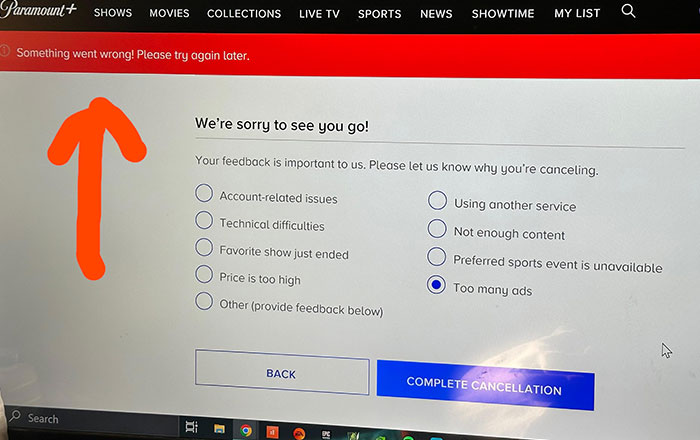

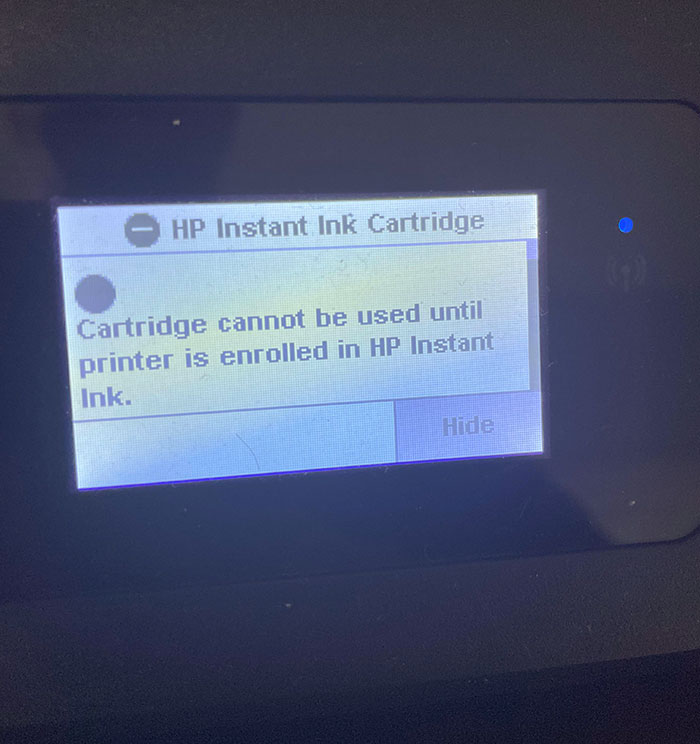

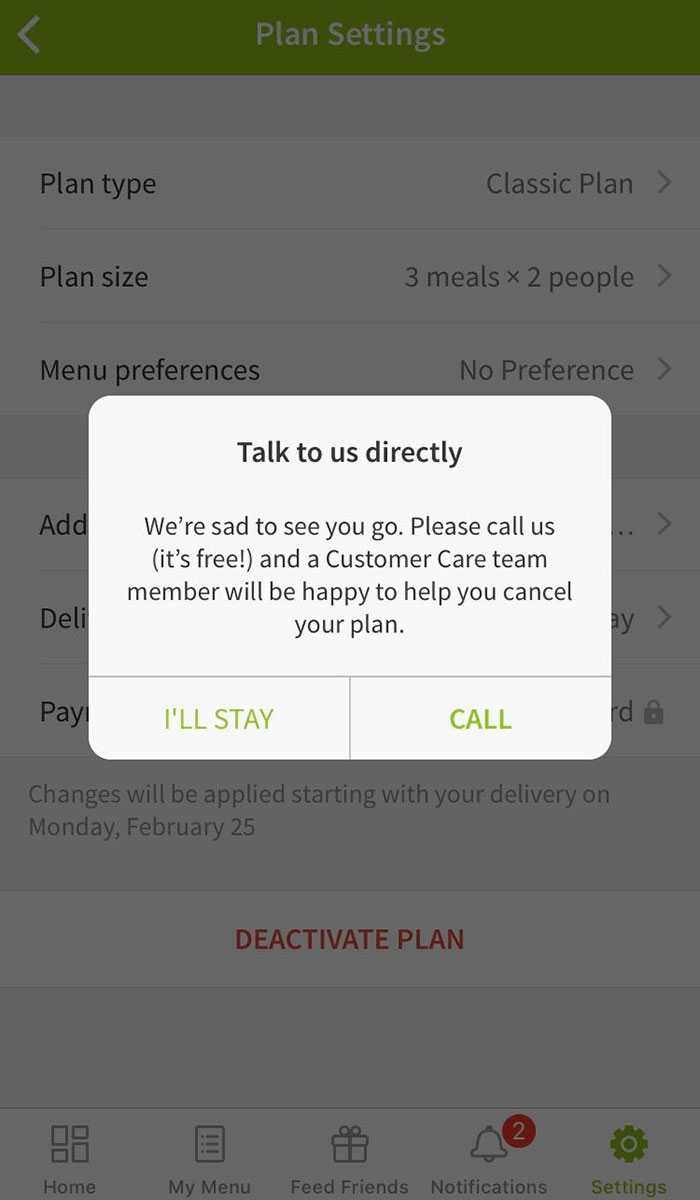

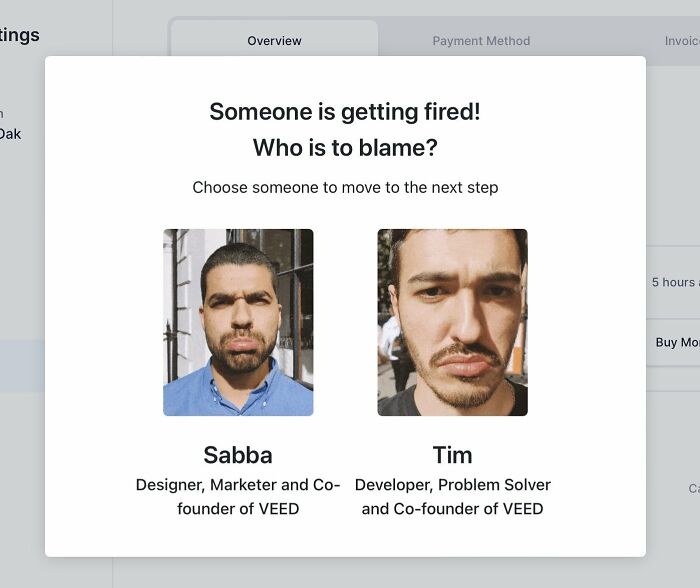

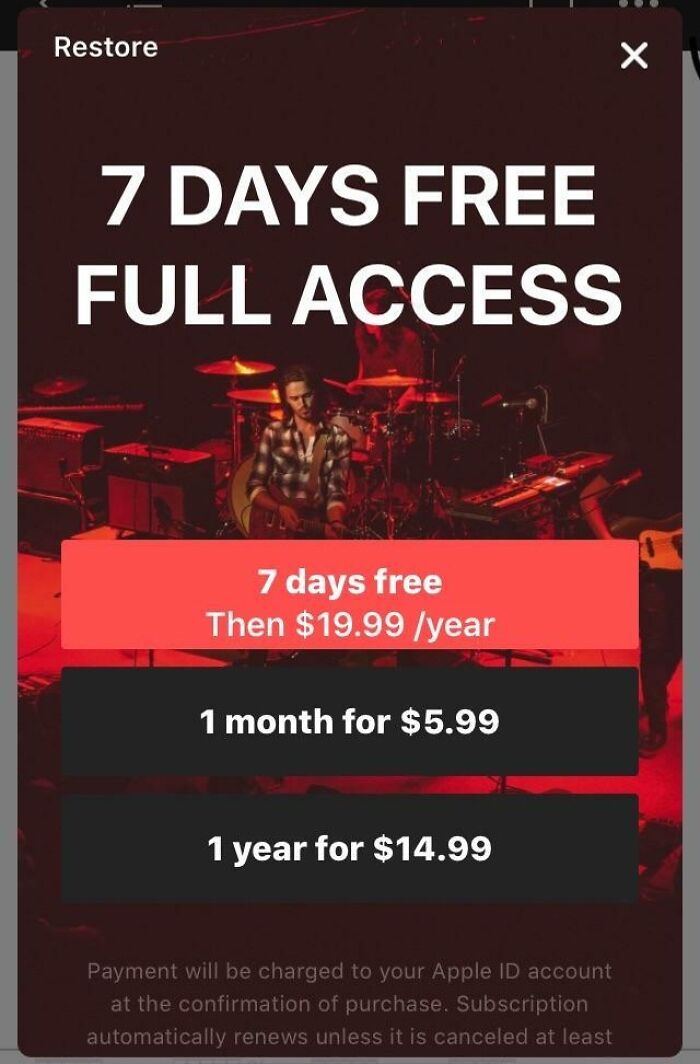

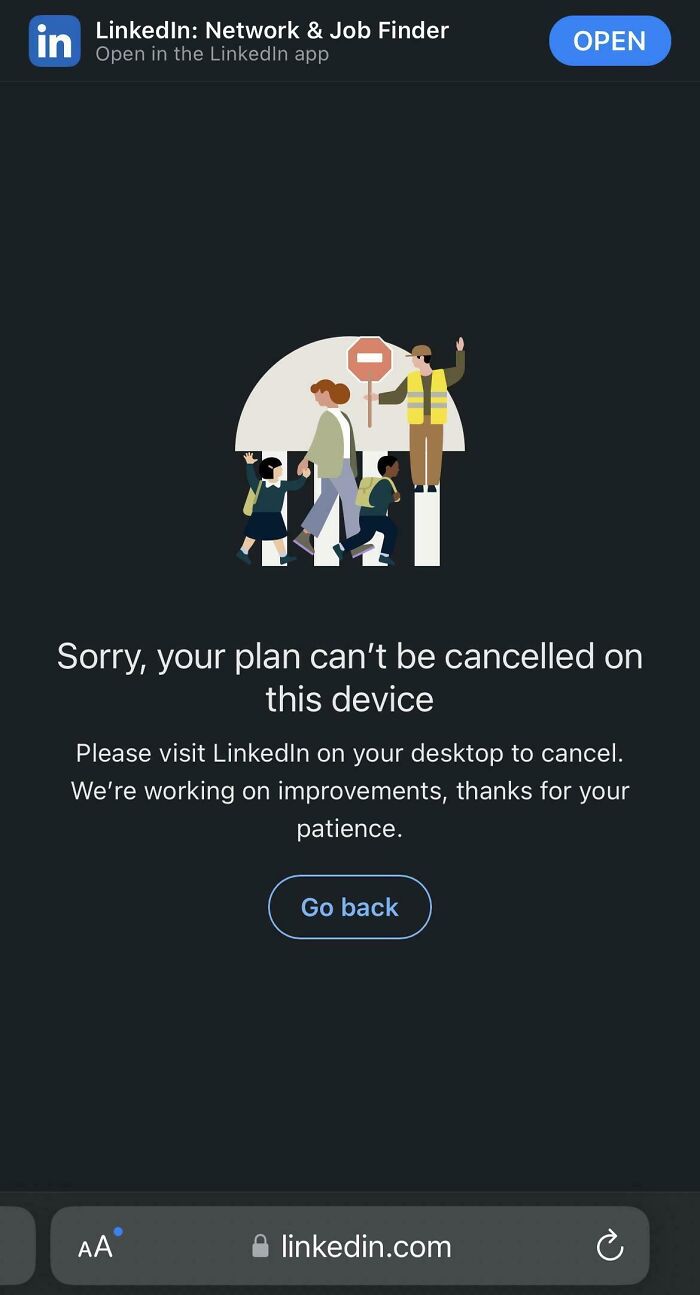

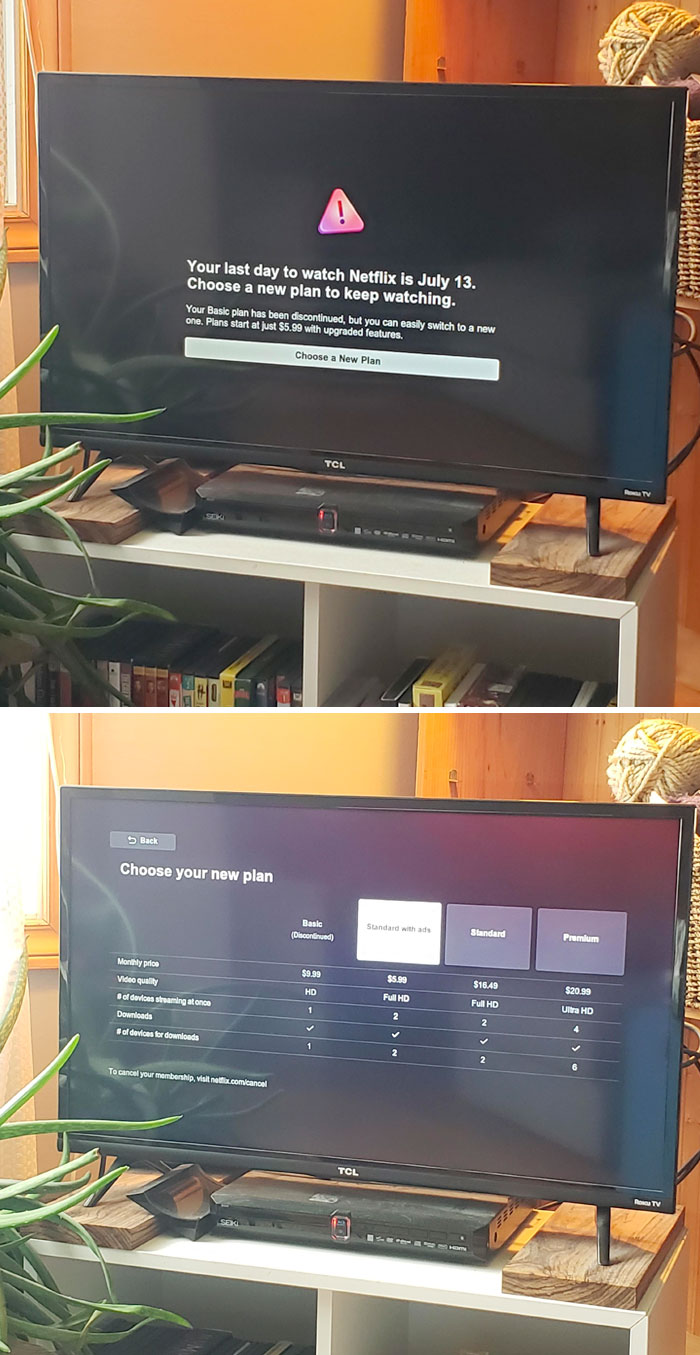

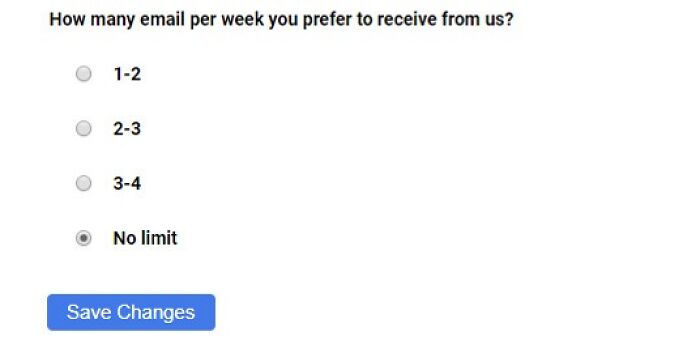

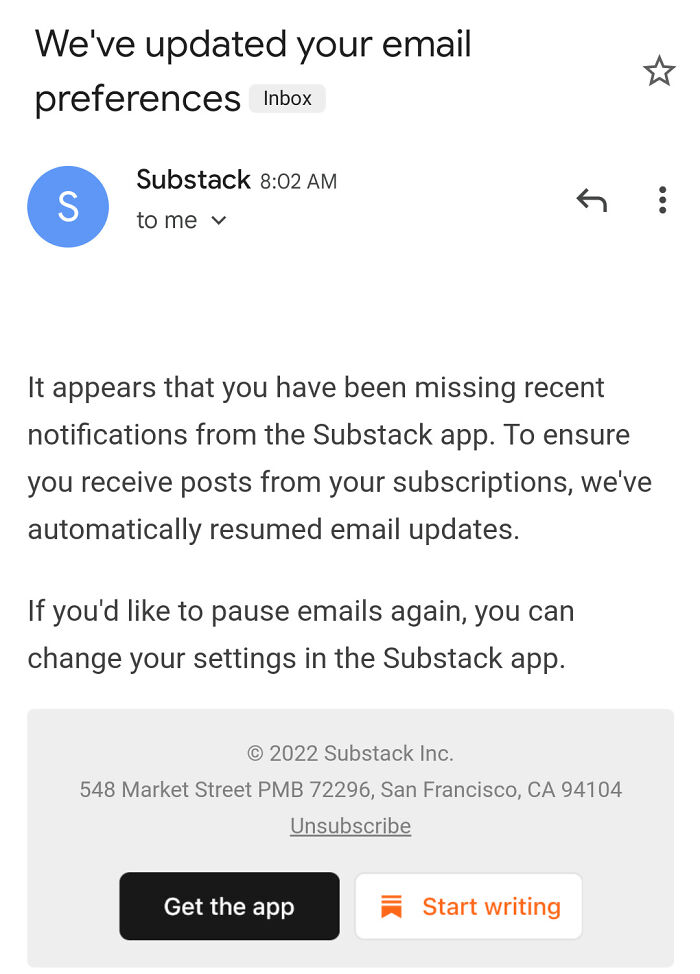

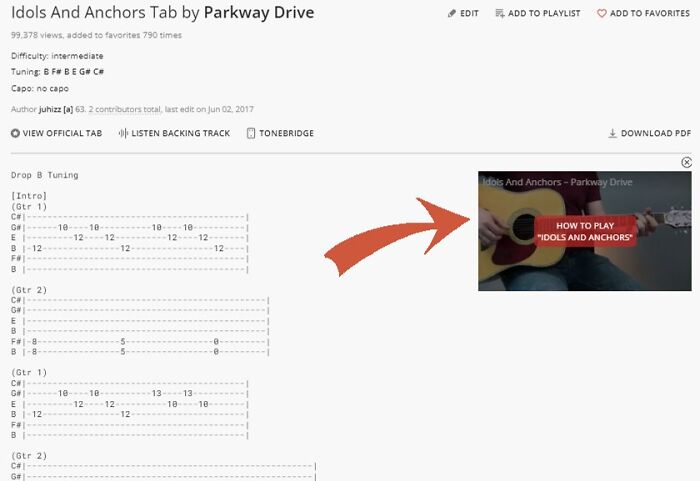

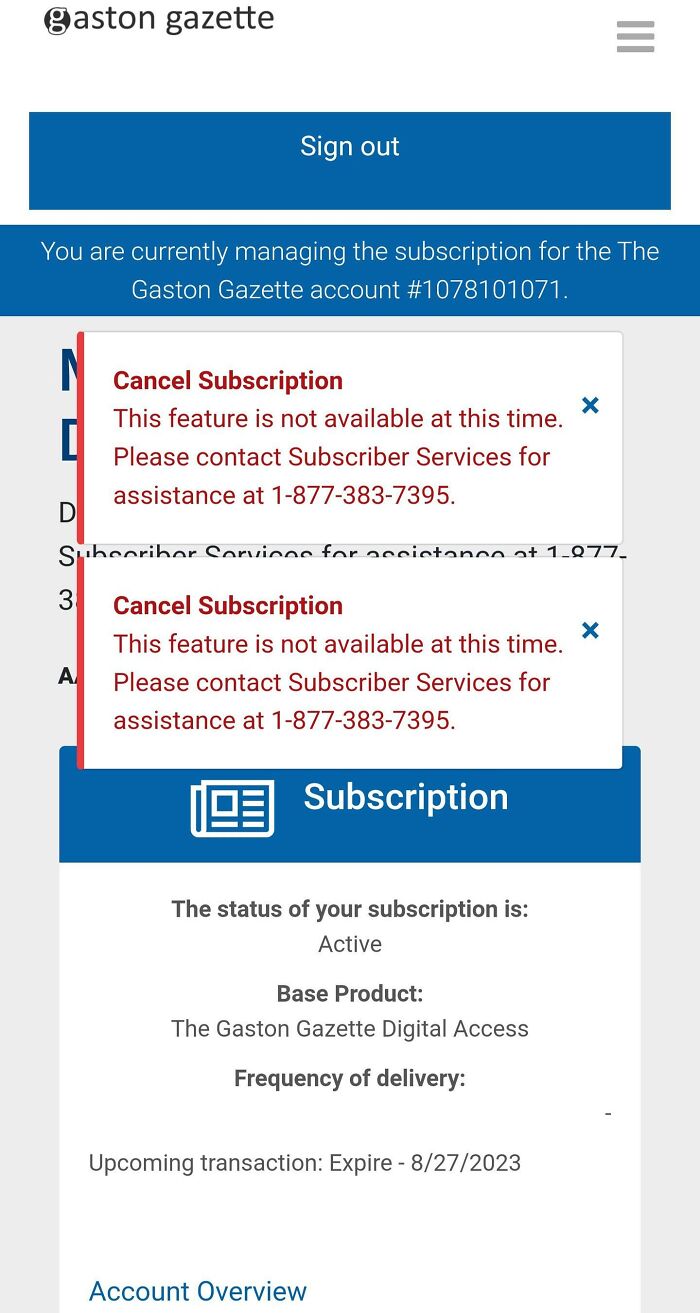

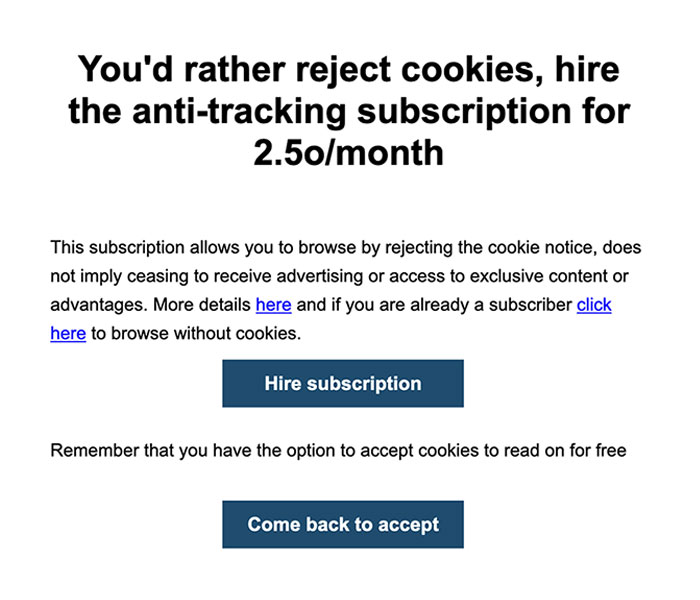

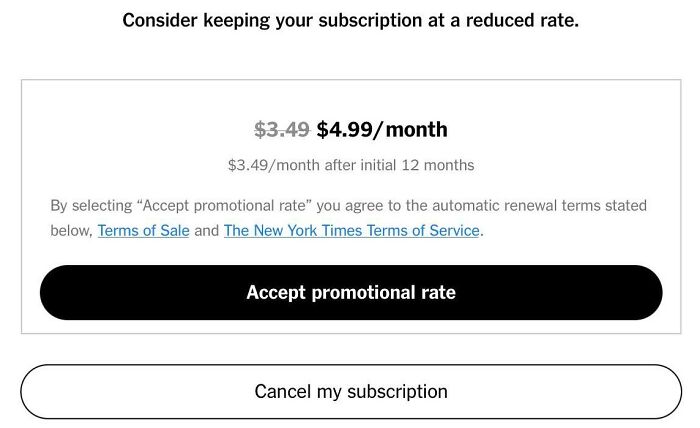

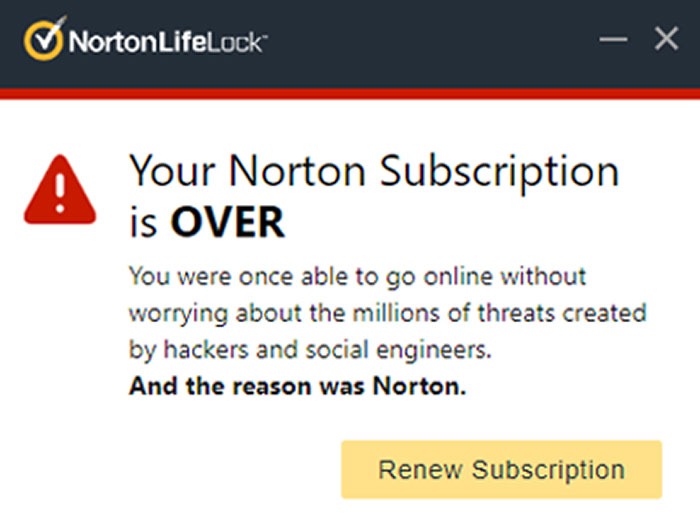

Companies know the harder it is to stop paying for their services, the more money they’ll make from people who either don’t realize they’re subscribed or are too busy to opt out.

This post may includeaffiliate links.

RELATED:

The Federal Trade Commission (FTC) accused Amazon of repeatedly pushing customers to sign up for Prime during their shopping journey, often using big, eye-catching buttons for enrollment and tiny, easy-to-miss links to decline. The suit claims these Prime offers were often not clearly labeled, leading consumers to think they were choosing free shipping or a trial, not realizing they were agreeing to a paid subscription.

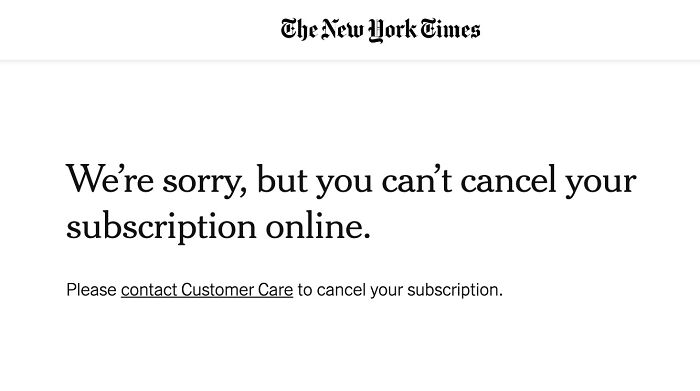

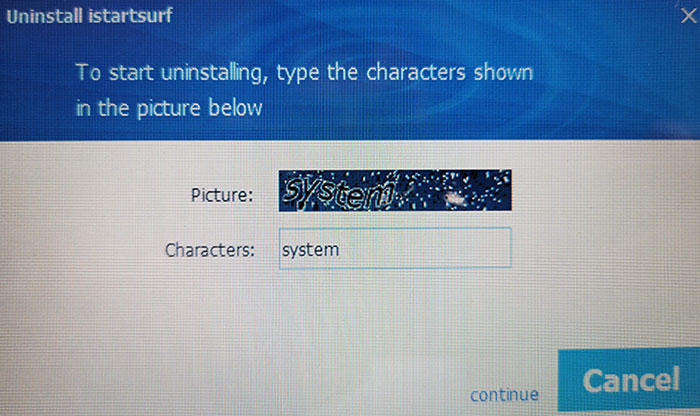

With suchdeceptive marketing techniques, it’s no wonder people get so frustrated. Fortunately, the FTC is stepping in to help. In 2023, they proposed a‘click to cancel rule,’which would force businesses to make unsubscribing as easy as signing up.“I’m sure this is an experience that all of you can relate to, where you tried to cancel a subscription and the company has made you jump through an endless number of hoops,” commented FTC Chair Lina Khan. “Companies should not be able to manipulate consumers into paying for subscriptions that they don’t want.”

With suchdeceptive marketing techniques, it’s no wonder people get so frustrated. Fortunately, the FTC is stepping in to help. In 2023, they proposed a‘click to cancel rule,’which would force businesses to make unsubscribing as easy as signing up.

“I’m sure this is an experience that all of you can relate to, where you tried to cancel a subscription and the company has made you jump through an endless number of hoops,” commented FTC Chair Lina Khan. “Companies should not be able to manipulate consumers into paying for subscriptions that they don’t want.”

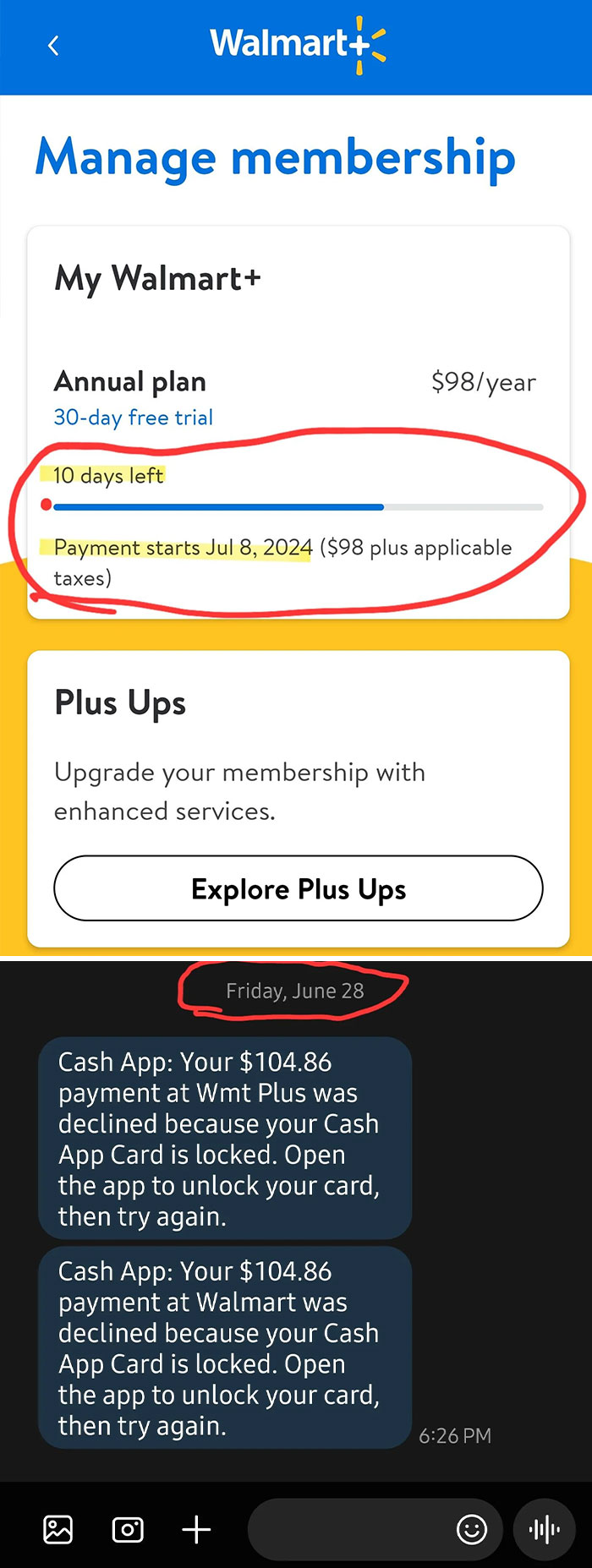

The ‘click to cancel rule’ is still in the works, but if it goes through, it will put an end to in-person visits, handwritten letters, and hours spent on hold on the phone. Companies would also have to clearly inform consumers they’re signing up for a paid service, get users’ explicit consent, and remind them before services automatically renew.

Making it easier to end subscriptions could actually be beneficial for businesses in the long run. Some providers who are already transparent about their policies say honesty has helped them retain more customers.“We had fewer cancellation requests, more saves, and lesscustomer servicetime,”saysAlex Brown, CEO of sustainable cleaning supplies subscription firm Truly Free. “That’s given us the latitude to take a little bit of the pressure off of them, and I think it’s caused more of them to come back in the future too.”

Making it easier to end subscriptions could actually be beneficial for businesses in the long run. Some providers who are already transparent about their policies say honesty has helped them retain more customers.

“We had fewer cancellation requests, more saves, and lesscustomer servicetime,”saysAlex Brown, CEO of sustainable cleaning supplies subscription firm Truly Free. “That’s given us the latitude to take a little bit of the pressure off of them, and I think it’s caused more of them to come back in the future too.”

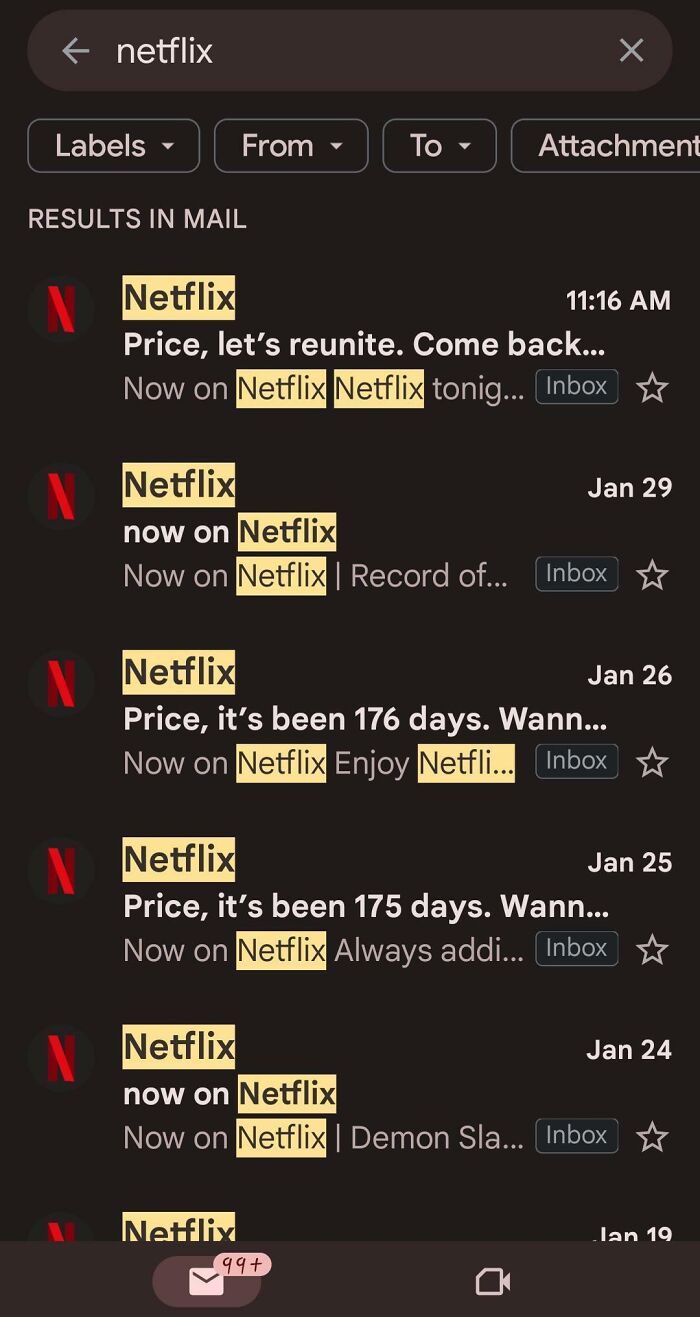

While some companies have made the shift to be more honest and straightforward, others still use sneaky tactics to keep customers locked in. Personal finance expertClark Howard offers some tipson handling your subscriptions.“It requires a mental reset,” Howard says. He suggests reviewing your checking and credit card statements every three months to spot recurring charges you might have forgotten about. If there’s something you no longer use, cancel it.

While some companies have made the shift to be more honest and straightforward, others still use sneaky tactics to keep customers locked in. Personal finance expertClark Howard offers some tipson handling your subscriptions.

“It requires a mental reset,” Howard says. He suggests reviewing your checking and credit card statements every three months to spot recurring charges you might have forgotten about. If there’s something you no longer use, cancel it.

More importantly, Howard urges consumers to research new services and their cancellation policies before enrolling. Look beyond the service’s website for its cancellation policy and see if there are any complaints about it. It might take some time, but it will save a lot of hassle in the future. “You have to look at how you get divorced before you get married,” he says.

The FTC alsorecommendswatching for prechecked boxes when making a purchase online, as they may sign you up for products or services you don’t want unless you uncheck them. If you cancel a subscription but are still being charged, dispute it with your credit card company and file a complaint on the FTC’s website.

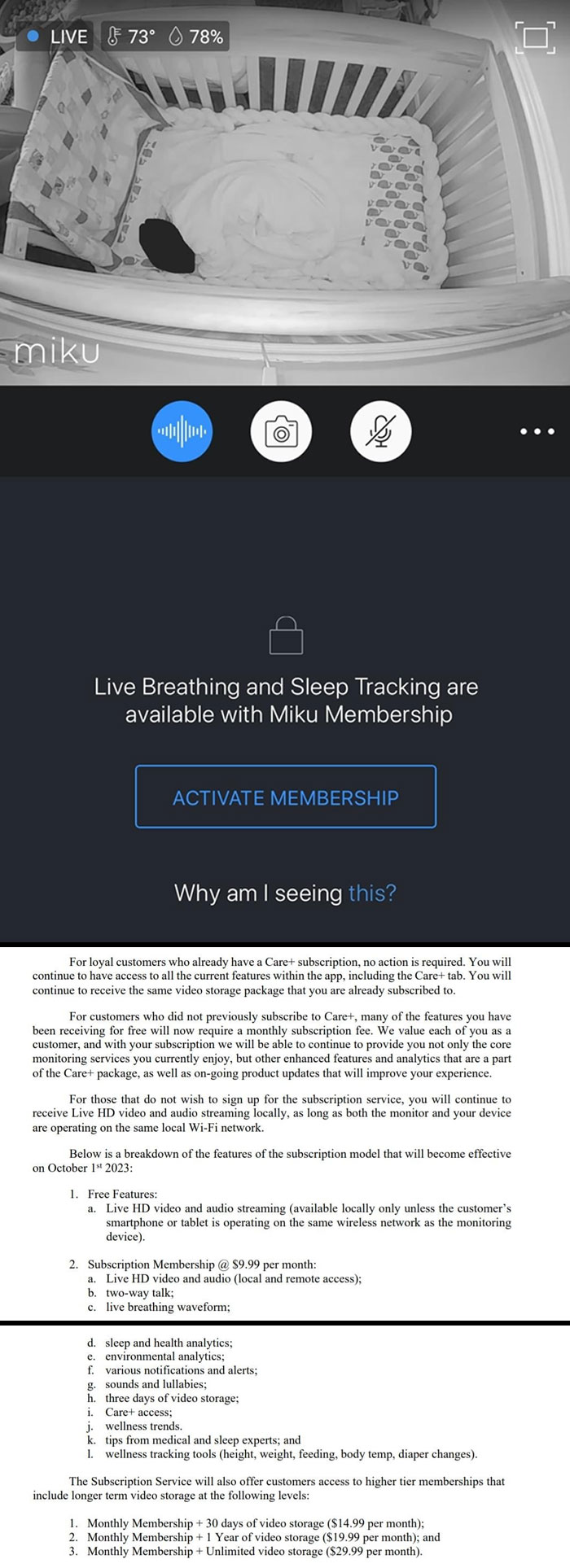

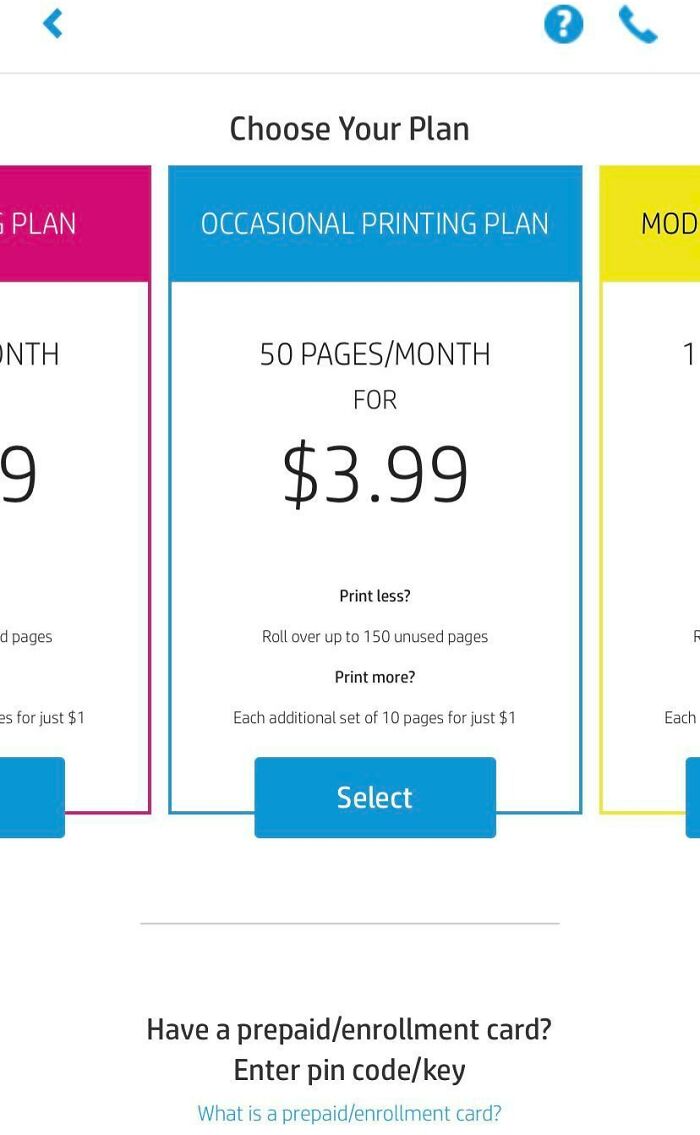

I called a customer representative and was told I had to pay a monthly subscription fee for that service (he told me the price was $12.95).

So, the next time you consider starting a new subscription, remember to do your homework and stay vigilant about hidden charges. Hopefully, in the future, better consumer protection policies like the ‘click to cancel rule’ will make managing subscriptions easier and more transparent for everyone.

See Also on Bored Panda

Continue reading with Bored Panda PremiumUnlimited contentAd-free browsingDark modeSubscribe nowAlready a subscriber?Sign In

Continue reading with Bored Panda Premium

Unlimited contentAd-free browsingDark mode

Unlimited content

Ad-free browsing

Dark mode

Subscribe nowAlready a subscriber?Sign In

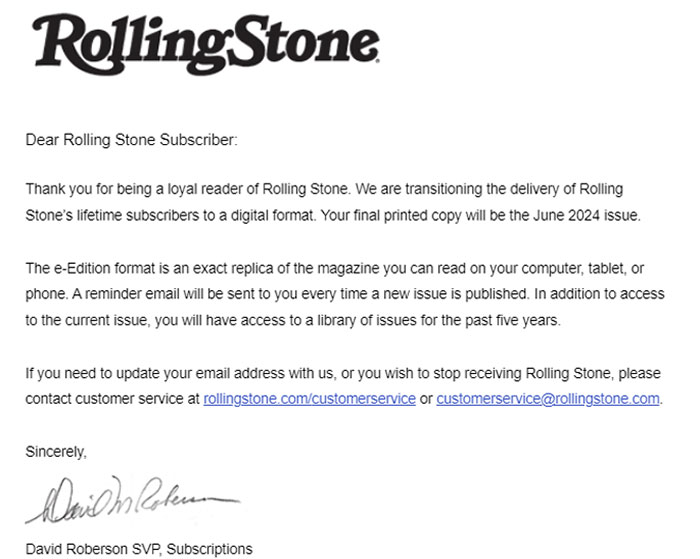

They still offer a print subscription. I guess I was costing them too much money.

Modal closeAdd New ImageModal closeAdd Your Photo To This ListPlease use high-res photos without watermarksOoops! Your image is too large, maximum file size is 8 MB.Not your original work?Add sourcePublish

Modal close

Add New ImageModal closeAdd Your Photo To This ListPlease use high-res photos without watermarksOoops! Your image is too large, maximum file size is 8 MB.Not your original work?Add sourcePublish

Modal closeAdd Your Photo To This ListPlease use high-res photos without watermarksOoops! Your image is too large, maximum file size is 8 MB.Not your original work?Add sourcePublish

Add Your Photo To This ListPlease use high-res photos without watermarksOoops! Your image is too large, maximum file size is 8 MB.

Add Your Photo To This List

Please use high-res photos without watermarks

Ooops! Your image is too large, maximum file size is 8 MB.

Not your original work?Add source

Modal closeModal closeOoops! Your image is too large, maximum file size is 8 MB.UploadUploadError occurred when generating embed. Please check link and try again.TwitterRender conversationUse html versionGenerate not embedded versionAdd watermarkInstagramShow Image OnlyHide CaptionCropAdd watermarkFacebookShow Image OnlyAdd watermarkChangeSourceTitleUpdateAdd Image

Modal closeOoops! Your image is too large, maximum file size is 8 MB.UploadUploadError occurred when generating embed. Please check link and try again.TwitterRender conversationUse html versionGenerate not embedded versionAdd watermarkInstagramShow Image OnlyHide CaptionCropAdd watermarkFacebookShow Image OnlyAdd watermarkChangeSourceTitleUpdateAdd Image

Upload

UploadError occurred when generating embed. Please check link and try again.TwitterRender conversationUse html versionGenerate not embedded versionAdd watermarkInstagramShow Image OnlyHide CaptionCropAdd watermarkFacebookShow Image OnlyAdd watermark

Error occurred when generating embed. Please check link and try again.

TwitterRender conversationUse html versionGenerate not embedded versionAdd watermark

InstagramShow Image OnlyHide CaptionCropAdd watermark

FacebookShow Image OnlyAdd watermark

ChangeSourceTitle

Social Issues