Being rich isn’t about having fancy cars, a yacht, and a dozen vacation houses scattered around the globe. Being rich means managing your finances in such a way that you can live the type of life you want. And that means learning to manage your income, expenses, and investments well.The‘Frugal’subreddit is a 3.8-million-member-strong online community that has been around for over 15 years. It is dedicated to frugal living and saving time, as well as money. We’ve collected some of their top pieces of advice to share with you. Scroll down to check them out.Bored Pandagot in touch withpersonal finance expert Rick Orfordfor his thoughts on budgeting, plus his advice for anyone who’s not sure what to invest in. You’ll find our full interview with the author of‘The Financially Independent Millennial,’about why even small savings and investments are important, below.This post may includeaffiliate links.

Being rich isn’t about having fancy cars, a yacht, and a dozen vacation houses scattered around the globe. Being rich means managing your finances in such a way that you can live the type of life you want. And that means learning to manage your income, expenses, and investments well.

The‘Frugal’subreddit is a 3.8-million-member-strong online community that has been around for over 15 years. It is dedicated to frugal living and saving time, as well as money. We’ve collected some of their top pieces of advice to share with you. Scroll down to check them out.

Bored Pandagot in touch withpersonal finance expert Rick Orfordfor his thoughts on budgeting, plus his advice for anyone who’s not sure what to invest in. You’ll find our full interview with the author of‘The Financially Independent Millennial,’about why even small savings and investments are important, below.

This post may includeaffiliate links.

How much someone should cut back on their expenses or look for additional income streams will depend a lot on their situation at home, their lifestyle and current career, their job prospects, as well as where in the world they live. For example, in the United States, consumers have been spending a lot this holiday season. The job market remains strong and inflation continues to ease, though interest rates are still extremely high.CNN reports thatretail sales rose0.3% in November compared to October, though economists expected a decline. Retail sales rose even more (0.6%) if you don’t count gasoline sales. In short, Americans are, on average, eating out more at restaurants, as well as buying more things in stores and online.

How much someone should cut back on their expenses or look for additional income streams will depend a lot on their situation at home, their lifestyle and current career, their job prospects, as well as where in the world they live. For example, in the United States, consumers have been spending a lot this holiday season. The job market remains strong and inflation continues to ease, though interest rates are still extremely high.

CNN reports thatretail sales rose0.3% in November compared to October, though economists expected a decline. Retail sales rose even more (0.6%) if you don’t count gasoline sales. In short, Americans are, on average, eating out more at restaurants, as well as buying more things in stores and online.

We bought it for our kids 5 years ago. The bouncy part and netting were no longer safe, but the frame itself was in great condition. Almost threw it away but as I was taking it down I started brainstorming and this is the result!

As Allison Morrowrecently wroteon CNN, many Americans might complain about how ‘bad’ the economy is and how high many prices are when asked. However, their actions “tell a different story” when you look at their behavior.“Despite higher prices and all-around sour mood, American consumers have been exceptionally willing to spend money on dining out, travel, concert tickets, and all manner of goods.”

As Allison Morrowrecently wroteon CNN, many Americans might complain about how ‘bad’ the economy is and how high many prices are when asked. However, their actions “tell a different story” when you look at their behavior.

“Despite higher prices and all-around sour mood, American consumers have been exceptionally willing to spend money on dining out, travel, concert tickets, and all manner of goods.”

However, across the Atlantic Ocean, the United Kingdom is ringing alarm bells about the deepening state of financial inequality in the country. The Center for Social Justice think tank recently warned about the growing gap between the haves and the have-nots.The BBC states that, according to the report, stagnant wages, poor housing family breakdown, crime, and mental health issues have widened the gap during the Covid-19 pandemic. The disadvantaged are “no better off than they were 15 years ago.”

However, across the Atlantic Ocean, the United Kingdom is ringing alarm bells about the deepening state of financial inequality in the country. The Center for Social Justice think tank recently warned about the growing gap between the haves and the have-nots.

The BBC states that, according to the report, stagnant wages, poor housing family breakdown, crime, and mental health issues have widened the gap during the Covid-19 pandemic. The disadvantaged are “no better off than they were 15 years ago.”

The danger, according to the Center for Social Justice report, is that the UK might slip back into a level of deep social divide the likes of which have not been seen since the Victorian era.The think tank explains that for many poor Brits, “work is not worth it” because it is poor quality, offers little to no security, and gives little chance of progression. That’s why people turn to welfare.

The danger, according to the Center for Social Justice report, is that the UK might slip back into a level of deep social divide the likes of which have not been seen since the Victorian era.

The think tank explains that for many poor Brits, “work is not worth it” because it is poor quality, offers little to no security, and gives little chance of progression. That’s why people turn to welfare.

Total meals 115. $130.60/115meals = $1.14 per mealFrom left to right:2 meals in one round container of egg salad.5 meals of Teriyaki Ground Turkey with Chunked Pineapple and rice.5 meals of Spinach Feta Scramble6 meals of Creamy Parmesan Shrimp with Spinach and Bacon.9 meals of Parmesan Pork over Zucchini Noodles.6 meals of Bangers and Mash.5 meals of Korean BBQ Chicken.8 meals of African Peanut Curry.12 meals in six containers of Tomato and Carrot Soup.6 meals in three containers of Chicken Korma.18 meals in nine containers of Chicken n’ Dumplings.6 containers of Green Chili Pork Roast.9 meals of tacos.18 meals of steamed boa.I put about 3-4 days of meals in the refrigerator and the rest goes into the freezer. We stay on top of eating the meals “First In, First Out” to avoid spoiling food in the refrigerator and freezer burn on food in the freezer.

We askedpersonal finance expert Orfordabout the biggest barriers that people tend to have when it comes to saving money. He was kind enough to share some insights with us and stressed the importance of budgeting and even seemingly minuscule savings.“In the media, it’s common to hear ‘cut back on the little expenses’ to save money. Having been in a situation myself where I was spending far more than I earned, I recall asking myself, ‘How could saving $4 on this or that make any meaningful change?’ The fact is, every little bit helps,” the author of‘The Financially Independent Millennial’told Bored Panda via email.“In my case, to be successful in spending less than I earn started with ‘paying myself first.’ This meant keeping three separate bank accounts: one for needs, one for wants, and another for savings/investment.”

We askedpersonal finance expert Orfordabout the biggest barriers that people tend to have when it comes to saving money. He was kind enough to share some insights with us and stressed the importance of budgeting and even seemingly minuscule savings.

“In the media, it’s common to hear ‘cut back on the little expenses’ to save money. Having been in a situation myself where I was spending far more than I earned, I recall asking myself, ‘How could saving $4 on this or that make any meaningful change?’ The fact is, every little bit helps,” the author of‘The Financially Independent Millennial’told Bored Panda via email.

“In my case, to be successful in spending less than I earn started with ‘paying myself first.’ This meant keeping three separate bank accounts: one for needs, one for wants, and another for savings/investment.”

Orfordexplained that his ‘needs’ included necessities like rent, insurance, and groceries. Meanwhile, his ‘wants’ included going out to eat at restaurants, going shopping, and holidays—things that usually meant he was spending more than he was earning. His solution to the problem was to create a budget.“My needs money stayed in the needs account, and I moved a portion of the remainder to my ‘wants.’ The key was sticking within the ‘wants’ budget, and not going over. I recall my in my first month with this exercise, I ran out of all my ‘wants money’ after the first weekend! That meant staying at home for the remainder of the month—and that got me thinking, ‘How can I go out more, have a life, while not over-spending.’ The answer? I found a balance. I didn’t go out as much, didn’t shop as much, and before I knew it, I had money left over in the ‘wants’ account at the end of the month. This is the monthly surplus.”

Orfordexplained that his ‘needs’ included necessities like rent, insurance, and groceries. Meanwhile, his ‘wants’ included going out to eat at restaurants, going shopping, and holidays—things that usually meant he was spending more than he was earning. His solution to the problem was to create a budget.

“My needs money stayed in the needs account, and I moved a portion of the remainder to my ‘wants.’ The key was sticking within the ‘wants’ budget, and not going over. I recall my in my first month with this exercise, I ran out of all my ‘wants money’ after the first weekend! That meant staying at home for the remainder of the month—and that got me thinking, ‘How can I go out more, have a life, while not over-spending.’ The answer? I found a balance. I didn’t go out as much, didn’t shop as much, and before I knew it, I had money left over in the ‘wants’ account at the end of the month. This is the monthly surplus.”

Thepersonal finance experttold us that he then moved this surplus to his third “and most important account” meant for his savings and investments. “Growing this account was the key tobecoming financially independent,” he opened up to us.According to Orford, the ‘every little bit counts’ philosophy applies not only to reducing one’s expenses but also their savings and investments.“I believe the money is best spent buying a home, even with higher than normal mortgages. But, the home should be affordable: so that means perhaps living with parents, or in an economical rental as long as needed until one can buy the home,” he gave some advice on what to invest in first.

Thepersonal finance experttold us that he then moved this surplus to his third “and most important account” meant for his savings and investments. “Growing this account was the key tobecoming financially independent,” he opened up to us.

According to Orford, the ‘every little bit counts’ philosophy applies not only to reducing one’s expenses but also their savings and investments.

“I believe the money is best spent buying a home, even with higher than normal mortgages. But, the home should be affordable: so that means perhaps living with parents, or in an economical rental as long as needed until one can buy the home,” he gave some advice on what to invest in first.

Trying to be more frugal, we got 2 large top roasts for “buy-one-get-one-free” processed it, and cut it up at home ourselves. Now we have meals for days.

“Once the home is purchased, the next step is to evaluate whether the goal is to pay it off fast or invest it in other things. Some say mortgage debt is bad, but I’m not one of them,” Orford told Bored Panda.

“On the other hand, investing the money into a low-cost S&P 500 index fund, for example, historically returns 10% on average. In the end, I wouldn’t fault anyone for making either choice as the money is put to work regardless.”

The r/frugal online community covers a lot of different aspects of frugal living. As the moderator team behind the project points out, everyone has their own definition of frugality, as well as their own reasons for being frugal.It’s something to keep in mind so that all those friendly discussions about saving cash, time, and energy don’t turn into fiery arguments. “Discuss and debate, but don’t fight over it, or be condescending to those who do not share your particular view on frugality,” the team shares.

The r/frugal online community covers a lot of different aspects of frugal living. As the moderator team behind the project points out, everyone has their own definition of frugality, as well as their own reasons for being frugal.

It’s something to keep in mind so that all those friendly discussions about saving cash, time, and energy don’t turn into fiery arguments. “Discuss and debate, but don’t fight over it, or be condescending to those who do not share your particular view on frugality,” the team shares.

Meanwhile, it helps to remember that the online community includes internet users from all over the globe. That means that general advice and personal finance philosophies might appeal to (nearly) everyone. However, tips about specific stores, products, or deals might only be helpful to folks living in certain countries.

The more specific someone is about their particular situation, without revealing sensitive overly personal information, the more accurate the advice they receive can be.

Someone with much more money than me decided to just gift the piles of new diapers (300+) their kid had outgrown. They posted it on our city’s parent Facebook group. A 25-minute roundtrip drive saved me over $100 worth of diapers. A frugal win for sure!

A big bag of frozen pineapple goes for $16 - $19 where I live. We filled this big ziploc with 3 pineapples we got on sale for $1.99 each.

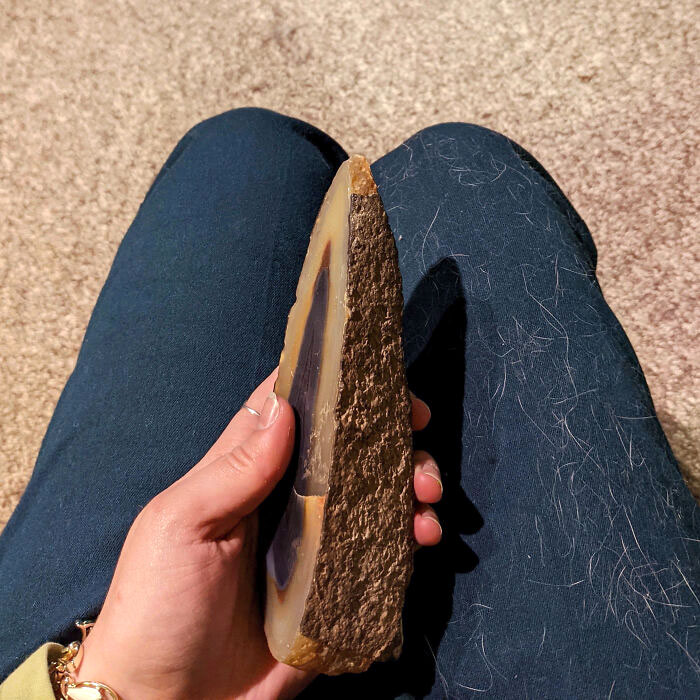

Didn’t have a lint roller, saw the rock and its rougher edges, and just pictured it helping a little, but it did a better job than I thought! We use it as decoration when it’s not a lint roller.

See Also on Bored Panda

Continue reading with Bored Panda PremiumUnlimited contentAd-free browsingDark modeSubscribe nowAlready a subscriber?Sign In

Continue reading with Bored Panda Premium

Unlimited contentAd-free browsingDark mode

Unlimited content

Ad-free browsing

Dark mode

Subscribe nowAlready a subscriber?Sign In

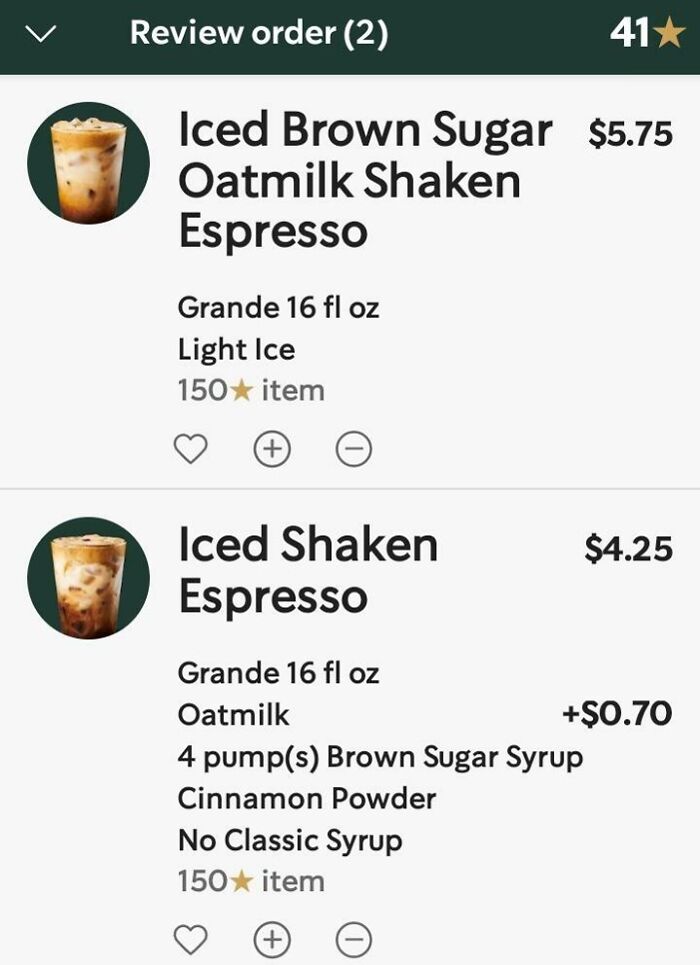

You must download all the apps and create an account for each of the businesses. No purchase is necessary for these. I only wanted to do freebies with no purchase necessary. Make sure you give yourself at least a week before your birthday to download the apps and create an account. Tomorrow is my actual birthday so more freebies will be loaded onto my accounts. Bummed I missed out on getting my free Starbucks. For Starbucks, you need to have made one purchase and you need to be signed up at least 7 days before your birthday.

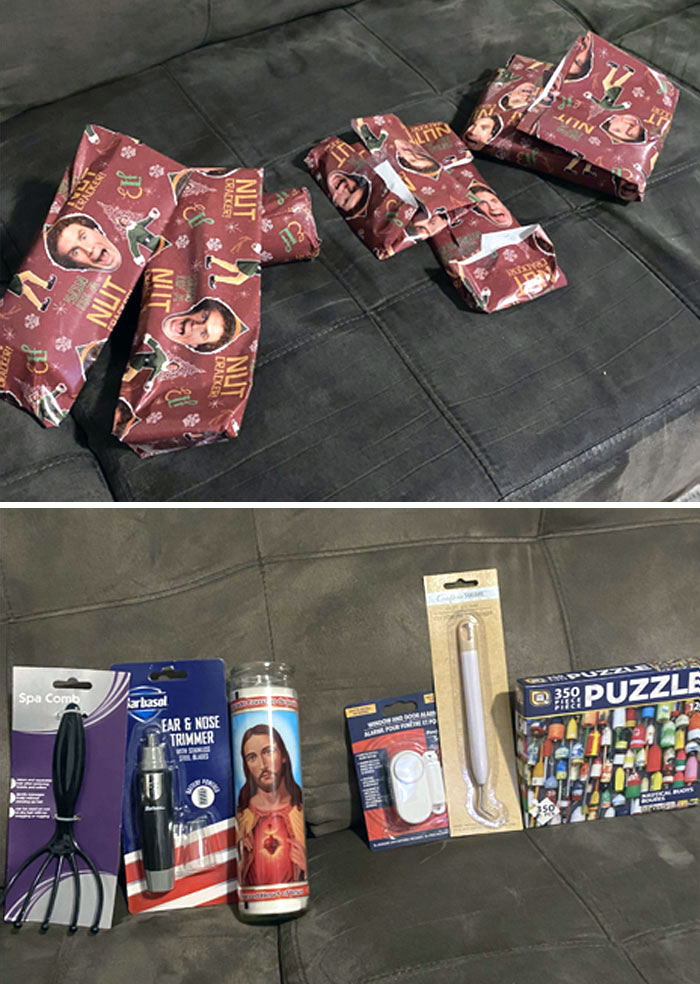

The Jesus thing is a candle she got me as a joke. The thing to the left of the puzzle is a needlepoint crafting tool and to the left of that is a door alarm.

My husband and I were both in academia so we have a lot of books around the house. We wanted a cozy festive glow in the living room, but didn’t want to buy a live or fake tree for many reasons. I’ve seen libraries do this before, so voilà! A free tree with household items!

These carrots were soft and pliable when I put them in the Weck jar with water in the fridge. They firmed up so much they popped the lid and I had to put them in a Mason jar with a screw on lid.

Modal closeAdd New ImageModal closeAdd Your Photo To This ListPlease use high-res photos without watermarksOoops! Your image is too large, maximum file size is 8 MB.Not your original work?Add sourcePublish

Modal close

Add New ImageModal closeAdd Your Photo To This ListPlease use high-res photos without watermarksOoops! Your image is too large, maximum file size is 8 MB.Not your original work?Add sourcePublish

Modal closeAdd Your Photo To This ListPlease use high-res photos without watermarksOoops! Your image is too large, maximum file size is 8 MB.Not your original work?Add sourcePublish

Add Your Photo To This ListPlease use high-res photos without watermarksOoops! Your image is too large, maximum file size is 8 MB.

Add Your Photo To This List

Please use high-res photos without watermarks

Ooops! Your image is too large, maximum file size is 8 MB.

Not your original work?Add source

Modal closeModal closeOoops! Your image is too large, maximum file size is 8 MB.UploadUploadError occurred when generating embed. Please check link and try again.TwitterRender conversationUse html versionGenerate not embedded versionAdd watermarkInstagramShow Image OnlyHide CaptionCropAdd watermarkFacebookShow Image OnlyAdd watermarkChangeSourceTitleUpdateAdd Image

Modal closeOoops! Your image is too large, maximum file size is 8 MB.UploadUploadError occurred when generating embed. Please check link and try again.TwitterRender conversationUse html versionGenerate not embedded versionAdd watermarkInstagramShow Image OnlyHide CaptionCropAdd watermarkFacebookShow Image OnlyAdd watermarkChangeSourceTitleUpdateAdd Image

Upload

UploadError occurred when generating embed. Please check link and try again.TwitterRender conversationUse html versionGenerate not embedded versionAdd watermarkInstagramShow Image OnlyHide CaptionCropAdd watermarkFacebookShow Image OnlyAdd watermark

Error occurred when generating embed. Please check link and try again.

TwitterRender conversationUse html versionGenerate not embedded versionAdd watermark

InstagramShow Image OnlyHide CaptionCropAdd watermark

FacebookShow Image OnlyAdd watermark

ChangeSourceTitle

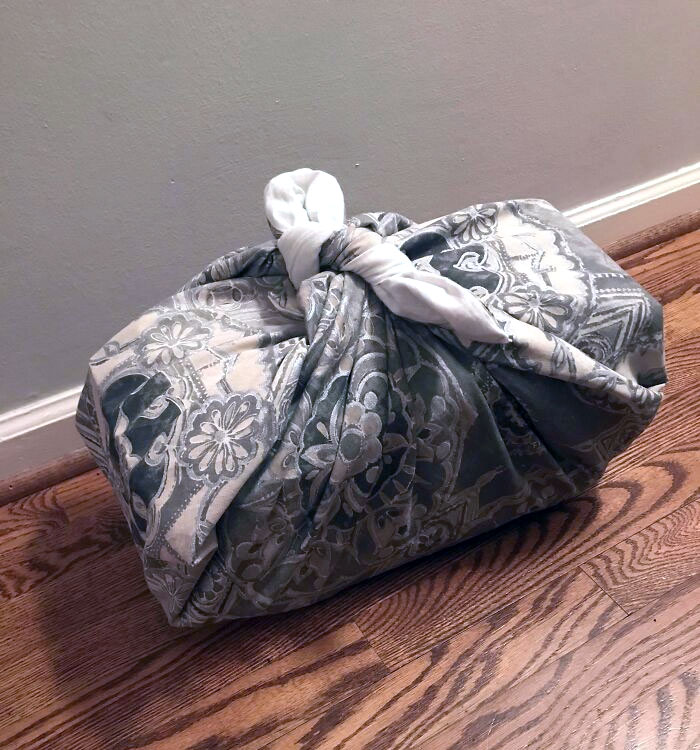

Recycling