If Barbie gets to have her dream house, you should too! If you’ve been saving up for decades to be able to afford that quaint home in the countryside or a two-story in the best school district in the city, you might feel like your dreams have come true when you finally sign off on purchasing the property.But sometimes, what appears to be the perfect home ends up revealing unexpected issues upon moving in. Below, you’ll find photos that homeowners have shared on theWell… That sucks…subreddit detailing the moments where they may have had some regrets about their purchases. Enjoy scrolling through this list that might make you feel better about not owning your own home yet, and keep reading to find a conversation with Diane Henkler ofIn My Own Style!This post may includeaffiliate links.

If Barbie gets to have her dream house, you should too! If you’ve been saving up for decades to be able to afford that quaint home in the countryside or a two-story in the best school district in the city, you might feel like your dreams have come true when you finally sign off on purchasing the property.

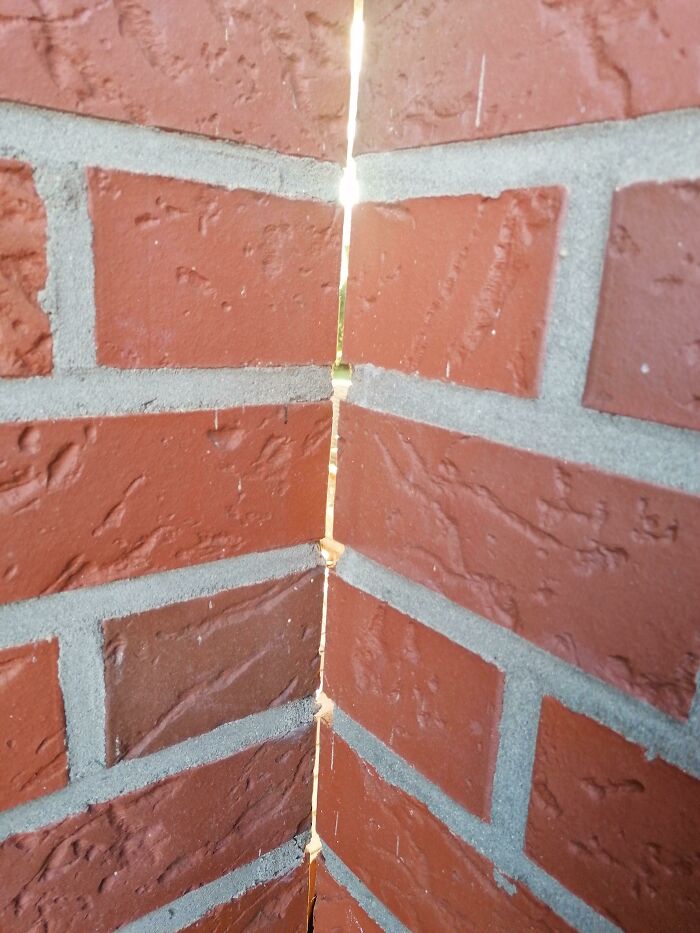

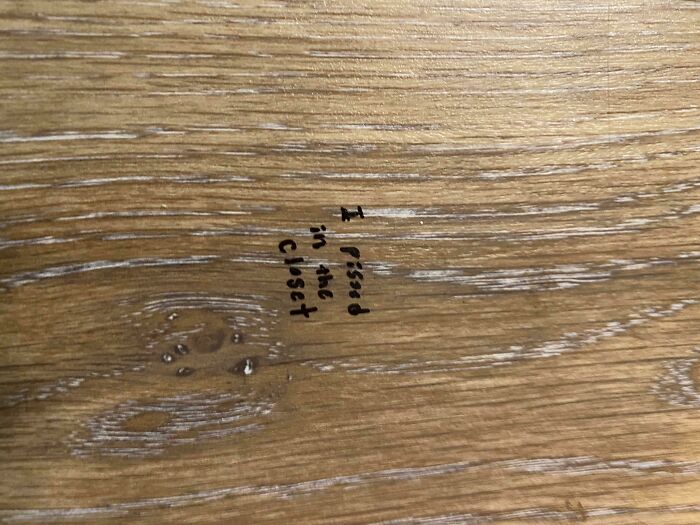

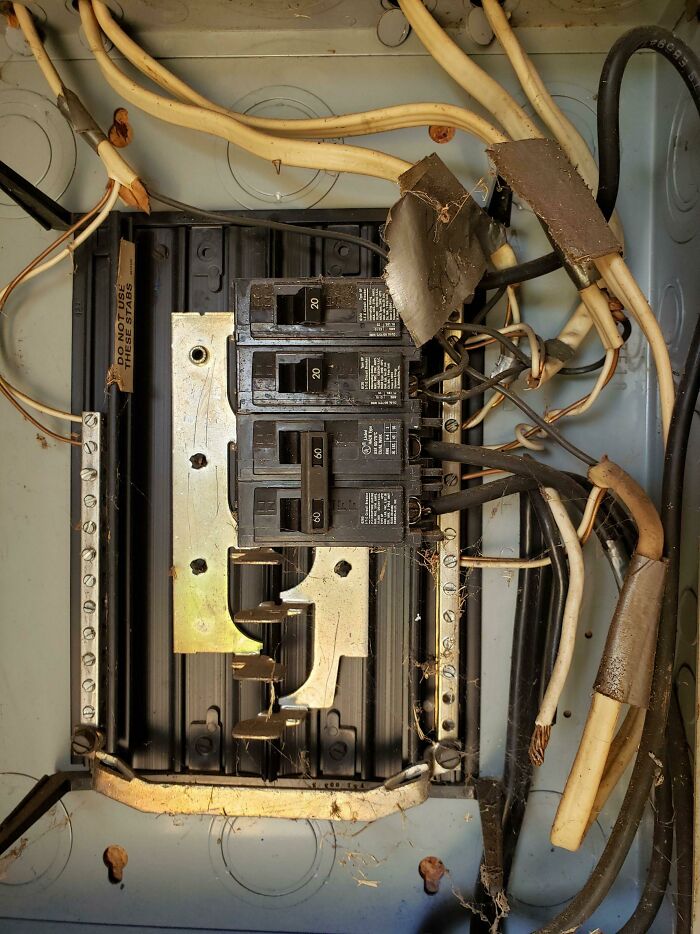

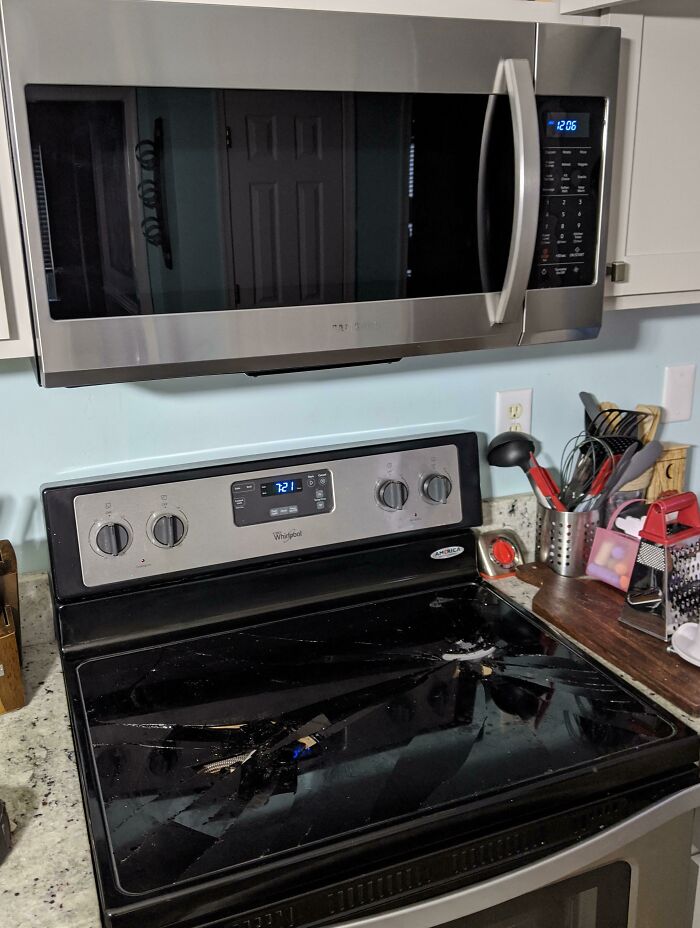

But sometimes, what appears to be the perfect home ends up revealing unexpected issues upon moving in. Below, you’ll find photos that homeowners have shared on theWell… That sucks…subreddit detailing the moments where they may have had some regrets about their purchases. Enjoy scrolling through this list that might make you feel better about not owning your own home yet, and keep reading to find a conversation with Diane Henkler ofIn My Own Style!

This post may includeaffiliate links.

As children, many of us assumed that one day we would grow up and own our own homes. That’s the logical conclusion that you come to when you imagine yourself with a “big boy” or “big girl” job that pays enough to have a comfortable life, right? And while not everyone has the desire to purchase a house, as some of us are more interested in traveling frequently and don’t need much space to be happy, having theoptionto be able to buy a house is something we should all have.Unfortunately, however, given the ridiculous rise of inflation, student debt, and home prices in recent years, buying a humble abode is looking less and less possible for many people. In 2020, thehomeownership ratein the US hit the lowest point it had in 50 years, reaching 63.1%. Meanwhile, housing prices increased a whopping 18.7%between 2021 and 2022, and they don’t seem to be declining any time soon. So at this point, it seems like buying any home at all would be a dream.

As children, many of us assumed that one day we would grow up and own our own homes. That’s the logical conclusion that you come to when you imagine yourself with a “big boy” or “big girl” job that pays enough to have a comfortable life, right? And while not everyone has the desire to purchase a house, as some of us are more interested in traveling frequently and don’t need much space to be happy, having theoptionto be able to buy a house is something we should all have.

Unfortunately, however, given the ridiculous rise of inflation, student debt, and home prices in recent years, buying a humble abode is looking less and less possible for many people. In 2020, thehomeownership ratein the US hit the lowest point it had in 50 years, reaching 63.1%. Meanwhile, housing prices increased a whopping 18.7%between 2021 and 2022, and they don’t seem to be declining any time soon. So at this point, it seems like buying any home at all would be a dream.

But just because you’ve been able to reach that milestone of purchasing your own home, or the home you’ve always dreamed of, doesn’t mean the hard part is over. In fact, it might just be getting started. As of 2023, theaverage monthly mortgagepayment for homeowners in the US is $2,317, and the average mortgage term is30 years. So it’s understandable when homeowners are upset if surprises creep up after they’ve already moved in or started making payments on what was supposed to be a wonderful home.To learn more about what homeowners should expect after purchasing a house, we reached out to Diane Henkler, the woman behindIn My Own Style. Diane is an expert on home design and DIY projects that will help spice up your humble abode, so we wanted to hear her thoughts on when things go wrong after moving into a new home.

But just because you’ve been able to reach that milestone of purchasing your own home, or the home you’ve always dreamed of, doesn’t mean the hard part is over. In fact, it might just be getting started. As of 2023, theaverage monthly mortgagepayment for homeowners in the US is $2,317, and the average mortgage term is30 years. So it’s understandable when homeowners are upset if surprises creep up after they’ve already moved in or started making payments on what was supposed to be a wonderful home.

To learn more about what homeowners should expect after purchasing a house, we reached out to Diane Henkler, the woman behindIn My Own Style. Diane is an expert on home design and DIY projects that will help spice up your humble abode, so we wanted to hear her thoughts on when things go wrong after moving into a new home.

“Something will always go wrong, from your vision of what can be done in the home not turning out how you planned to existing furniture not fitting to finding unseen problems in the plumbing or electrical that need more than a DIY knows how to do,” Diane shared.“Little things can go wrong as well, such as the holes in cabinets not matching up to the new door hardware you bought or not buying enough paint or wallpaper to do the job and then not being able to get back to the store right away to finish the job.““Just know something will go wrong - just hope it is a small inconvenience and nothing that will cost thousands of dollars to fix,” the expert added.

“Something will always go wrong, from your vision of what can be done in the home not turning out how you planned to existing furniture not fitting to finding unseen problems in the plumbing or electrical that need more than a DIY knows how to do,” Diane shared.

“Little things can go wrong as well, such as the holes in cabinets not matching up to the new door hardware you bought or not buying enough paint or wallpaper to do the job and then not being able to get back to the store right away to finish the job.”

“Just know something will go wrong - just hope it is a small inconvenience and nothing that will cost thousands of dollars to fix,” the expert added.

If you start having regrets after moving into your new home, Diane says it’s important to keep your expectations realistic. “Most of us want to jump right in and start decorating and making a new home look like a vision board,” she told Bored Panda. “This leads to let down. It is always smart to let the decor slowly evolve over time, so you can live in the space and find out what it actually needs to be a functioning space. It will only be a temporary situation, so live in the space and see what it needs not only in furnishings, but color and light.”

Don’t put too much pressure on yourself to have a flawless house either. “A home will never be perfect, and if it does look perfect, then no one is living in it,” Diane noted. “Homes are meant to be lived in, change will happen, tastes change, we get older, kids grow and have new interests that will need new space or storage.”

“Remember now that you own a whole home, you want the rooms to flow nicely together,” the design expert added. “From the get go, choose a few colors and accent colors for the home. The rooms don’t have to be the same color scheme, but try to add at least one of the colors to each room so you create a flow.”

If you’d like to hear more design tips from Diane or find DIY projects that would be great for your own home, be sure to visitIn My Own Style!

While we would like to assume that sellers will be upfront and honest about the flaws of their homes, buyers have to understand that they can’t always give sellers the benefit of the doubt. There are even some places that have “loophole laws” that can make it easier for sellers to avoid disclosing certain information. For example,in New York State, sellers can keep some flaws to themselves as long as they “pay a $500 credit to the buyer at closing.”In Texas, sellers also don’t have to inform future residents of “deaths from natural causes, suicides, or accidents unrelated to the property.“Unfortunately, most issues that creep up after the sale become the buyer’s responsibility.Orchardnotes on their blog that even if an inspector took a look at the property before you bought it, there are certain areas that they might not have been required to check. Or, if you decided to waive the inspection before purchasing the house, you agreed to take it as-is. If a seller was actually aware of an issue and decided not to disclose it, then they may be liable. But this can be hard to prove, so usually, the responsibility falls on the new homeowners. Lucky for them!

While we would like to assume that sellers will be upfront and honest about the flaws of their homes, buyers have to understand that they can’t always give sellers the benefit of the doubt. There are even some places that have “loophole laws” that can make it easier for sellers to avoid disclosing certain information. For example,in New York State, sellers can keep some flaws to themselves as long as they “pay a $500 credit to the buyer at closing.”In Texas, sellers also don’t have to inform future residents of “deaths from natural causes, suicides, or accidents unrelated to the property.”

Unfortunately, most issues that creep up after the sale become the buyer’s responsibility.Orchardnotes on their blog that even if an inspector took a look at the property before you bought it, there are certain areas that they might not have been required to check. Or, if you decided to waive the inspection before purchasing the house, you agreed to take it as-is. If a seller was actually aware of an issue and decided not to disclose it, then they may be liable. But this can be hard to prove, so usually, the responsibility falls on the new homeowners. Lucky for them!

Overall, it’s extremely important to know what you’re getting yourself into when purchasing a home. “Buying a home is a large investment, and you should take the time to understand what you are buying, and the contract you are signing,” Nathan Serr, attorney at Wagner, Falconer & Judd in Minneapolis, told US News. “It’s worth hiring a competent real estate agent or attorney to review the documents regarding the sale. Homeowner disputes can be lengthy and costly, so if you notice any red flags regarding the property, purchase agreement or disclosure, ask your realtor to ask the seller additional questions, and ask for them in writing.”

If you’re having some second thoughts after purchasing a home, your initial reaction might be to feel guilty, but you should know that you’re not alone. In fact, one 2022 survey found that72% of homeownersexperience some buyer’s remorse. This can be due to having high interest rates on their mortgage, buying a home they couldn’t afford in the first place, realizing they don’t like the house as much as they thought they did, or finding unexpected issues. But buyer’s remorse can be a friendly reminder that you should never rush into the purchase of a home. Take your time, and do it when it feels right.

Issues in your home are inevitable. Even if they don’t appear right away, one day you’ll need to call a plumber or patch up the roof or replace a window. In the past, you may have been able to call a landlord for these problems, but along with the title and prestige of being a homeowner comes a host of new responsibilities. Don’t beat yourself up if you’re having some regrets following the purchase of your home, and if you need to feel better about the issues present in your house, you can always take a trip to theWell… That sucks…subreddit.

See Also on Bored Panda

We hope these photos aren’t deterring you from going after your dream house if you can afford it, pandas. Just remember to expect the unexpected, because nothing in life is predictable, not even our own homes. Keep upvoting the pics you find to be most unfortunate, and then if you’re interested in checking out another Bored Panda article featuring nightmares that happened to homeowners from the Well… That sucks… subreddit, look no further thanright here!

Continue reading with Bored Panda PremiumUnlimited contentAd-free browsingDark modeSubscribe nowAlready a subscriber?Sign In

Continue reading with Bored Panda Premium

Unlimited contentAd-free browsingDark mode

Unlimited content

Ad-free browsing

Dark mode

Subscribe nowAlready a subscriber?Sign In

Modal closeAdd New ImageModal closeAdd Your Photo To This ListPlease use high-res photos without watermarksOoops! Your image is too large, maximum file size is 8 MB.Not your original work?Add sourcePublish

Modal close

Add New ImageModal closeAdd Your Photo To This ListPlease use high-res photos without watermarksOoops! Your image is too large, maximum file size is 8 MB.Not your original work?Add sourcePublish

Modal closeAdd Your Photo To This ListPlease use high-res photos without watermarksOoops! Your image is too large, maximum file size is 8 MB.Not your original work?Add sourcePublish

Add Your Photo To This ListPlease use high-res photos without watermarksOoops! Your image is too large, maximum file size is 8 MB.

Add Your Photo To This List

Please use high-res photos without watermarks

Ooops! Your image is too large, maximum file size is 8 MB.

Not your original work?Add source

Modal closeModal closeOoops! Your image is too large, maximum file size is 8 MB.UploadUploadError occurred when generating embed. Please check link and try again.TwitterRender conversationUse html versionGenerate not embedded versionAdd watermarkInstagramShow Image OnlyHide CaptionCropAdd watermarkFacebookShow Image OnlyAdd watermarkChangeSourceTitleUpdateAdd Image

Modal closeOoops! Your image is too large, maximum file size is 8 MB.UploadUploadError occurred when generating embed. Please check link and try again.TwitterRender conversationUse html versionGenerate not embedded versionAdd watermarkInstagramShow Image OnlyHide CaptionCropAdd watermarkFacebookShow Image OnlyAdd watermarkChangeSourceTitleUpdateAdd Image

Upload

UploadError occurred when generating embed. Please check link and try again.TwitterRender conversationUse html versionGenerate not embedded versionAdd watermarkInstagramShow Image OnlyHide CaptionCropAdd watermarkFacebookShow Image OnlyAdd watermark

Error occurred when generating embed. Please check link and try again.

TwitterRender conversationUse html versionGenerate not embedded versionAdd watermark

InstagramShow Image OnlyHide CaptionCropAdd watermark

FacebookShow Image OnlyAdd watermark

ChangeSourceTitle

Home & Design