If you’re also looking for ways to thicken up yourwallet, you’ve come to the right place. Redditors have recently beensharingtheir best frugal habits, so we’ve gathered the most helpful replies below. Enjoy scrolling through, and keep reading to find conversations with Lydia Beiler ofThrifty Frugal Mom, Caitlin Self, MS, CNS, LDN ofFrugal Nutritionand Melissa Vera ofAdventures of Frugal Mom!

This post may includeaffiliate links.

I’ve been on a mission to use up all of the soaps, shampoos and cleaning supplies that I already have. I’m saving money and gaining cabinet space.

To learn more about which frugal habits will have the biggest impact on our finances nowadays, we reached out to some budget-friendly experts to hear their tips.

“If you wait several days before buying something, you’ll often realize you don’t really need it that much,” she explained, noting that she’s always tried to live pretty frugally. “And especially so, since my husband and I got married nearly 18 years ago,” she added.

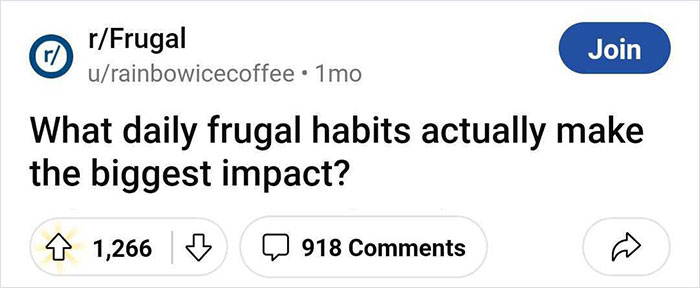

It’s amazing how much eating out costs. Even a $10 meal ends up being closer to $20 or even $35+ if you get it delivered. Eat. At. Home. It’s amazing how much money you’ll have in other parts of your life when you aren’t literally eating it all.

Quitting drinking saved me an embarrassing amount of money.Second, I now pay myself first with bills and other budget categories and transfer a set $ into my “fun” money account. I use that account for whatever but when it’s gone it’s gone. It’s the only way to trick my brain which naturally spends to the last available penny. Keeping my budget money like “vacation” funds separate in an account that takes 3-5 days to transfer from keeps impulse spending down.

We were also lucky enough to get in touch with Caitlin Self, MS, CNS, LDN ofFrugal Nutritionto hear how she likes to live frugally. “In my experience, cooking at home is an amazing way to significantly save on your food budget each week. Ordering delivery and dining out can typically cost around $20 or more per portion of food, but you can easily make dinner at home for $5 per serving,” Caitlin told Bored Panda.“The key is to do it consistently, so you can buy more things in bulk and so you use everything you purchase - rather than letting some of it go bad.Learning to cookis one of the best things you can do for your budget, and for your overall health! I’ve been cooking the majority of our meals at home for over a decade, and when we have to tighten the purse strings on our own spending, my food budget is the easiest area for me to quickly modify,” the nutritionist shared.

We were also lucky enough to get in touch with Caitlin Self, MS, CNS, LDN ofFrugal Nutritionto hear how she likes to live frugally. “In my experience, cooking at home is an amazing way to significantly save on your food budget each week. Ordering delivery and dining out can typically cost around $20 or more per portion of food, but you can easily make dinner at home for $5 per serving,” Caitlin told Bored Panda.

“The key is to do it consistently, so you can buy more things in bulk and so you use everything you purchase - rather than letting some of it go bad.Learning to cookis one of the best things you can do for your budget, and for your overall health! I’ve been cooking the majority of our meals at home for over a decade, and when we have to tighten the purse strings on our own spending, my food budget is the easiest area for me to quickly modify,” the nutritionist shared.

I have 3: I make my own coffee at home, so no need to buy it, I eat at home and whenever I’m out and about I have my lunch pail with me. Lastly, I’m a college student and we get a free bus pass so I rely heavily on public transportation.Those 3 things I just mentioned are such game changers. And I don’t wanna sound TOO frugal, I love the days whenever I don’t spend a single cent and at the same time I had an amazing and productive day.

The difference is not huge, but air drying more of my clothing has been saving me a bit on my electricity bill (electric dryer). It also helps the clothes last longer.

“Always compare prices and seek out deals, discounts, and coupons before making purchases. (Just because you have a coupon doesn’t mean that you should have multiple items because, seriously, how many bottles of mustard does your family really need?) Utilize credit cards with cashback or rewards programs, ensuring you pay off the balance monthly to avoid interest charges,” Melissa continued.

Transferring a portion of money to savings as soon as the paycheck hits. It’s there if I need it, but I’m not as likely to spend it on a whim if I have to transfer it back to checking first. .

“Negotiate bills with service providers and inquire about available discounts or promotions,” Melissa recommends. “Evaluate subscriptions regularly and cancel those that are not frequently used. Plus you can always read the magazine or borrow videos from your local library. Learn basic DIY skills for household maintenance tasks instead of hiring professionals.”

We switched from paper towels to wash cloths a couple years ago, has probably saved us thousands on paper towels cause we’re so damn wasteful with them. We also have bidets, so very little paper usage in general, it’s great.

Melissa also recommends looking for free or low-cost entertainment options, such as community events, parks, libraries, or cultural activities, rather than expensive alternatives.And she says she did lots of secondhand shopping when her daughters were little. “I always got compliments on their clothes because they were so unique,” she shared, noting that she’s been using most of these frugal habits since she started staying home when her oldest daughter was 2 and a half. “She will be 29 this year,” Melissa says.

Melissa also recommends looking for free or low-cost entertainment options, such as community events, parks, libraries, or cultural activities, rather than expensive alternatives.

And she says she did lots of secondhand shopping when her daughters were little. “I always got compliments on their clothes because they were so unique,” she shared, noting that she’s been using most of these frugal habits since she started staying home when her oldest daughter was 2 and a half. “She will be 29 this year,” Melissa says.

Secondhand shopping (clothes, cars, household goods, furniture etc.), getting to know prices so you can spot a deal, Aldi, dollar stores, just learning not to buy stuff mindlessly - getting to a point of not needing a lot of stuff, living below your means, being a smart consumer - standing up for yourself if something goes wrong and complaining if necessary - questioning things and doing follow up, reviewing bills regularly and watching for fee creep and looking for alternatives periodically (like insurance), deferring gratification when necessary, cooking at home (if you can - it’s a hard one for me but can be huge).

The only one that really makes a dent for me, is mostly eating at home. But the problem is, it takes a lot of time to meal prep. I try to meal prep one day a week. But when you order out, part of the surcharge is paying for convenience and saving time.

Caitlin also noted that she sometimes has her clients audit their grocery bills to see what is costing them the most money, and then they review how essential their bigger ticket items are. “Consistently among clients, it is snack foods and convenience items that are busting their grocery budgets!” she shared. “Choosing super simple snacks like nut butter and rice cakes with banana slices, or making your own homemade snacks, likemuffins, can save families $10-$25 per week.”

“Of course, reducing discretionary spending on non-essentials such as travel, alcohol, and fashion can make a big difference as well, depending on how you spend your money and your personal preferences,” the expert added.

Instead of buying stuff, I pick out what I WOULD buy and put the link to it in a spreadsheet. Every few months, if I have extra cash I can buy that item. It’s nice because it satisfies the impulse to shop without actually spending any money. Of course, you have to have the willpower to not buy whatever you picked out. When I first started, I straight up forgot a couple of times that I was ONLY shopping and not buying lol oops.

I live alone but for about 1 week every couple months I have a pantry/fridge clean out and I only allow myself to eat what’s on hand. It forces me to use those things that just sit on the shelf. I tend to get creative and go through a lot and I save so much money. It’s also something I do when I want to buy something outside of my budget.

The best frugal habit is valuing your time. Spending 2 hours doom scrolling tiktok is going to cost you more than you know. Hanging out with that friend you’ve outgrow for 1 hour is going to cost you more than you expected. Staying in a so-so relationship out of boredom is going to cost you.

But not everyfrugal tipis worth it. According to Lydia, “trying to plan electricity use around off peak hours to get a lower rate” and selling small dollar items on Facebook Marketplace just aren’t worth the time if you are busy.But she does believe it’s wise for all of us to live frugally, regardless of the state of our finances, because none of us know when our financial situation might change.“Continuing to live at least somewhat frugally will make it easier if we need to adjust to spending less again at some point. Also, I’m a big proponent of giving generously,” Lydia says. “If we aren’t spending extravagantly, we have more to share with those around the world that haven’t been as privileged as we have been. And often living frugally means less waste too, which is better for the planet and all of us!”

But not everyfrugal tipis worth it. According to Lydia, “trying to plan electricity use around off peak hours to get a lower rate” and selling small dollar items on Facebook Marketplace just aren’t worth the time if you are busy.

But she does believe it’s wise for all of us to live frugally, regardless of the state of our finances, because none of us know when our financial situation might change.

“Continuing to live at least somewhat frugally will make it easier if we need to adjust to spending less again at some point. Also, I’m a big proponent of giving generously,” Lydia says. “If we aren’t spending extravagantly, we have more to share with those around the world that haven’t been as privileged as we have been. And often living frugally means less waste too, which is better for the planet and all of us!”

I have a random one which I call “No New Money Days” (NNMD). A few days a week, I attempt to spend no additional money. I eat what I have in the fridge, I make use of existing memberships (gym etc), I use the petrol I’ve already purchased etc. Having a few a week has helped me save and helps prevent me mindlessly spend.

Not getting coffee for $7 a pop every day or every other day.

Walking /cycling to do as many everyday things as possible from commuting to work to shopping. You get the preventative health benefits of daily fitness without paying to go to a gym., in addition to ga$, car.

When determining if a frugal habit is worth it, Caitlin notes that sometimes you have to weigh the savings against the time you’re spending preparing meals. “If you don’t have a lot of time, cooking your beans from scratch, making homemade bread, or making a homemade dessert might not be worth the effort,” she explained. “I think it comes down to a cost-benefit analysis of your time, your stress levels, your energy, and your financial flexibility.“Caitlin also pointed out that you might regret choosing the cheapest option for something that you really enjoy. “For example, a $4 pastry from a coffee shop chain is going to be mediocre at best, whereas a $5 pastry from a local bakery or coffee shop that makes everything in house is likely to be excellent! So when the cost savings aren’t hugely significant, but will impact your enjoyment immensely, I recommend you go for the splurge every once in a while rather than settling for something sub-par,” she shared. “Something mediocre might not satisfy your craving and could leave you reaching for something else to feel more satisfied!”

When determining if a frugal habit is worth it, Caitlin notes that sometimes you have to weigh the savings against the time you’re spending preparing meals. “If you don’t have a lot of time, cooking your beans from scratch, making homemade bread, or making a homemade dessert might not be worth the effort,” she explained. “I think it comes down to a cost-benefit analysis of your time, your stress levels, your energy, and your financial flexibility.”

Caitlin also pointed out that you might regret choosing the cheapest option for something that you really enjoy. “For example, a $4 pastry from a coffee shop chain is going to be mediocre at best, whereas a $5 pastry from a local bakery or coffee shop that makes everything in house is likely to be excellent! So when the cost savings aren’t hugely significant, but will impact your enjoyment immensely, I recommend you go for the splurge every once in a while rather than settling for something sub-par,” she shared. “Something mediocre might not satisfy your craving and could leave you reaching for something else to feel more satisfied!”

I know everything adds up, but I like going after big ticket items because it feels more successful. I drive my cars til they’re dead. My last car went 20 years with very little maintenance needed, so that was approximately $350/mo for 15 years. I also make coffee at home, bring breakfast/lunch to work every day (we sometimes do an office run to a local taco place, but that’s less than once a week), and I generally try to make dinner 4-5x a week (I really enjoy eating out and trying new places so I’m less frugal there, but I budget specifically for eating out and save a lot bringing coffee, breakfast, and lunch.

A little thing my wife and I do is pay for everything possible that doesn’t result in a service fee with our PayPal credit card. We pay it off every month. PayPal gives 2% cash back. It really does add up. We spend about 3k a month between both of us. $60 bucks every month. Pays for half of our car insurance every month… $700 a year.

See Also on Bored Panda

“I think it is important to have some kind of a ‘why’ associated with frugal habits,” Caitlin continued. “Spending within your means is great for you and for society, and saving for retirement and possible illnesses are essential habits in the US based on our policies. But, cutting costs just for the sake of it can also be restricting pleasure and joy - and what is life without those things?““So if you’re choosing to avoid hanging out with friends and family because of the cost of dining out or the cost of gas or travel, without actually having a good reason to save that money, well, I’m not sure if that is really worth it in the grand scheme of things,” the nutritionist says. “It’s important to bring balance, even to the concept of frugality!”

“I think it is important to have some kind of a ‘why’ associated with frugal habits,” Caitlin continued. “Spending within your means is great for you and for society, and saving for retirement and possible illnesses are essential habits in the US based on our policies. But, cutting costs just for the sake of it can also be restricting pleasure and joy - and what is life without those things?”

“So if you’re choosing to avoid hanging out with friends and family because of the cost of dining out or the cost of gas or travel, without actually having a good reason to save that money, well, I’m not sure if that is really worth it in the grand scheme of things,” the nutritionist says. “It’s important to bring balance, even to the concept of frugality!”

Spending at least 1 hour a day developing new skills to move your career forward for me.I know everyone talks about ways to save on here and they are great but being frugal with your time at least for me has proven to be the most crucial thing.That focus allowed me to enter into a new field then specialize and allowed me to go from working 60+ hours a week to support my family to where I work 32-40 but not nearly as hard per hour of work as the old job while making drastically more money.I’ve gotten to the point now where developing more knowledge in my field is very hard for me to find so I have diverted this education towards understanding real estate and other forms of investing.Time is precious don’t waste it on dumb stuff like I did for far too long. There is value in relaxing and playing video games sometimes, and watching tik Tok and scrolling reddit, but too much consumption of that stuff in my experience is not being frugal with your time and in the long run will hold you down from being as successful as you deserve to be.

Melissa shared that some of the frugal habits that aren’t always worth it for her are developing DIY skills and taking advantage of rebate programs. “Sometimes, you get overconfident with the DIY and end up making more of a mess and costing you more money than the actual repair,” she noted. “And rebates and cash back programs are awesome, but not if you justify the purchase with ‘Oh, I am okay with spending this much money because I am not technically spending all of it.'”

Also, from my experience food is the easiest way to manipulate your budget. You can easily spend several hundred a month per person, the other extreme being rice and chicken every meal. Find a place on that scale which works for you. You can put in a lot of work cooking and save a lot of money.

Priorities are also something to consider when deciding where tocut costs. “In the earlier years of our marriage, I felt like I had more time than money. So some of the things that took more time but made us money or saved us money felt worth it,” Lydia told Bored Panda. “As I’ve gotten busier and now run my own business, I am a lot more choosy about what money saving things I do.““For example, sometimes, it makes more sense to pay more for something that will save me time, because it’s actually more financially wise for me to use that time saved and invest it in my business,” she explained. “In the end, I’ll make more money that way. I think that’s always something to consider when you think about saving money.”

Priorities are also something to consider when deciding where tocut costs. “In the earlier years of our marriage, I felt like I had more time than money. So some of the things that took more time but made us money or saved us money felt worth it,” Lydia told Bored Panda. “As I’ve gotten busier and now run my own business, I am a lot more choosy about what money saving things I do.”

“For example, sometimes, it makes more sense to pay more for something that will save me time, because it’s actually more financially wise for me to use that time saved and invest it in my business,” she explained. “In the end, I’ll make more money that way. I think that’s always something to consider when you think about saving money.”

Melissa also recommends living frugally, even if you don’t have to “because we will never know when the other shoe will drop, and because of that, we need to be wise with how and when we spend our earned money.“But she added that not every financial plan or frugal living plan is right for everyone. “You have to decide what is right for you and your family and learn the art of compromise. If you really want to keep one thing, then you might have to give up something else,” the frugal mom shared.

Melissa also recommends living frugally, even if you don’t have to “because we will never know when the other shoe will drop, and because of that, we need to be wise with how and when we spend our earned money.”

But she added that not every financial plan or frugal living plan is right for everyone. “You have to decide what is right for you and your family and learn the art of compromise. If you really want to keep one thing, then you might have to give up something else,” the frugal mom shared.

Living frugally can also benefit us in more ways than one. Caitlin says, “In many cases, living in a way that is better for our budgets is also better for the environment, and better for our health!“But we also have to be realistic about how much groceries cost nowadays. “Gone are the days when you could slash your food budget in half with a few simple tricks,” the nutritionist noted. “Food costs in the USA have increased exponentially, and in order to choose nourishing meals that fill our bellies, we may have to incorporate these tricks while also increasing our food budgets to accommodate the increases in cost.”

Living frugally can also benefit us in more ways than one. Caitlin says, “In many cases, living in a way that is better for our budgets is also better for the environment, and better for our health!”

But we also have to be realistic about how much groceries cost nowadays. “Gone are the days when you could slash your food budget in half with a few simple tricks,” the nutritionist noted. “Food costs in the USA have increased exponentially, and in order to choose nourishing meals that fill our bellies, we may have to incorporate these tricks while also increasing our food budgets to accommodate the increases in cost.”

Brush and floss and rinse with water after meals. Do not overeat. Don’t smoke. Don’t drink. Get daily exercise.Avoid junk food. Learn and read daily. Increase your health understanding. Health is wealth and it’s real dollars and affect quality of life.

Couponing for consumables like shampoo toothpaste laundry detergent etc. They are necessities that quickly add up!! Also things like using kitchen towels over paper towels, making sure food doesn’t go bad before you eat it, and layering or doing outside activities before turning on ac/heat!

“I definitely don’t mean to demonize these foods at all, but a full meal at a fast food restaurant is still likely to cost you $10, so unless it’s a special treat, that’s still not super budget-friendly,” she explained. “If this is a meal that you really enjoy, I would treat it as just that - something you’re eating because you enjoy it! But if you’re only choosing it because it’s cheap, you might be better off with a delicioushomemade sandwichand potato chips!”

We eat at home and stopped eating meat and birds 9 years ago. We bake our bread in a machine several times a week. Small but super productive garden helps. We are successfully living a frugal lifestyle to the point we can afford to live in Mexico half the year. This saves us more than you’d expect because food is so much cheaper and better here. We save 1,000 a month on overpriced Canadian food which pretty much pays our rent in Mexico. A good coffee machine and bread machine keeps us out of grocery stores longer!

For me1) Living in a rent controlled apartment that costs me WAY below what I can really afford. It’s old(er) but is in a great area and has everything I need.2) Driving a used Toyota Prius. I only drive Japanese cars as I learned the hard way that buying a German POS is the fastest way to being broke.3) Reducing my taxes (maxing out my 401k and Roth, tax lost harvesting (if any)).4) Staying in shape and getting regular tests, getting my teeth cleaned, ever year.Yes I could afford a much nicer place, a new car, and not save for retirement but why?I’m saving $12000 on rent + $12000 on a new car payment plus insurance + thousands on taxes + quality of life and future health care costs every yearIMO, doing the above things is going to save you more money than you ever could on trivial things like watering down shampoo, eating top ramen every day, driving 15 miles to save a few bucks on gas, reusing every last material. That’s cool and all, but I got more things I rather spend my time and energy on (funny enough I’m on reddit).BTW I cook almost every meal at home. But it’s more because I’m too lazy to go get food and it’s much quicker and much more enjoyable cooking because I love cooking.

I use a cookie sheet instead of aluminum foil. Cut up old towels for paper towels. Bidet instead of toilet paper (healthier, too).

Modal closeAdd Your Answer!Not your original work?Add sourcePublish

Modal close

Add Your Answer!Not your original work?Add sourcePublish

Not your original work?Add sourcePublish

Not your original work?Add source

Modal closeModal closeOoops! Your image is too large, maximum file size is 8 MB.UploadUploadError occurred when generating embed. Please check link and try again.TwitterRender conversationUse html versionGenerate not embedded versionAdd watermarkInstagramShow Image OnlyHide CaptionCropAdd watermarkFacebookShow Image OnlyAdd watermarkChangeSourceTitleUpdateAdd Image

Modal closeOoops! Your image is too large, maximum file size is 8 MB.UploadUploadError occurred when generating embed. Please check link and try again.TwitterRender conversationUse html versionGenerate not embedded versionAdd watermarkInstagramShow Image OnlyHide CaptionCropAdd watermarkFacebookShow Image OnlyAdd watermarkChangeSourceTitleUpdateAdd Image

Ooops! Your image is too large, maximum file size is 8 MB.

Upload

UploadError occurred when generating embed. Please check link and try again.TwitterRender conversationUse html versionGenerate not embedded versionAdd watermarkInstagramShow Image OnlyHide CaptionCropAdd watermarkFacebookShow Image OnlyAdd watermark

Error occurred when generating embed. Please check link and try again.

TwitterRender conversationUse html versionGenerate not embedded versionAdd watermark

InstagramShow Image OnlyHide CaptionCropAdd watermark

FacebookShow Image OnlyAdd watermark

ChangeSourceTitle

You May Like"Starts To Bleed Into The Relationship”: 30 Times Frugal Crossed The Line Into CheapIndrė Lukošiūtė30 Frugal Choices That Ended In Tears, Fires, And FiascosIlona BaliūnaitėGuy Hides His Lottery Millions For Years Until He Meets The One And Can Finally Reveal ItMonika Pašukonytė

Indrė Lukošiūtė

Ilona Baliūnaitė

Monika Pašukonytė

Work & Money