College funds are a great way to save up for a kid’s education, as you will not need to worry about affording it and it will not be so ‘painful’ financially to collect money. However, college funds do not always go towards actually paying tuition. Parents give this money to kids because when they turn 18 years old, the money is theirs. However, as you may think, 18 Y.O. adults sometimes can make mistakes, especially after receiving a large amount of money with which they can literally do whatever they want.

More info:Reddit

Traveling is also a nice kind of investment, though when choosing between college and traveling, it’s important to think through the outcomes

Image credits:olia danilevich (not the actual photo)

Dad ponders if he is being a jerk for refusing to pay for son’s education after he blew his college fund on traveling

Image credits:u/Ornery-Cranberry7577

Image credits:Chanka Madushan Sugathdasa (not the actual photo)

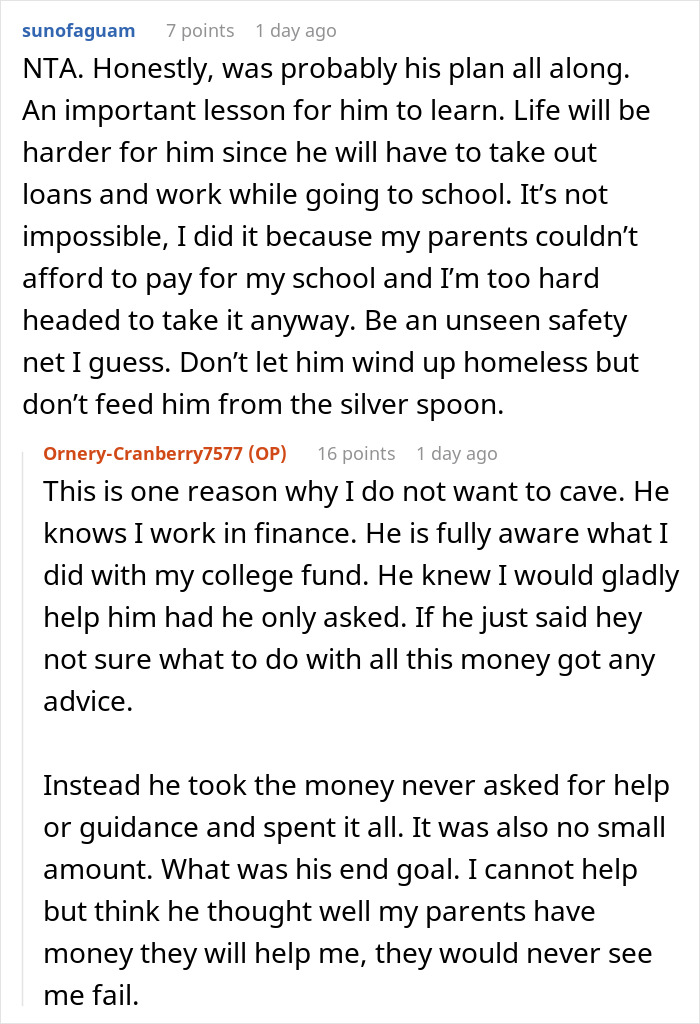

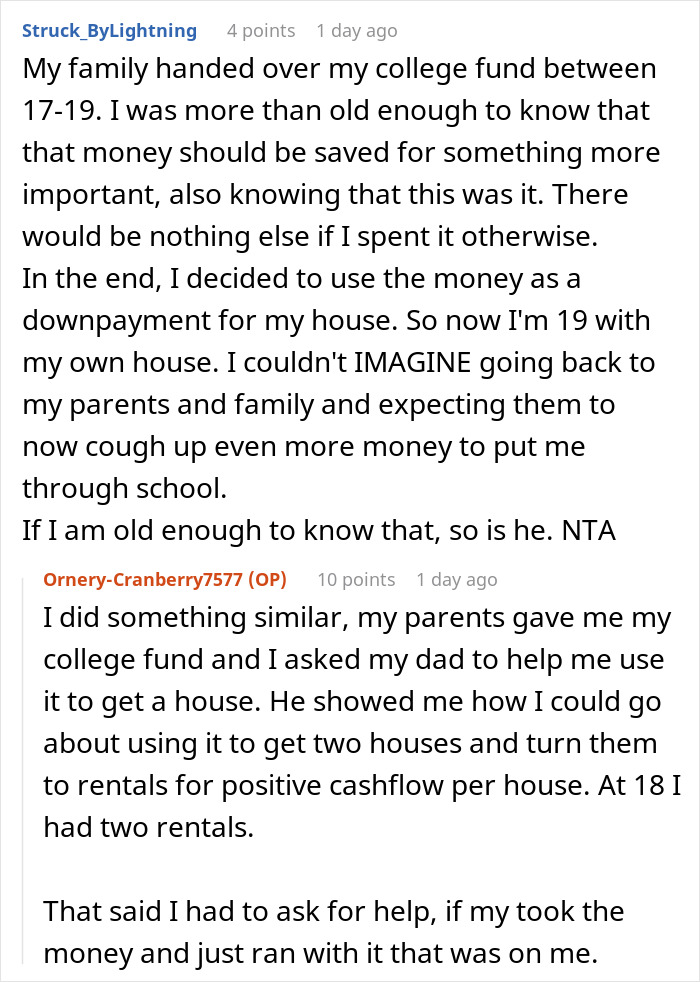

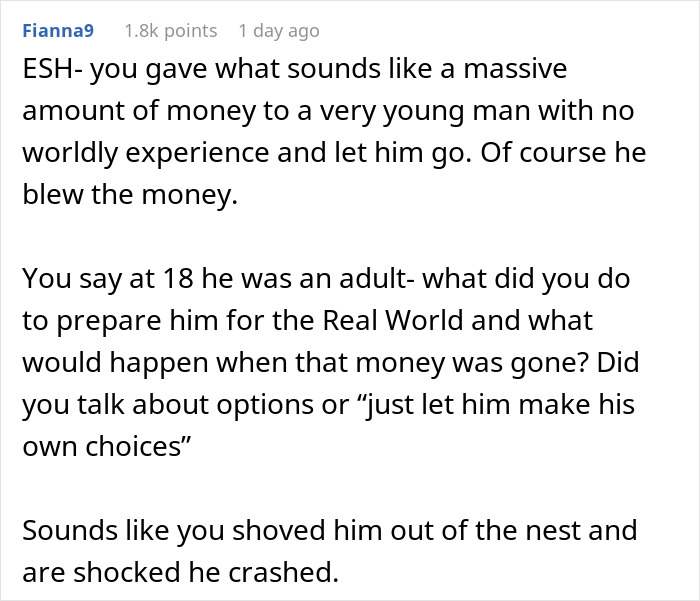

When their son was 18 Y.O., his parents gave him his college fund which he could spend however he wanted, knowing consequences

Image credits:Nicola Barts (not the actual photo)

The 18 Y.O. spent the money on traveling; however, 2 years later, he wishes to go to school

However, his dad instructed him that as he spent his college fund, now he has to earn his own money to pay tuition

However, now, 2 years later, the guy wants to go to school and asked his parents to pay for the tuition. However, knowing where he blew his money, his father said no and if he wants to go to study, he needs to get a job. In the later edit, OP added that he is not a monster and if his son had informed him that he wanted to travel, he would have given him money.

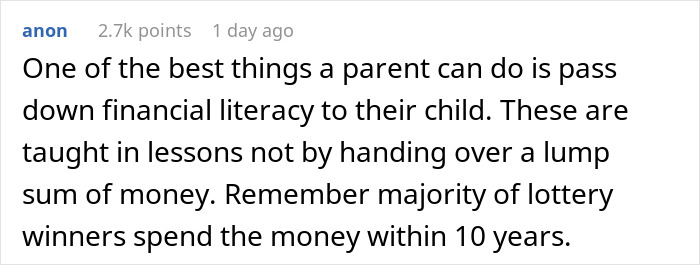

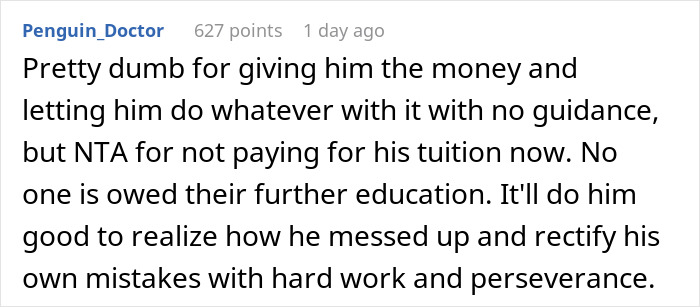

The community members defended the author and gave him the ‘Not the A-hole’ badge. However, they discussed that 18 Y.O. is not old enough to make smart decisions. “One of the best things a parent can do is pass down financial literacy to their child,” one user wrote. “Pretty dumb for giving him the money and letting him do whatever with it with no guidance, but NTA for not paying for his tuition now,” another added.

Image credits:RDNE Stock project (not the actual photo)

Bored Pandagot in touch with Samantha, who is a parental blogger and founder ofWalking Outside in Slippers. She kindly agreed to share her insights regarding how parents can approach discussing financial decisions with kids and offer guidance but still let kids make their own choices.

“In my experience with my own kids, an appreciation for money and budgeting starts young with allowance and setting savings goals,” Samantha starts. She says that her kids have chores they are expected to do each week to earn their allowance and they have their own kid-friendly debit cards they can use to buy something. “When there is a toy or video game they want, we encourage them to save up enough money to buy that item.”

Samantha emphasizes that even though she and her husband reward their kids with a small toy or something else for accomplishments such as good grades, they try to leave the major spoiling to the grandparents. But in addition to this, they often talk about the importance of college for them and being self-reliant as adults.

Moreover, she shared that parents can do all they can to try to shelter kids from mistakes, but they are still bound to make many. “I believe learning from your choices, good and bad, is a crucial part of maturing. When parenting our kids, my husband and I stick to putting focus on the most important life lessons. Being kind, fair and honest, especially. With a strong core moral compass, I believe the other pieces will eventually fall into place.”

So long story short, kids are going to make mistakes, but they will learn from them. It’s important to provide kids with guidance and share suggestions from personal experiences. However, what do you think about this story? Did this father do the right thing or is he being too harsh?

Redditors backed up the father, but emphasized that it’s important to teach kids financial literacy

Travel